- The CAC Courant initially tried to rally during the trading session on Friday, but we've seen French equities give up some of the gains showing signs of hesitation.

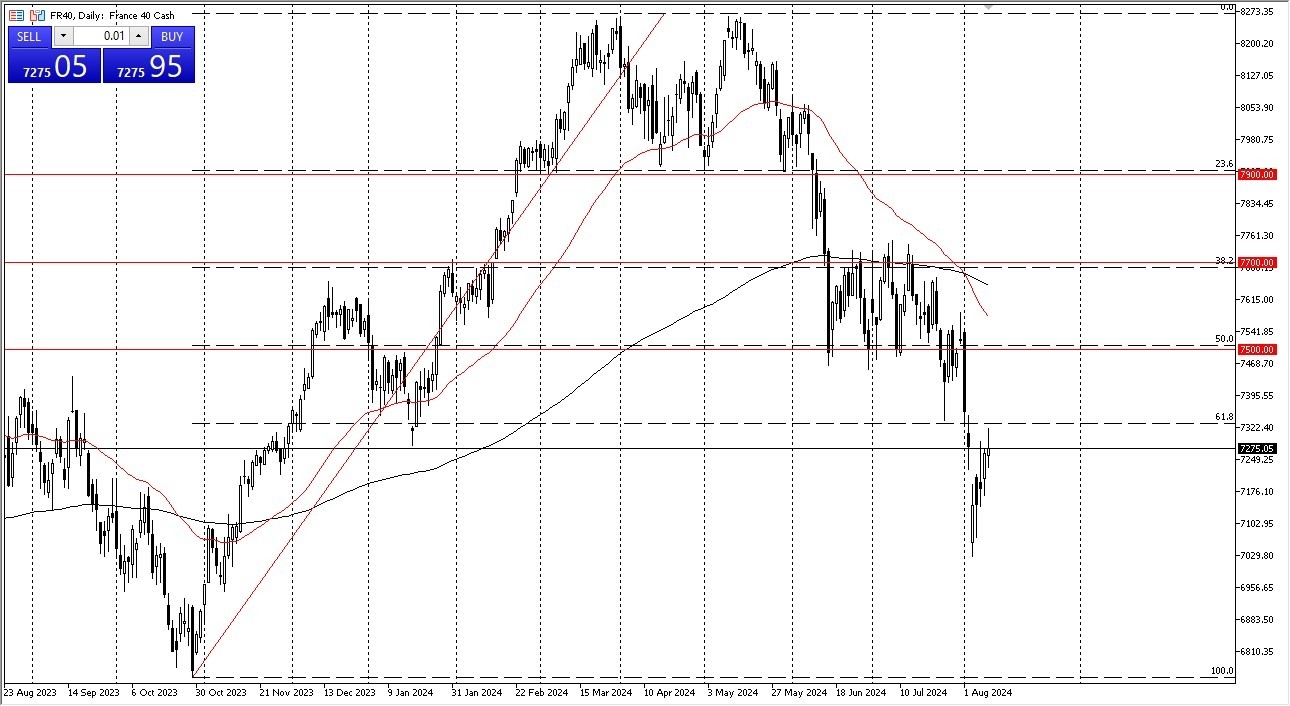

- The 7,325 euro level seems to be an area of resistance, which does make a certain amount of sense considering it was an area of previous support on the way up.

- With that being the case, I think you probably have a market that is still trying to search for its next significant move.

Given the fact that we could not hang on to gains during the trading session on Friday, I suspect that the next move could be lower. The Parisian index of course is highly sensitive to luxury goods as market participants tend to focus on French exports more than anything else.

Top Forex Brokers

With the exception of Airbus, most of its higher end purchases, while Airbus of course is a major industrial. At this point in time, if we break down below the lows of the trading session on Friday, then I do think that we will get a bit of follow-through, perhaps back down towards the 7,030 euros level. If we break the highs of the Friday session, then it's possible that the CAC may go looking to the 7,500 euro level, which is an area that obviously has a lot of psychology attached to it. Of course, is an area that previously has been supported. With this being the case, I think you've got a market that is inexorably broken as the rest of the world is all over the place. I think you're going to continue to see a lot of volatility. And as a general rule, volatility means that stock markets don't do well over the longer term.

The French market will also take some clues from the German DAX, which tends to lead the way in the European Union, as it is the biggest economy in that region. This is a market that is also trying to price in the idea of a French recession, although in this world – that isn’t overly rare.

Ready to trade our daily stock market analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.