WTI Crude Oil has delivered a potentially expensive lesson to speculators who do not have experience when wagering on commodities, this as the price of the energy has gone lower.

- As political sabers rattle in the Middle East, inexperienced speculators in WTI Crude Oil may have believed free money was about to be offered in the commodity, only if they bought the energy and held on.

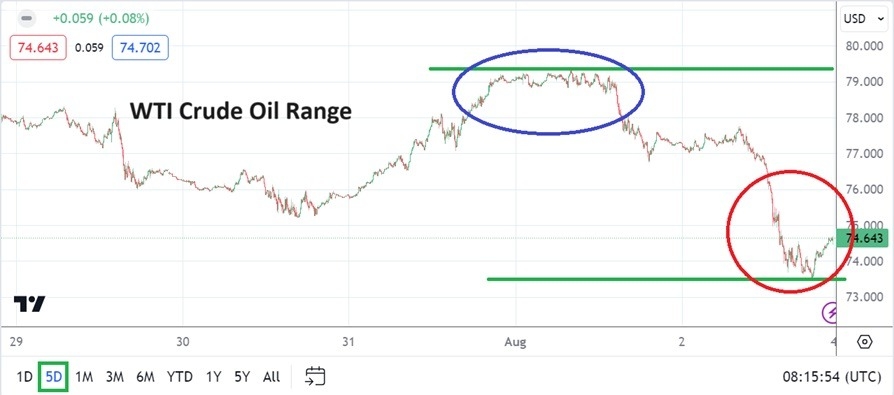

- However, WTI Crude Oil has gone into the weekend near its lows for the week and past month.

- The commodity is also within sight of depths seen in the first week of June. WTI Crude Oil closed this past Friday near the 74.643 ratio, this after touching a high during the week around 79.440 on Thursday.

Interesting too is the notion that WTI Crude Oil never traded above 80.000 USD the past handful of days. The last time the commodity even traced the 80.000 level was on the 22nd of July. Before this date in July WTI Crude Oil had been in the midst of a bullish run higher when a price of 84.700 was challenged in the first week of July. Importantly since more ‘firecrackers’ have gone off in the Middle East at the end of July, the price of Crude Oil has effectively come down. This as even more ‘firecrackers’ are promised in the Middle East in the near-term.

Top Forex Brokers

What Big Traders of WTI Crude Oil Know

While many media pundits created headlines about the dangers for the price to WTI Crude Oil because of the Middle East tension, technical charts show the commodity has been in a bearish trajectory. What has happened during this time of heightened noise from the Middle East is that more U.S economic data from the U.S, Europe and Asia has been seen by large players in the energy sector who clearly understand the major economies continue to show signs of struggling. The outlook over the mid-term regarding lackluster major global economies helps dampen the demand for WTI Crude Oil.

Thus, while inexperienced traders may have blindly bet on swings higher in WTI Crude Oil the past handful of days, the price of the commodity has decreased which have likely led to losing bets. There are no guarantees the Middle East tensions will not escalate and that the price of WTI Crude Oil is going to remain tame, but experienced traders it must be pointed out have dealt with these ill winds of noise before.

WTI Crude Oil in the Near-Term and Coming Week

The inability to know exactly what is going to happen in the future and the added potential of wrong forecasts can prove extremely difficult for speculators. WTI Crude Oil is now touching what may be viewed as technically important support levels, which could spur a reversal higher based on this perception alone.

- Except, it should be remembered that WTI Crude Oil was trading around the 72.500 mark on the 4th of June, which should serve as a warning that the commodity could move lower.

- And if a six month chart is looked at traders can see that in early February WTI Crude Oil traded near 71.600.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 72.510 to 80.10

The price of WTI Crude Oil remains dynamic and day traders need to remember that large players in the commodity have plenty of information which shifts their behavioral sentiment including economic data, shipments of current tankers, production levels from a variety of global producers, and yes, perhaps even political insights.

Small traders need to try and remember that large speculators in WTI Crude Oil are not immune to being wrong, but they have many years of experience which allows them to control their emotions when others do not. WTI Crude Oil may look cheap taking into consideration globally developments, but the market price is telling us that for the moment things may be calmer than many believe.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.