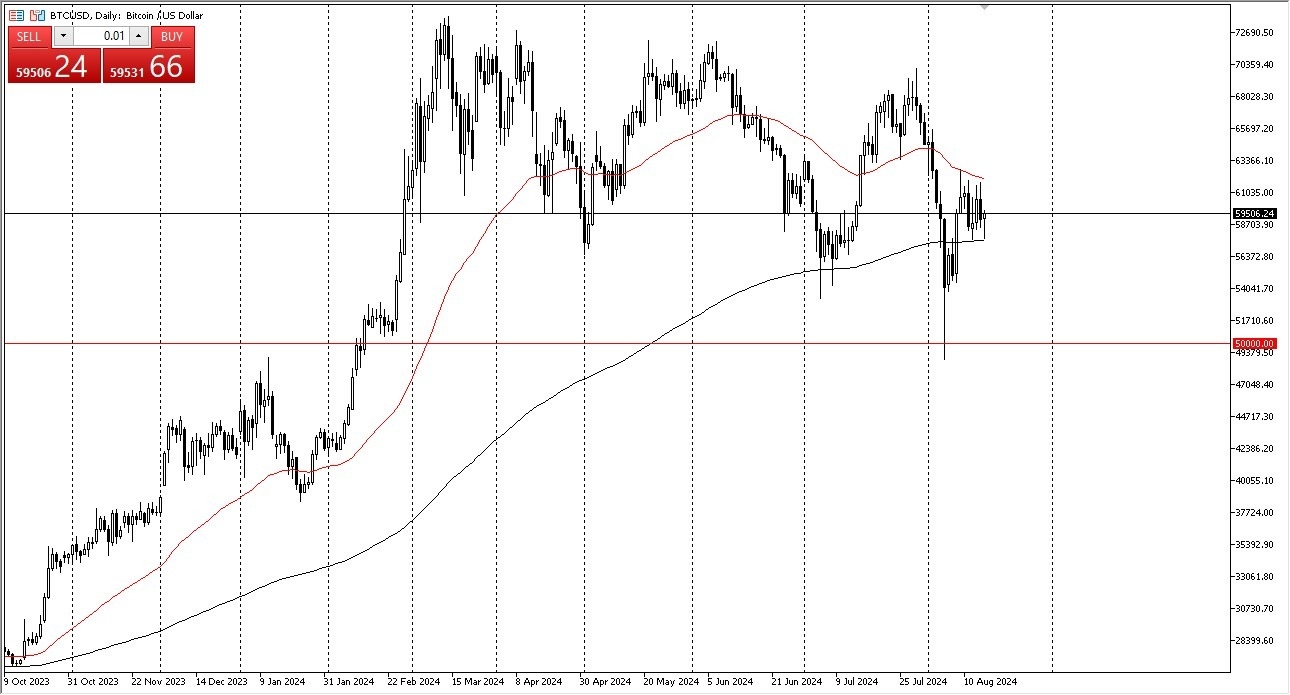

- In my daily analysis of bitcoin, the first thing I notice is that we reach toward the 200-Day EMA, only to turn around and show signs of life again.

- By doing so, the market looks as if it is trying to find a way to print some type of hammer, which of course is a very bullish sign.

- All things being equal, the 200-Day EMA is of course a very important indicator that a lot of people pay close attention to, so it’s not a huge surprise to see that bitcoin has bounced a bit.

Above, we have the 50-Day EMA which sits right around the $62,000 level, and therefore I think we are in the midst of some type of consolidation. Ultimately, this is a market that will need a lot of “risk off behavior” to get things going, as bitcoin is pretty far out on the risk appetite spectrum. With that being said, I think you need to pay close attention to other markets such as the NASDAQ 100, as the NASDAQ 100 is likely to continue to be a bit of a “heads up” as to where the bitcoin market might go, as the NASDAQ 100 is the biggest market that I think traders look to for risk appetite and where it’s going.

Top Forex Brokers

Longer-term Noise

Looking at the chart, it’s easy to see that bitcoin is essentially nothing but long-term noise at the moment, as we continue to try to digest all of the massive amounts of money that had flown into the bitcoin related ETF’s on Wall Street, and of course we have seen quite a bit of bitcoin dumped on the market from the Mt. Gox settlement, and of course Germany getting rid of its reserves. That being said, it has performed fairly well, but at the end of the day, the market is likely to continue to see a lot of noise, and therefore I think you have to look at this through the prism of a longer-term consolidation between the $50,000 level underneath, as well as the $73,000 level above.

Ready to trade daily Bitcoin predictions? We’ve made a list of the best Forex crypto brokers worth trading with.