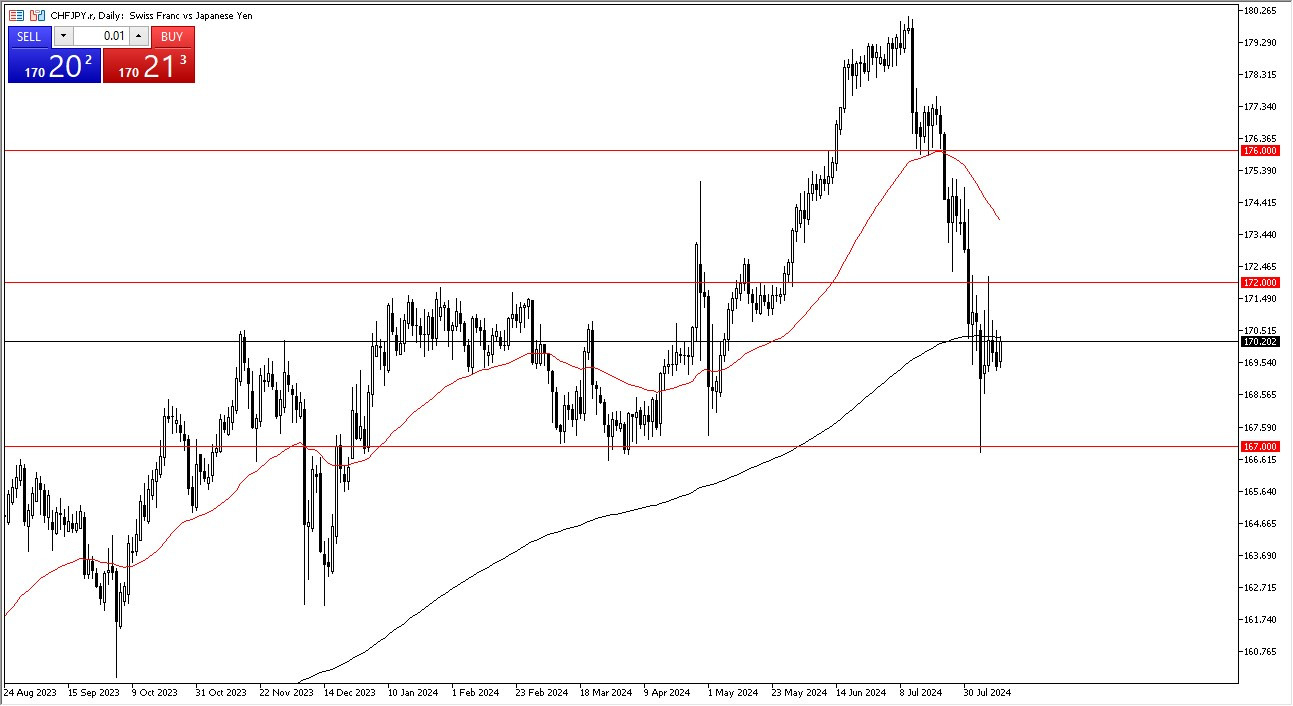

- The Swiss franc has shown itself to be very noisy over the last couple of days against the Japanese yen and I find that very interesting considering that the market is likely to continue seeing a lot of noise.

- I think ultimately, this is going to be a very interesting place to pay close attention to because this could give you a bit of a heads up as to how the carry trade may or may not work in the future.

- Keep in mind that both of these are considered to be funding currencies, and therefore the weaker of the two probably gets sold against almost everything.

- At least, all things being equal, that's the case.

This assumes of course that there's some risk appetite out there, which is still somewhat a fluid situation. So, with that being said, I think you've got to look at this through the prism of whether or not the market is going to see reasons for the market to rally here and go looking towards the 172 yen level, anything above there would be extraordinarily bullish. And I think ultimately, you've got a situation where at that point you probably see the yen carry trade come back into the picture. Nonetheless, this is a market that given enough time probably sees some type of decision. If this pair were to break down below the 167 yen level, then that almost certainly would send this market much lower, perhaps down towards the 160 yen level over the longer term. I do recognize that we are still looking at a lot of volatility ahead and a lot of choppiness.

Top Forex Brokers

This Pair is an Indicator

So, my real interest in this pair is going to be along the lines of which currency do I short against everything else? Trading this pair itself takes an extraordinarily patient trader, which of course if you are and are comfortable hanging on to trades for weeks on end, this could be your plays. But I use it most of the time as a signal as to what to do elsewhere.

Want to begin trading our daily Forex forecasts? Get our most recommended Forex brokers to open a demo account with.