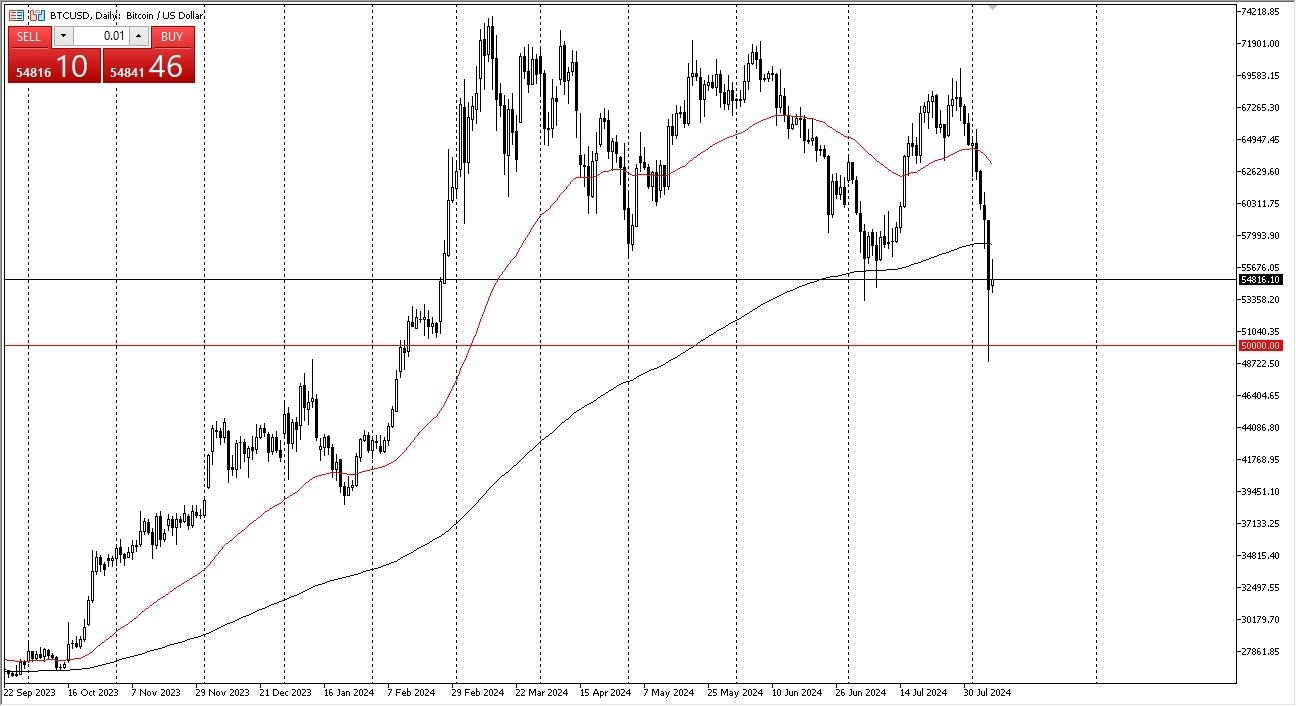

- The first thing I notice is that we could not hang on to the gains, and therefore it makes a certain amount of sense that we would continue to see negativity.

- It’s worth noting that the money candlestick was in absolute wipeout, but there was a flood of buying activity near the $50,000 level below.

- The so-called “bitcoin whale” known as “Mr. 100” was seen buying millions of dollars’ worth of bitcoin in that area, which could be like a huge trapdoor if we do in fact see the market plunged below that level.

Technical Analysis

While the $50,000 level of course is a large, round, psychologically significant figure that a lot of people will be paying attention to, and of course it’s an area where we had seen a lot of people jumping into the market to save it, the reality is that each successive high after the ETF high has been lower. While I’m not ready to call it a downtrend quite yet, it’s also worth noting that the bitcoin market is below the 200-Day EMA. Both of those are negative signs, but it’s not necessarily something that you can get aggressive with.

Top Forex Brokers

That being said, if the market does break down below the lows of the Monday session, bitcoin is probably in serious trouble, and we will see a massive unwinding. Keep in mind that there is an ETF in the bitcoin market now, so that will provide a little bit of cushion, and it’s not like the market would be very likely to drop to the $4000 level in this environment, but we most certainly could see massive selling.

The real question is going to be whether or not Wall Street just pulled some type of heist on retail traders, as they got the ETF approved, only to make all of this sweet, sweet commissions off of retail traders coming into purchase this asset. It’ll be interesting to see how this plays out, but at this point in time it’s not until we break above the highs of the money candlestick that you can see a lot of comfort come back into the market and people started chasing bitcoin at that point. Nonetheless, I think the biggest thing that you need to do right now to simply observe the market.

Ready to trade daily forex forecast? Here are the best MT4 crypto brokers to choose from.