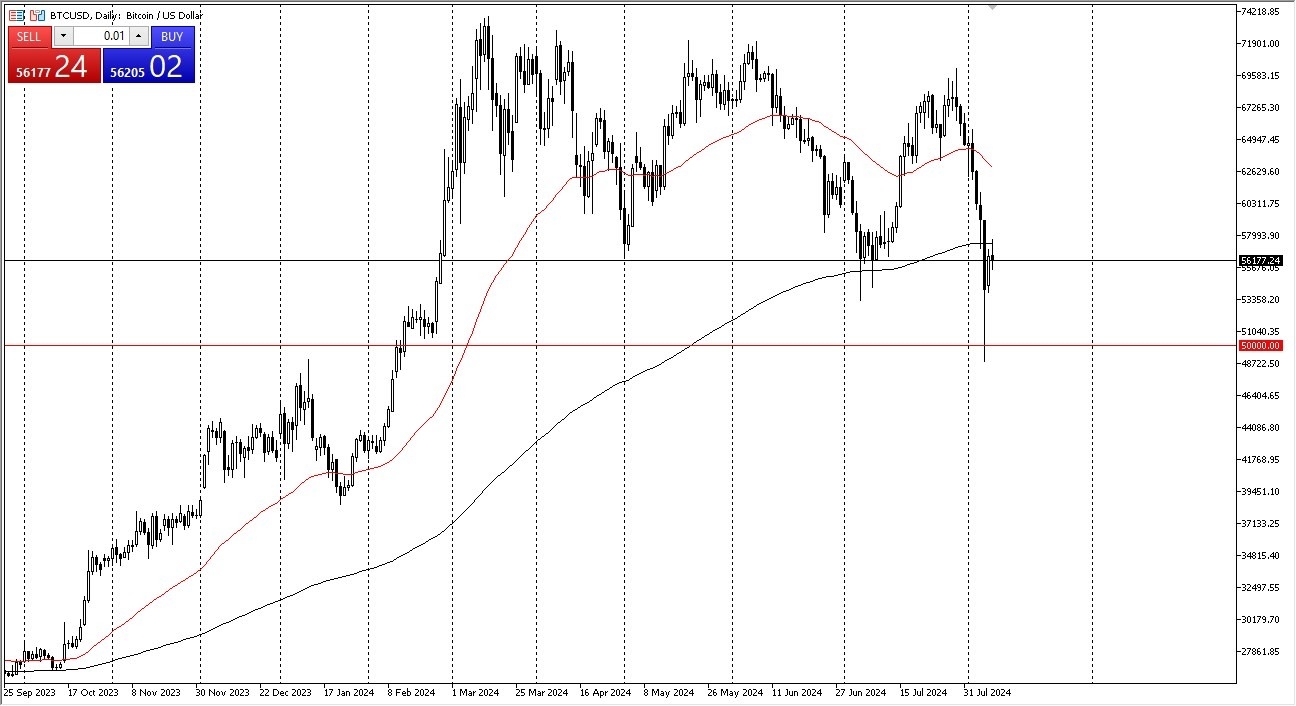

- The first thing I notice is that we are doing what we can to form some type of basing pattern.

- The 200-Day EMA is sitting just above that could offer quite a bit of resistance, and at this point in time it does seem to be holding.

- With that being the case, I think you’ve got a situation where traders will look at this through the prism of risk appetite, and whether or not market participants are willing to take it.

Technical Analysis

It’s worth noting that the technical analysis for this market is somewhat of a mixed bag, and although we are hanging around the 200-Day EMA, it’s probably worth noting that there is a massive amount of support all the way down to the $50,000 level. As long as we can stay above that crucial psychological barrier of $50,000, I think you have a real shot at seeing this market try to recover.

Top Forex Brokers

That being said, if the bitcoin market were to break down below the $50,000 level, then we could see this market go much lower, perhaps even down to the $40,000 level. The alternate scenario is of course that we close above the 200-Day EMA, perhaps even take out the $60,000 level to go higher. If that ends up being the case, then we could very well see bitcoin go looking to reach the $73,000 level over the longer term. I’m not necessarily looking for that to happen right away, but it would make a certain amount of sense considering that there are so many institutional traders involved in bitcoin.

One thing that’s going to be interesting is how bitcoin behaves over the next several sessions, because we are almost certainly going to see a lot of volatility in the world’s financial markets. If that’s going to be the case, then one would have to assume that bitcoin is going to continue to be very noisy as well. With this being the case, I think you have to look at this through the prism of a market that is in the process of trying to build its base, but hasn’t quite done so yet.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from