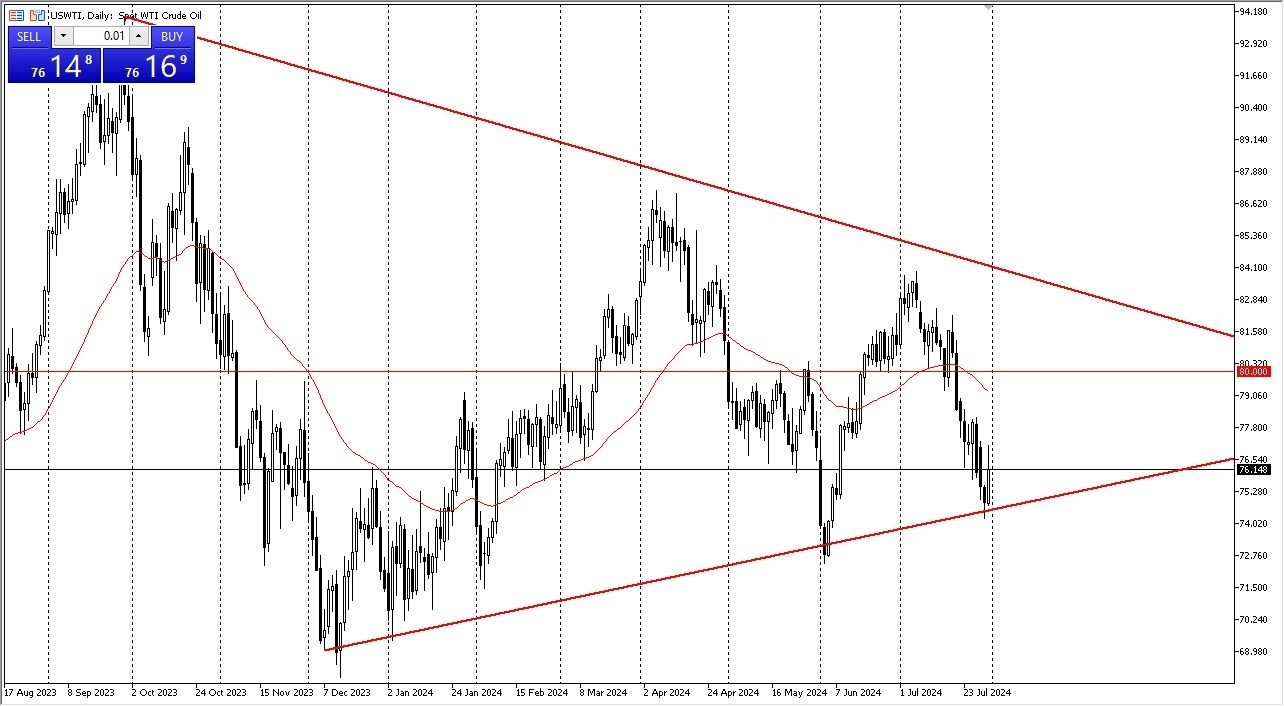

- I recognize immediately that we have bounced from the bottom of the symmetrical triangle that I have been paying close attention to.

- Middle East tension might have been the catalyst, but quite frankly, from a technical analysis standpoint, it did suggest that we were getting ready to get a bounce.

Whether or not this is sustained remains to be seen and it certainly looks like just above the $77 level we have a lot of noise. I think this is a short-term trader's market and I do think that we continue to stay within the triangle at least due to the reaction that we've seen during the early hours on Wednesday. If we were to break above the top of the candlestick then it's likely that the market could go looking to the $78.50 level, followed by the 50 day EMA and then the $80 level above there. I have no interest in shorting oil, it's far too oversold, but I do recognize that if we were to break down below the $74.50 level, that would be rather negative. In general, this is a market that continues to be noisy and choppy and therefore I think you have to be very nimble.

Top Forex Brokers

Position Sizing Matters

Keep your position size reasonable because oil can be a big mover. And of course, there are a lot of conflicting signals out there. Crude oil is suffering at the hands of the reality that the global economy may be slowing down and therefore demand could get hammered. On the other hand, we have a lot of geopolitical concerns that could continue to send the crude oil market higher. Beyond all of that, we have a lot of technical factors that have intersected in this general vicinity. And then we have the cyclical trade, which of course is that crude oil has a certain amount of support through the summer months as people are traveling.

Ready to trade Forex daily analysis and predictions? Here are the best Oil trading brokers to choose from.