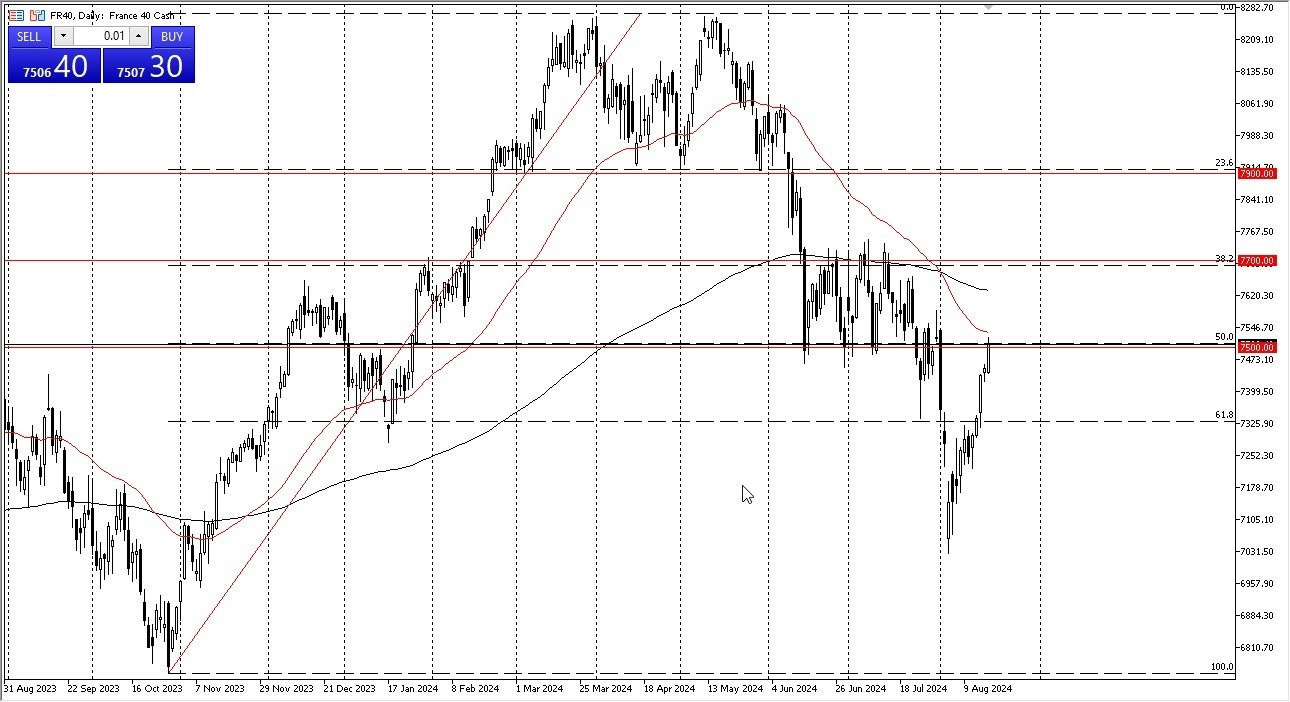

Potential signal:

- At this point, the CAC looks more vulnerable than the DAX. I think if we break below the lows of the trading session on Monday at the €7438 level, then I am shorting this market.

- However, I would only do that with the caveat that the DAX has started to drop as well.

- I would put a stop loss at the €7550 level, and would be aiming for the €7150 level below.

The CAC Quarante has shown itself to be bullish during the early hours on Monday, but then looks as if it is going to struggle with a 50 day EMA. The 7,500 euro level is an area that I think a lot of people will pay attention to because it is a large round psychologically significant figure, but it is also an area that's been important multiple times in the past. With that being said, I think you've got a situation where the market is probably going to continue to be very noisy, but I think a drop from here makes quite a bit of sense. If we do break down below the bottom of the candlestick from the Monday session, then I think you'll probably see Paris drop again.

Top Forex Brokers

Everything Moves in the Same Direction

Keep in mind that a lot of stock markets around the world are moving in the same direction at the same time. So, if we start to see selling pressure again, then I think Paris will be particularly hard hit. We are approaching an area of significant noise between 7,500 euros and 7,700 euros. So I am definitely watching for something like a shooting star or a turnaround and a breakdown that I can start shorting.

I do not want to buy this market; I believe that Germany will lead the way. So if I had to buy a European index right now, it would probably be the DAX and not the CAC. That being said, I think this is a market that is going to continue to struggle in general, and it almost certainly will lag Germany and some other places like the indices in New York.

Start trading the stock market analysis and predictions. Open a Forex account for CFD trading here.