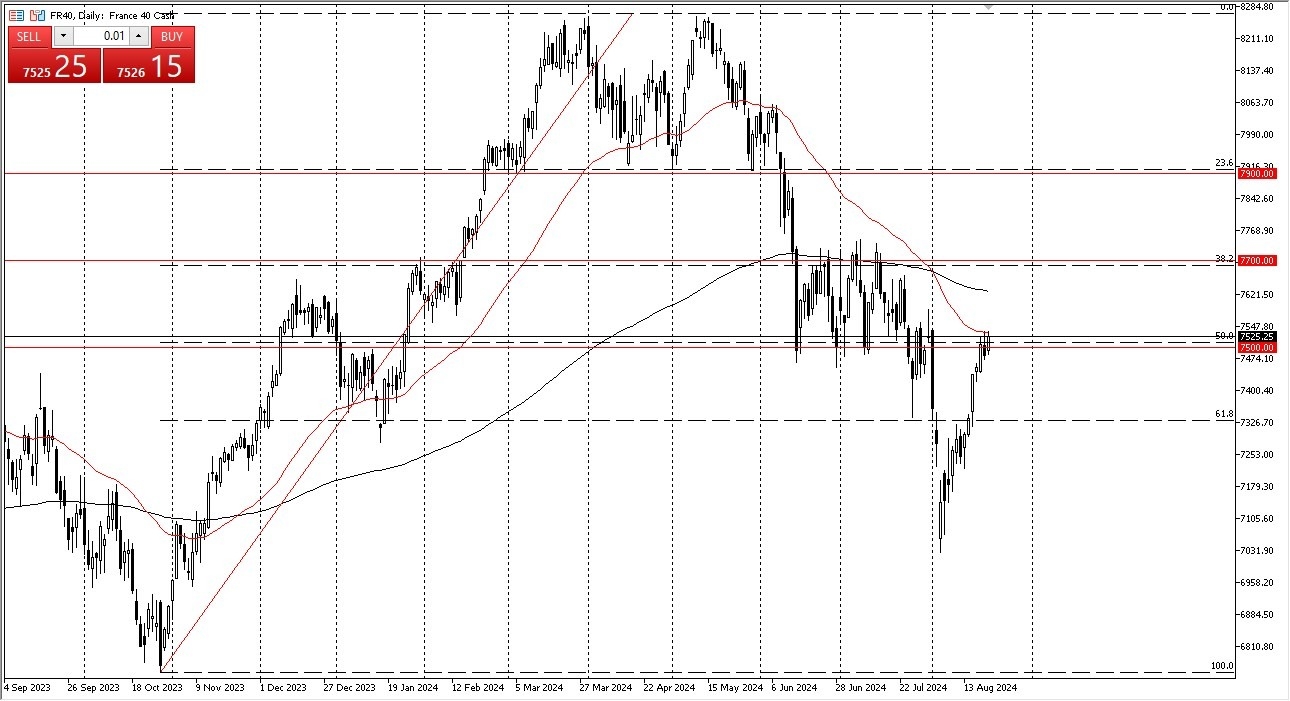

- It’s worth noting that the market is now pressuring the 50-Day EMA, which of course is the indicator that a lot of people used to determine the overall momentum of the market.

- That being said, I think you’ve got a situation where traders are trying to determine whether or not equities can continue to rally from here, because quite frankly a lot of the stock markets around the world, even the ones that a lot of people like, are a bit overdone.

Pay attention to the DAX

Pay attention to the DAX if you are going to trade the CAC, as it does tend to have a knock on effect over here. However, you should keep in mind that the Parisian index is highly influenced by luxury goods, so it’s a little bit different in its trading, but I also think you have to assume that this is a market that has to pay close attention to the global economy, because quite frankly if the rest of the world is struggling, nobody is going to be buying Hermes or other things like that.

Top Forex Brokers

From a technical analysis standpoint, if we can break above the €7600 level, it does open up the possibility of going to the 200-Day EMA, near the €7675 level. On the other hand, if we turn around a breakdown below the €7450 level, I think we could see a little bit of downward pressure, perhaps sending this market much lower. Pay close attention to the DAX, because if it is starting to drop, that will put further downward pressure on this market as well.

In general, this is a market that I think is at a major inflection point, and therefore I think we’ve got a deal where traders are going to be paying close attention to this marketplace, and therefore you need to be cautious with your position size but this is one that you need to watch. There is a lot of noise between here and the €7700 region, so it’s not until we break above there that we get the “all clear” to become bullish on this market.

Ready to trade our daily forex forecast? Here are the best CFD stocks brokers to choose from.