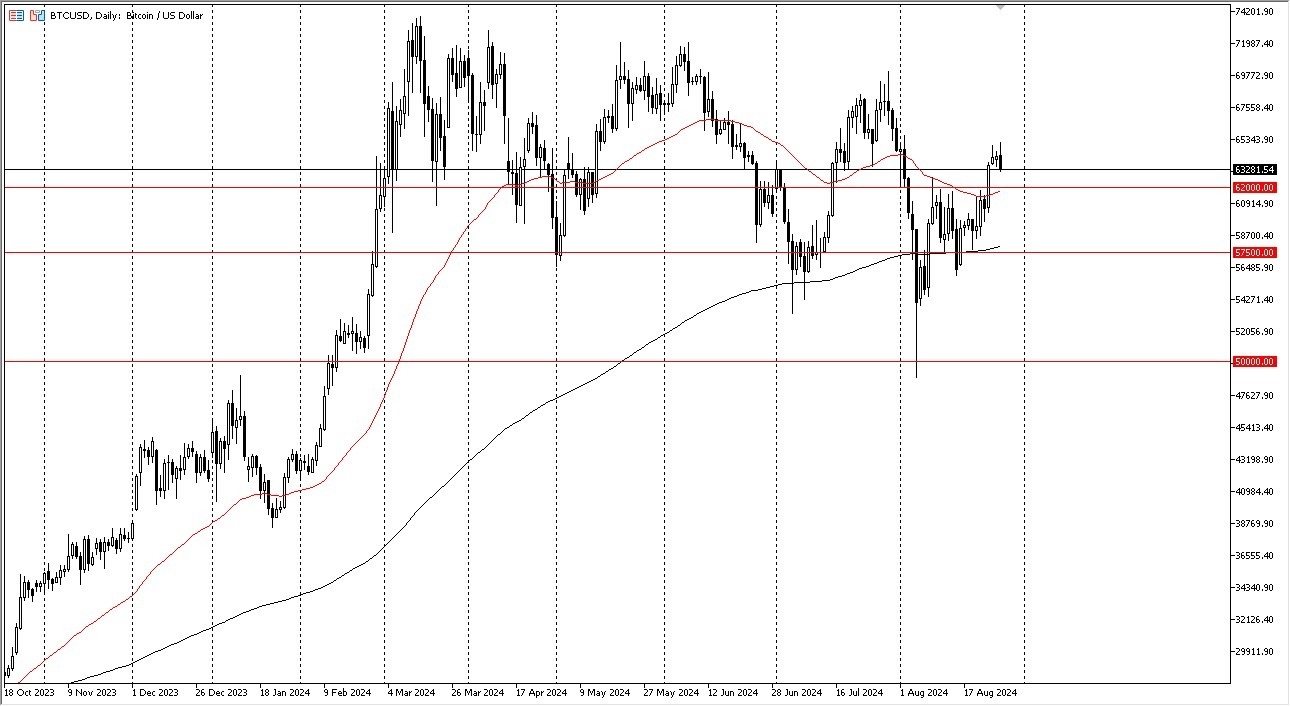

- Bitcoin initially tried to rally during the trading session on Monday but gave back gains as we broke above the $65,000 level.

- In my daily analysis of Bitcoin, the first thing I notice is that a couple of sessions ago we broke above the crucial $62,000 level, kicking off the possibility of an ascending triangle influencing the market.

- If this is going to end up being the case, I be paying close attention to the $62,000 level as it is a major previous resistance barrier.

Underneath, the 50-Day EMA is hanging around the $62,000 level, which is an area that is going to continue to be very important. That being said, the market were to turn around and bounce from that level, then it would be a classic “breakout, pullback, and continuation pattern.” On the other hand, if we were to turn around and break above the $65,500 level, then it’s likely that the market could go looking to the $69,000 level, where we had seen the market pull back from previously.

Risk Appetite

Top Forex Brokers

Bitcoin is all about risk appetite, and at this point in time it might be a bit of a mixed bag. Yes, the Federal Reserve is likely to continue to see its influence in this market, due to the fact that they are talking about cutting rates. That being said though, it’s worth noting that perhaps them cutting rates might be the sign of something ugly coming. There are a lot of people out there worried about the right now, and Bitcoin won’t be immune to it.

All things being equal, this is a market that is bullish, but we have a lot of concerns out there when it comes the Bitcoin, simply because we have yet to find a real use for it. The only use that I’ve seen in a highly liquid situation is speculation on Wall Street or other trading floors around the world. Now that we have an ETF, Wall Street will of course protect it, but whether or not it actually gets used in the real world remains an open question.

Ready to trade Bitcoin forex forecast? Here are the best MT4 crypto brokers to choose from.