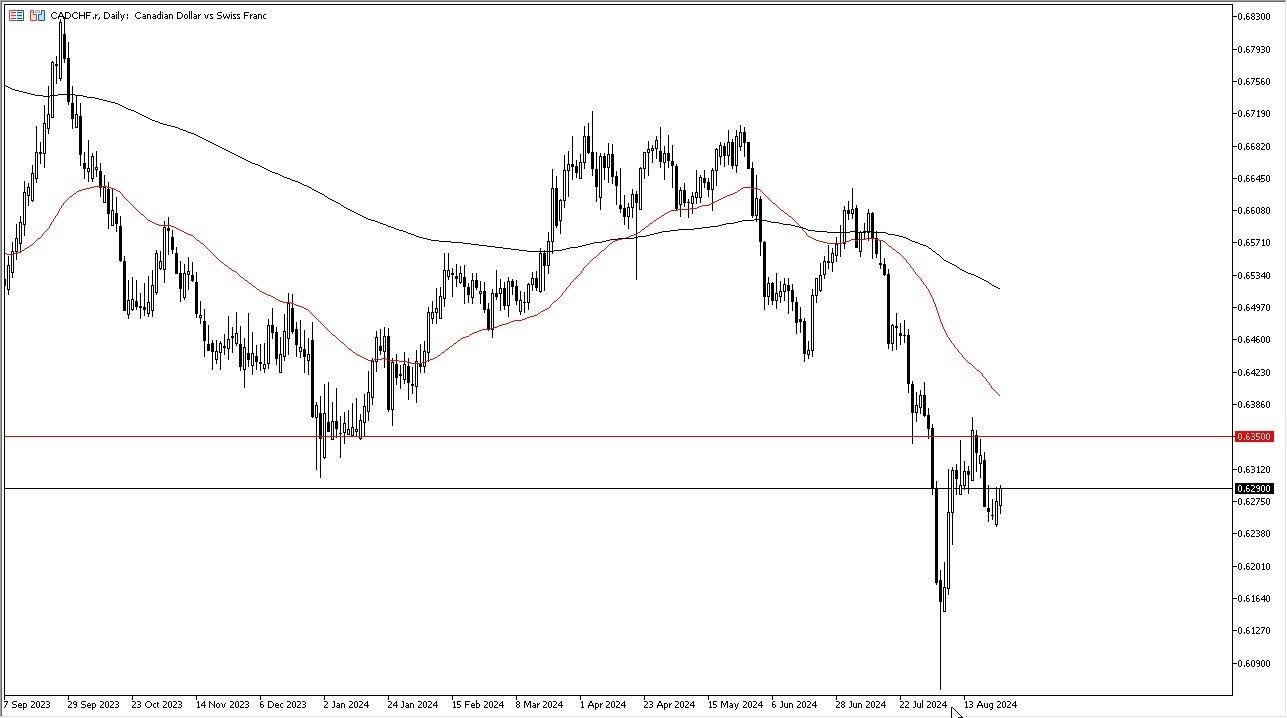

- The Canadian dollar has rallied a bit against the Swiss franc during early trading on Monday, and as you can see, we have rallied to reach towards the 0.63 level.

- Breaking above there opens up the possibility of a move to the 0.6350 level, which is an area that's been important multiple times in the past.

Because of this market memory, I think that the market will eventually try to get there just due to the fact that it will be attracted to it, almost like a gravitational pull. But the question then becomes what happens once we reach this region? I think what's interesting is that it is not only an area of previous interest, but it is also an area where traders will be looking at the possibility of a massive amount of technical analysis confluence with that 50 day EMA coming into the picture. If we can break above there, that could open up quite a bit of buying. After all, we are starting to question whether or not it's a risk on or risk off market. And if it's a risk on market, then the Swiss francs should be sold off given enough time.

Top Forex Brokers

Interest Rate Differential

There is an interest rate differential between these two currencies, although it's not as wide as it once was, as the Bank of Canada has cut rates twice recently. In general, I think this is a situation where you continue to see a lot of volatility, but I am watching that 0.6350 level very closely. We had recently bottomed out, and now it's a question as to whether or not the 0.61 level was actually the floor. It's a little early to say that, but it certainly is starting to look a little bit like that right now. With this, I am cautiously optimistic on the upside, but I also recognize that the market is going to continue to be jittery to say the least.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.