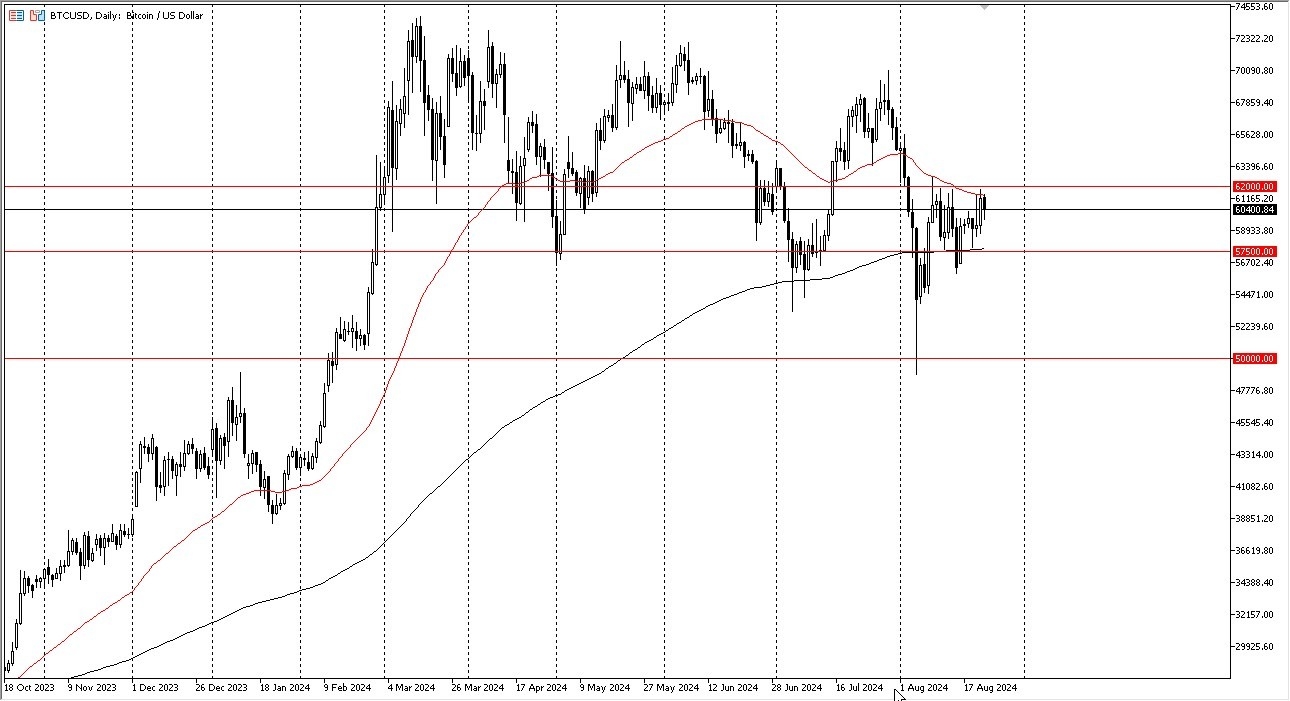

- Bitcoin has been somewhat negative during the trading session on Thursday as the 50 day EMA continues to offer a bit of resistance.

- Above there, we have the $62,000 level, which has been like a ceiling.

- I think that's an area that until we break above continues to be a major concern.

- It's also worth noting that we are trading between the 50 day EMA and the 200 day EMA indicators, which suggests that there is a bit of a state of flux at the moment.

When you look at the daily chart, it's easy to see that the ETF had a flood of money jumping into the Bitcoin market. And since then, we've actually gotten weaker. We haven't exactly broken down yet, although there's been a couple volatile moves to the downside. But it seems like we have nowhere to be. During the trading session on Thursday, a couple of central bankers suggested that interest rates are not going to be massive and with that being said it does make a certain amount of sense that perhaps bitcoin weakens because it relies almost solely on cheap money. I know there's a religion around bitcoin but quite frankly it's nonsense it's just another asset it doesn't fix anything. At this point in time, it's used as a trading vehicle and a trading vehicle only and the price is always going to be truth.

Top Forex Brokers

Be Careful of Fools Pushing the Religion of BTC

So, I would advise you to pay attention to what's happening, not what should happen according to some evangelist who owns more Bitcoin than you, who's trying to get you to buy into it to drive the price higher. I'm not saying that there isn't a use for Bitcoin, I'm just saying it's not being used. So, the reality is that we shot higher during the ETF euphoria and since then have chopped back and forth and underperformed.

In fact, and this will upset a lot of Bitcoin hopefuls, gold's actually outperformed Bitcoin over the last four or five months. I know the argument over the last 20 years or whatever, but dogmatism and being dogmatic is not a trading strategy. The reality is that it's okay to have a bit of Bitcoin, but to jump all in waiting for the next rise could have you holding the bag from Wall Street selling this to everyone. We'll have to wait and see, but right now this is about as neutral as it gets.

Ready to trade Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.