- The West Texas Intermediate Crude Oil Market, or US Oil, has rallied rather significantly during the trading session on Wednesday as we've seen more of a risk-on type of feel to the markets overall.

- The Bank of Japan is essentially ruling out further rate hikes until markets stabilize, and it has thrown more of a risk on attitude into the marketplace.

- Therefore, traders may be short covering or perhaps even playing the idea that loose interest rate policy will drive up demand over the longer term.

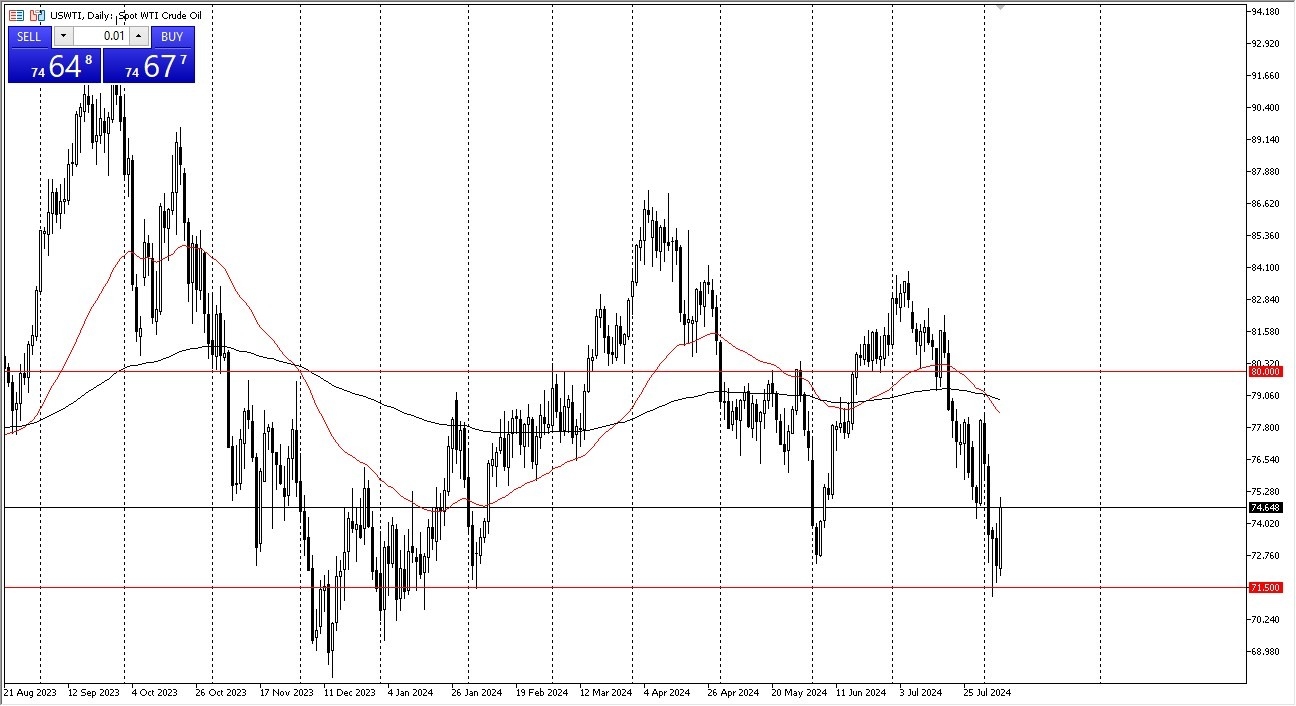

- It'll be interesting to see how this plays out, but it's also worth noting that we were near the $71.50 level when we bounced, and that's an area that's been important previously.

That being said, if we were to break down below the $71.50 level, then the $67.50 level is your next major support level. Whether or not that happens remains to be seen. Just as it remains to be seen whether or not we can hang on to this momentum. If we can, then traders will start to ask questions of the $75 level followed by the $77.50 level after that. I do think at this point in time, we've got a situation where crude oil will continue to be volatile for a whole host of reasons, not the least of which of course will be geopolitical as we continue to see more and more tension in the Middle East.

Top Forex Brokers

Oil and the Global Economy

All things being equal you have to keep in mind that the crude oil market is highly sensitive to the idea of global growth. Quite frankly, the crude oil markets are representation of the “lifeblood” of the global economy. After all, as economic activity increases or decreases, it will greatly influence how much crude oil is needed to move goods and services across the world.

If we do in fact see this crude oil market start to fall again, that does suggest that perhaps traders are worried about the idea of a global slowdown. On the other hand, it’s also possible that the market turns around and rally quite significantly, which would probably coincide with most other markets rally.

Ready to trade the daily oil forecast? Here’s a list of some of the best Oil trading platforms to check out.