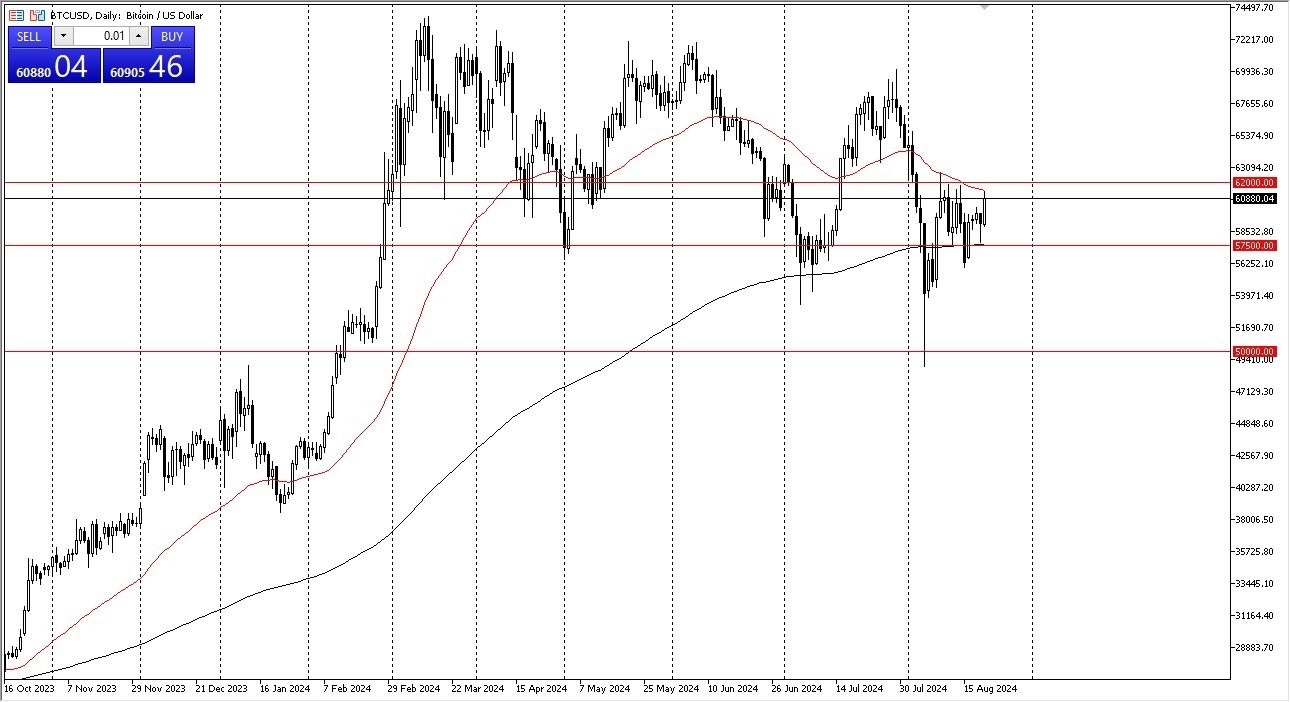

- Bitcoin has rallied a bit during the trading session on Tuesday, but it looks like the 50 day EMA has come into the picture to cause a few headaches.

- Over the last several weeks, we've seen a bit of consolidation with the 200 day EMA near the crucial $57,500 level and the 50 day EMA have come into the market to form competing forces.

- This is a market that has been grinding lower for several months.

At this point, it's not necessarily in a downtrend, but it does suggest that perhaps this is a market that I think continues to see a lot of lackadaisical type of trading. This might be the way going forward, because there’s nothing in the Bitcoin charts that tell me things are about to change. While I am not necessarily negative on this market, I think you have plenty of time to make some type of decision with a market that is just sideways overall. However, if I had to bet on a direction I’d say possibly higher.

Top Forex Brokers

Breaking Higher?

The market breaking above the $62,000 level opens up the possibility of a move towards the $69,000 level. That of course would be a major risk on type of move, and while it doesn't necessarily look like the market is overly negative, it doesn't necessarily either look like a market that has anywhere to be. I think this is a direct influence from Wall Street. It is now an index. It's not a cryptocurrency. It's not the future of money. It's not anything like that. It's just another thing that BlackRock and others have stepped into the market, started buying hand over fist, and they want to sell to their customers.

How this plays out of the longer term is anybody's guess, but I postulate at this point Bitcoin has become something very similar to the S&P 500. That's going to be the case. I think a lot of the Bitcoin maxis are going to be disappointed. It's not that the market will be negative. It just may not be that volatile.

Ready to trade daily Bitcoin forecast? Here’s a list of some of the best crypto brokers to check out