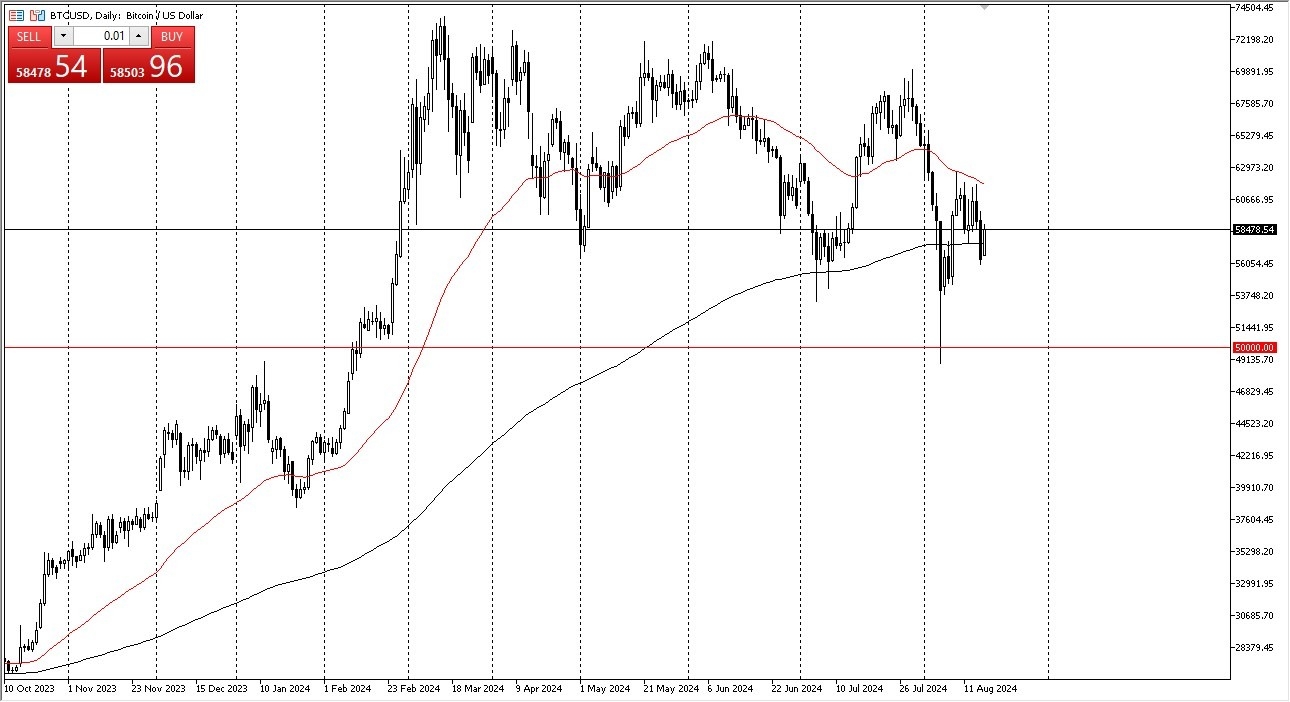

- The first thing I notice is that we continue to hang around the crucial 200-Day EMA, which of course is an indicator that a lot of people will pay close attention to.

- By bouncing the way we have, the market is likely to continue to go sideways, and as we are currently between the 200-Day EMA and the 50-Day EMA indicators, I think we are prone to see a lot of noisy behavior.

The market has shown the $58,000 level as support, and I think at this point in time we have a significant amount of resistance near the $63,000 level in other words, I believe that bitcoin is going to continue to be a very difficult place to hang onto if we get a huge position, the reality is that the market will continue to be very noisy, so therefore unless you are looking at this from a longer-term perspective, it is a market that you need to be very cautious with.

Top Forex Brokers

Longer-term Traders

However, if you are a longer-term trader, then the Bitcoin market should rise over time. After all, Wall Street now has a new toy to play with, in the form of the bitcoin ETF. Underneath the current trading, we have the $50,000 level, which of course is a large, round, psychologically significant figure, and an area that we had bounce from previously. In general, we have a market that remains a “buy on the dips”, and if we can break to the upside and above that crucial $63,000 level, then I think we have a real shot at going to the $70,000 level above.

I think at this point in time, the market is likely to continue to favor the upside, but I also recognize that it will also have a proclivity to follow the overall risk appetite in general. The market is likely to continue to pay close attention to the Federal Reserve, and what they may be doing about monetary policy. As long as they look likely to loosen monetary policy, it’s possible that the bitcoin market could rally.

Ready to trade daily forex forecast? Here are the best MT4 crypto brokers to choose from.