- The West Texas Intermediate Crude Oil Market initially pulled back just a bit during the early hours on Thursday, only to turn around and show signs of life.

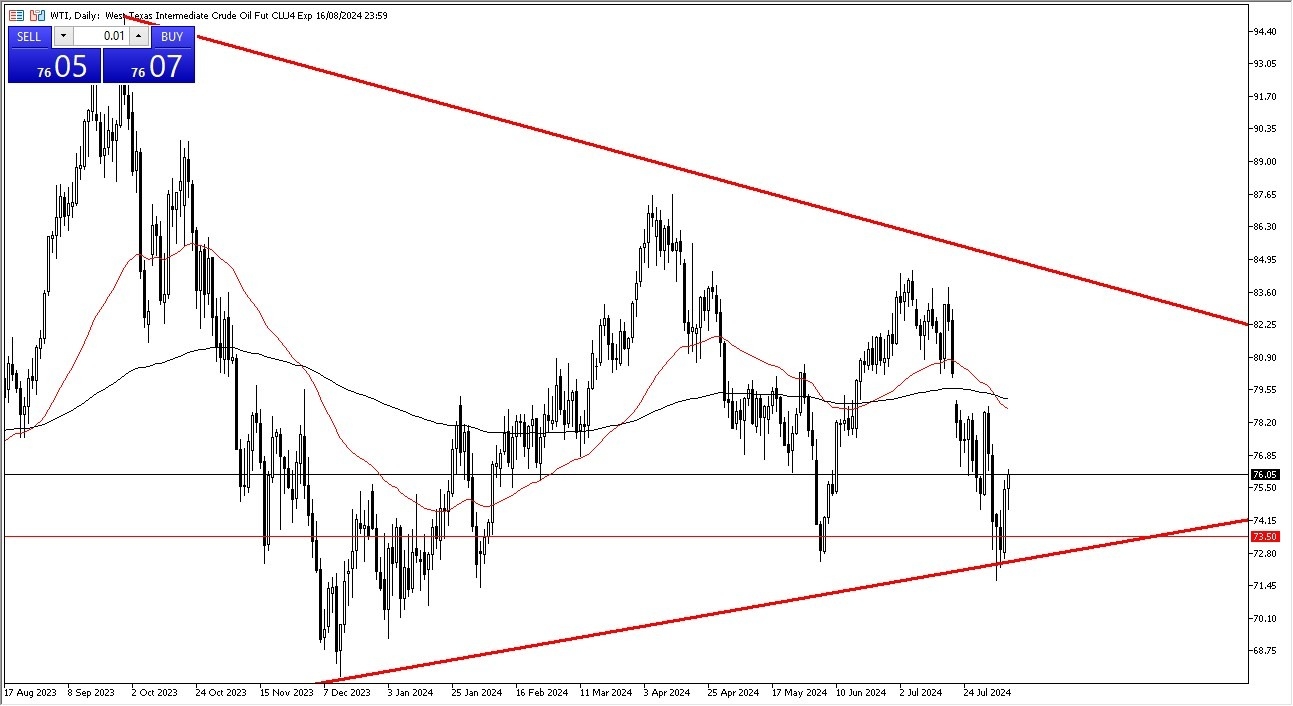

- By rallying the way it has, it tells me that the market is still going to pay attention to the symmetrical triangle that we had been trading in for some time.

- We need to pay close attention to the $73.50 level as it is supported.

A break higher at this point in time opens up the possibility of a move to the 50-day EMA, which is a major indicator that a lot of people pay close attention to. Furthermore, there's also a gap on the chart in this area, and therefore it's likely that we will continue to see every dip continue to attract significant attraction.

Top Forex Brokers

On a Turnaround

If we were to turn around and break down below the $71.50 level, then the market could drop down to the $67.50 level, which is also massive support. I think at this point in time, we are very cautious with our optimism in the short term, but I do think it looks like we are trying to squeeze to the upside. Keep in mind, there are a lot of geopolitical factors out there that continue to favor the idea of oil being something that is going to be bullish because of territorial disputes and conflicts.

You also have this time of year, which is typically bullish anyway. So as long as that's going to be the case, I find it very difficult to short oil anytime soon. That being said, I also recognize that the area right around the $83.50 level is significant resistance, so I don't think we get above there either. Essentially, we are in some type of summertime range that is squeezing tighter and tighter and will eventually have to be resolved.

Ready to trade the Crude Oil forecast? Here’s a list of some of the best Oil trading platforms to check out.