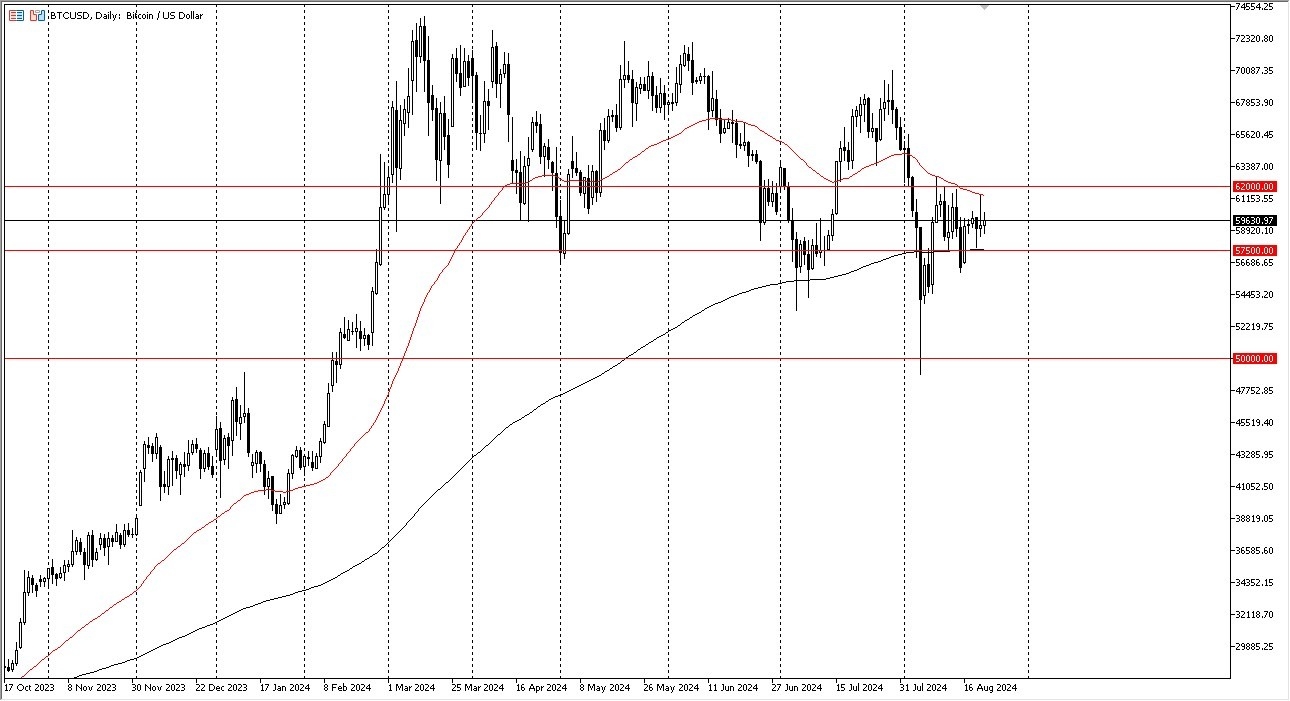

- I can see that we are consolidating yet again, and we have been compressing for some time.

- All things being equal, this is a market that I think is trying to sort out where it goes next, and I do think that pretty much anything is possible at this point.

We have formed a bit of the symmetrical triangle over the last several weeks, but when you look at the longer-term charts you can see that the Bitcoin market has almost certainly underperformed. After all, this was supposed to be the Renaissance of the Bitcoin market, as suddenly it had gained some “Street Cred” due to Wall Street having its ETF now. However, we have done almost nothing after the initial exuberance, and you can also make an argument that each successive high gets lower.

Top Forex Brokers

Will Bitcoin Lead Everything Lower?

The question at this point in time is whether or not risk appetite gets eviscerated soon. If it does, it could be the Bitcoin market that is giving us a little bit of a “heads up” as to whether or not that happens. After all, stock markets have done fairly well but we have seen quite a bit of volatility and fear jump into the market from time to time. During the same time, Bitcoin has been lackluster at best, and it is starting to enjoy the “benefits” of now being a Wall Street dominated asset. In other words, Wall Street won’t like the idea of massive volatility and will dampen it whenever they can. The days of massive 12% gains in the Bitcoin market are now over.

I think at this point in time we continue to bounce around between the 200-Day EMA and the 50-Day EMA above. Essentially, we’ve got the $57,500 level offering that floor, while the $62,000 level offers the short-term ceiling. I think we continue to see a lot of sideways nonsensical movement out of Bitcoin, and at this point I think we desperately needs some type of fundamental reason for this market to go higher. You would think that central banks around the world cutting interest rates would be that reason, which of course is the exact reason Bitcoin was invented in the first place, but it doesn’t seem to be the case.

Ready to trade daily forex forecast? Here’s a list of some of the best crypto brokers to check out.