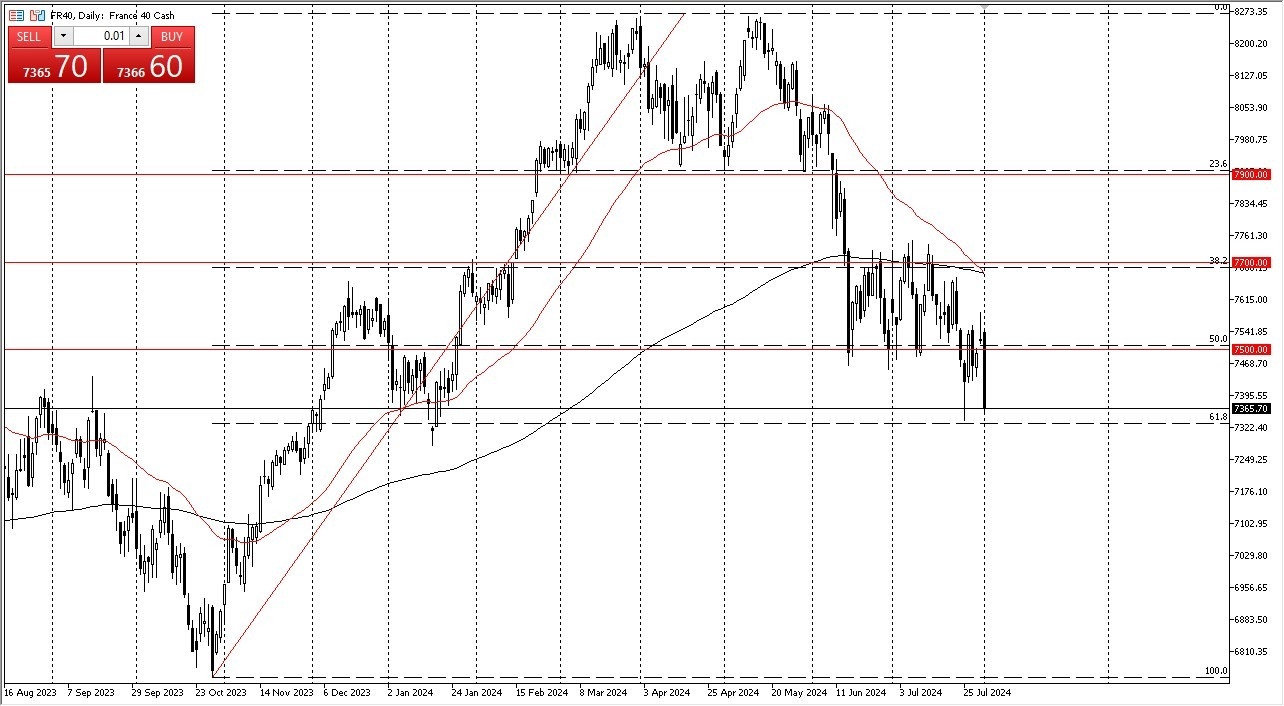

- In my daily analysis of the CAC 40, the first thing I notice is that we are approaching a major support level.

- The €7300 level is an area that I think we will have to pay close attention to, as it is not only a previous support level, but it is also where the 61.8% Fibonacci retracement level is currently residing.

- Any move below there could send the market much lower, as generally speaking, once we give up 61.8% of the initial move, we tend to make a “round-trip.”

I am a bit cautious when trying to get short of indices, because quite frankly they generally aren’t made to fall. However, France looks like it is heading into a lot of economic issues, and the CAC 40 might end up being a decent shorting opportunity, but for myself I will probably just wait to see if we can break down below that crucial €7300 level. Keep in mind that Francis the second-biggest index in the European Union, and for what it’s worth, the biggest one, the DAX in Germany looks miserable for the session as well.

Top Forex Brokers

Everything is correlated

Everything in the financial markets right now seems to be correlated and therefore the French index will be any different than anybody else. We have seen the American sell their major indices lower, and we have seen Europe follow right along, or perhaps it’s vice versa. At the end of the day, it doesn’t really matter due to the fact that it’s all about risk appetite.

I do believe at this point in time we are at a major point of inflection, and one of the biggest reasons to pay attention to this market and the DAX, is because we are heading into the weekend and what traders are willing to do heading into the weekend can give you a big “heads up” as to what they are thinking. If the market continues to sell off, that is a horrible sign, because it’s very where traders are willing to go into the weekend aggressively short of an index. These are going to be interesting times.

Ready to trade our daily forex forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.