- The crude oil market rallied a bit during the early hours on Friday, and then simply took off after Jerome Powell finally admitted that the Federal Reserve is likely to cut rates in a bit of a cycle.

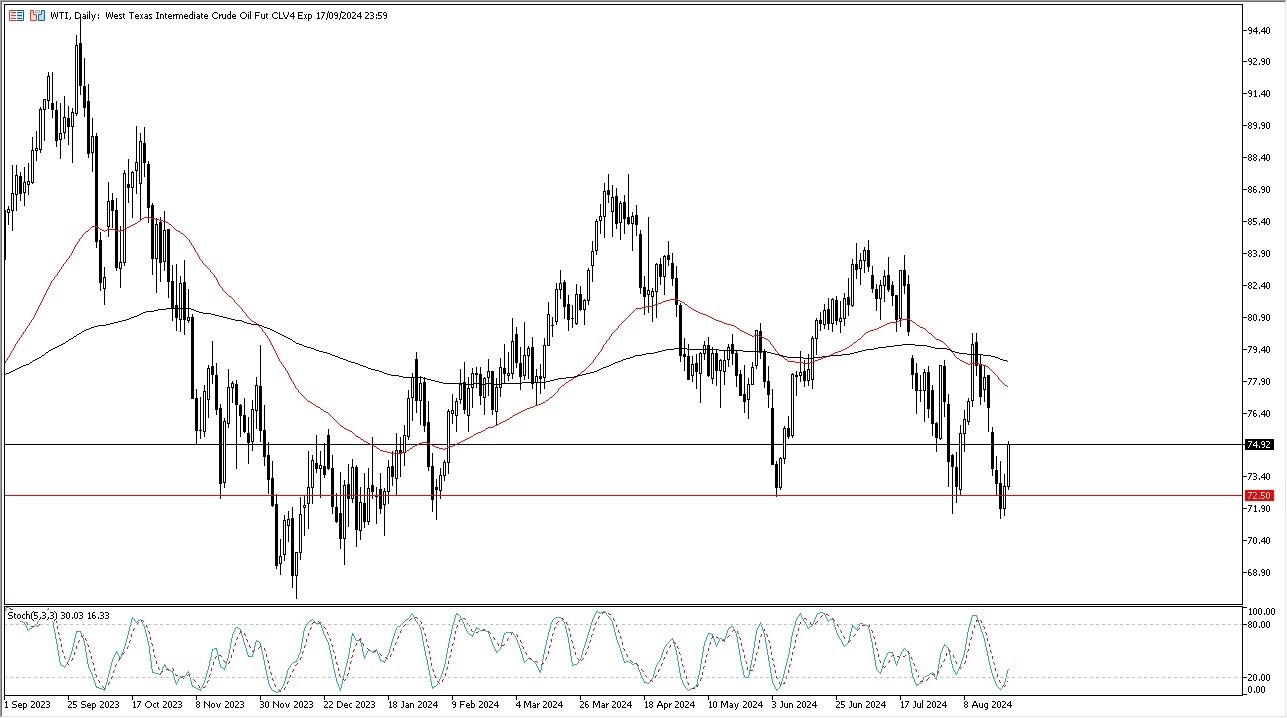

- With that being said, the market also recently has seen the $72.50 level as a major support level and an area that I think continues to attract a lot of people.

- The stochastic oscillator is crossing underneath the oversold condition. So, it does suggest that we are going to go to the upside.

Pullbacks Could be Opportunities

With that, I think short-term pullbacks continue to be buying opportunities. It's likely that the West Texas intermediate crude oil market goes looking to the $79.50 level. That's basically where the 200 day EMA is hanging around. And therefore, I think you've got a situation where a lot of technical traders will be paying attention.

Top Forex Brokers

The market is also going to have to deal with the fact that the overall demand picture is still a question as we have to wonder whether or not the markets are going to see enough demand. Is the economy slowing down? If it is, then we could get a situation where traders will look at this through the prism of perhaps a market that will maybe go sideways going forward or potentially break down, but it's really not until we break down below the $69 level that I would be concerned.

In general, I do think that eventually we try to sort things out, but right now it just looks like more chaos, which is all we've had in the markets as of late. I don’t see the oil market being any different than the other noisy markets that we have seen, and with this I am cautious about being “too big” in this market, as there are a lot of factors that will come into play when it comes to pricing the oil market

Want to trade the oil markets? Get our most recommended Forex brokers for oil trading here.