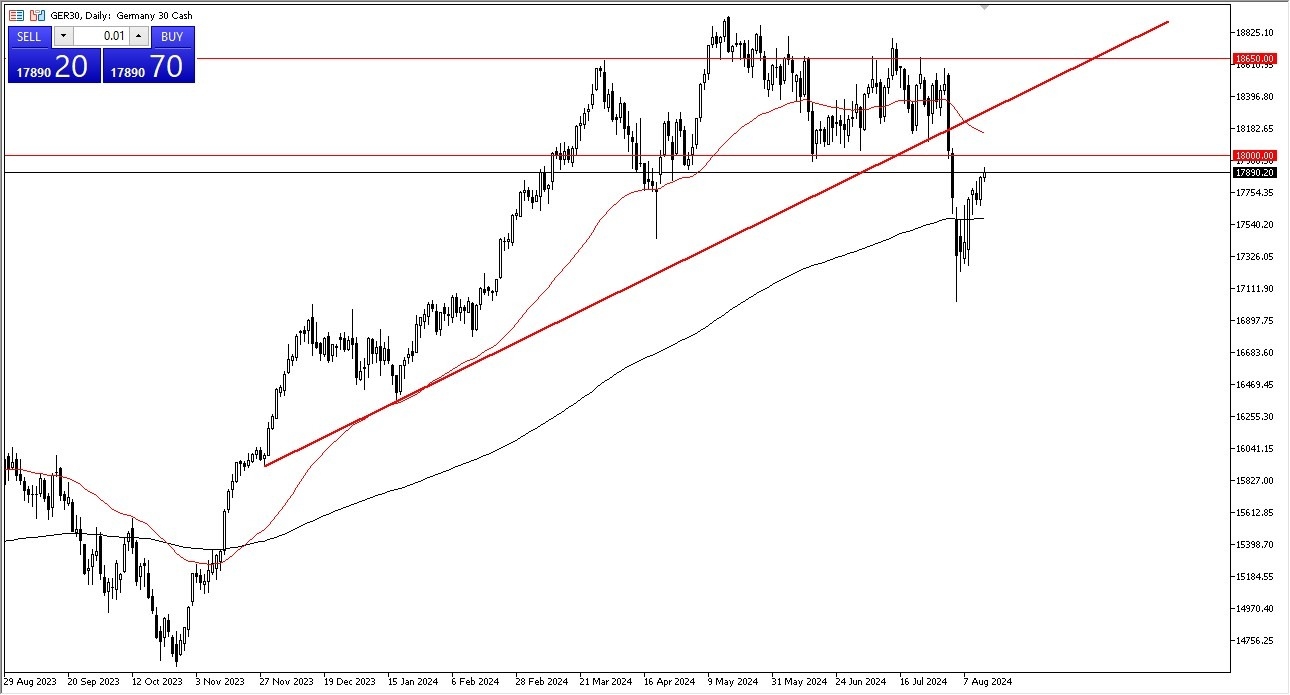

- The German index has rallied slightly during the early hours on Wednesday as we continue to see a lot of noisy behavior and a pretty significant attempt at a recovery.

- Last week we ended up forming a hammer, so breaking higher of course is a potentially bullish sign.

- At this juncture it's going to be very interesting to pay attention to the 18,000 euro level because it is a large round psychologically significant figure and of course an area that previously had been supported.

Underneath we have the 200 day EMA that the market bounced around for several sessions and then took off to the upside. In general, I think the DAX is something worth watching because Germany is heading into a recession, so we are already seeing traders try to bank on the idea of cheap money coming out of the European Central Bank.

Top Forex Brokers

Liquidity?

That of course is a situation where more liquidity has people looking for cheap assets. That being said though, I think this is a scenario where bad news might actually end up being bad news. And I think that's part of what people are concerned about. Since the great financial crisis, we've seen most traders react to whether or not there is liquidity in the market and whether or not that should send the market higher.

The break of the significant trend line, of course, is something that still keeps a bit of a lid on this market. And then of course we have the 50 day EMA, which is closer to the 18,200 euro level and dropping. I think the only thing we can count on is a lot of really back and forth choppy behavior. However, if we break back below the 200 day EMA, I think this is a market that comes undone.

I don't think if that happens that the DAX will be alone and quite frankly, I think it'll just be right along with other major indices doing the same thing around the world. On the other hand, if we continue to see more of a tentative bounce, sooner or later, we may see an attempt to break above the overhead resistance.

Ready to trade our daily forex analysis? Here are the best CFD brokers to choose from.