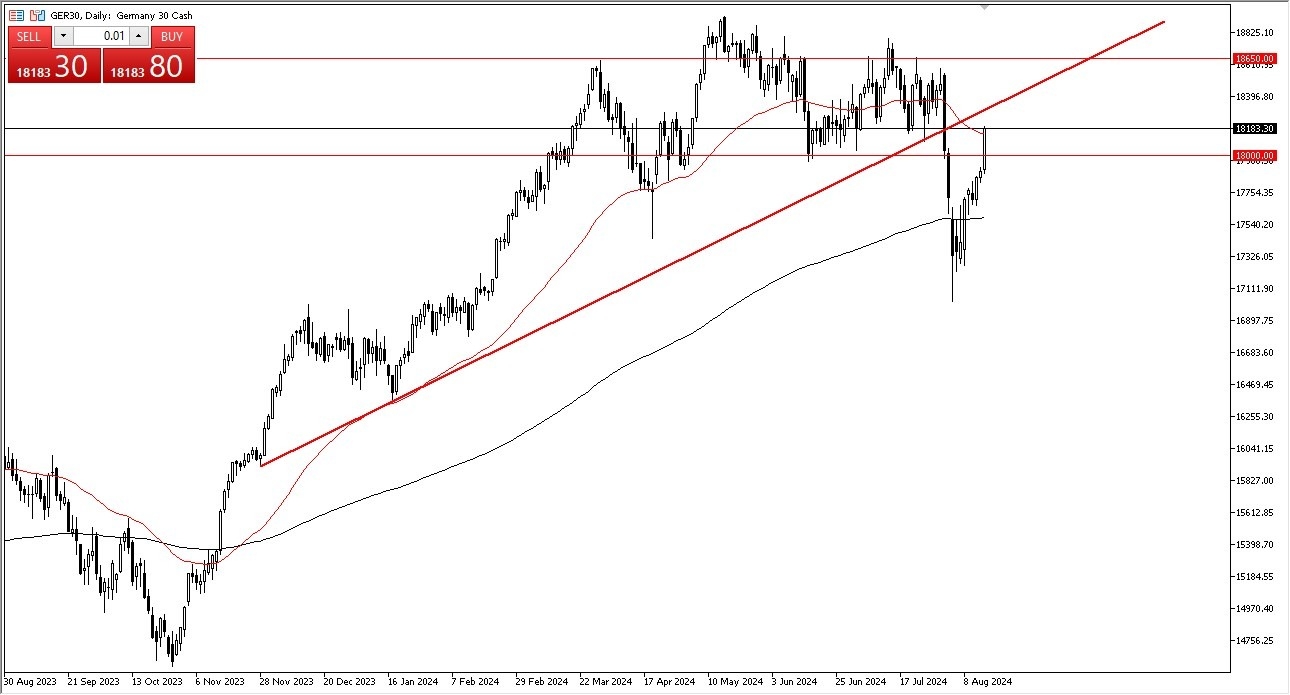

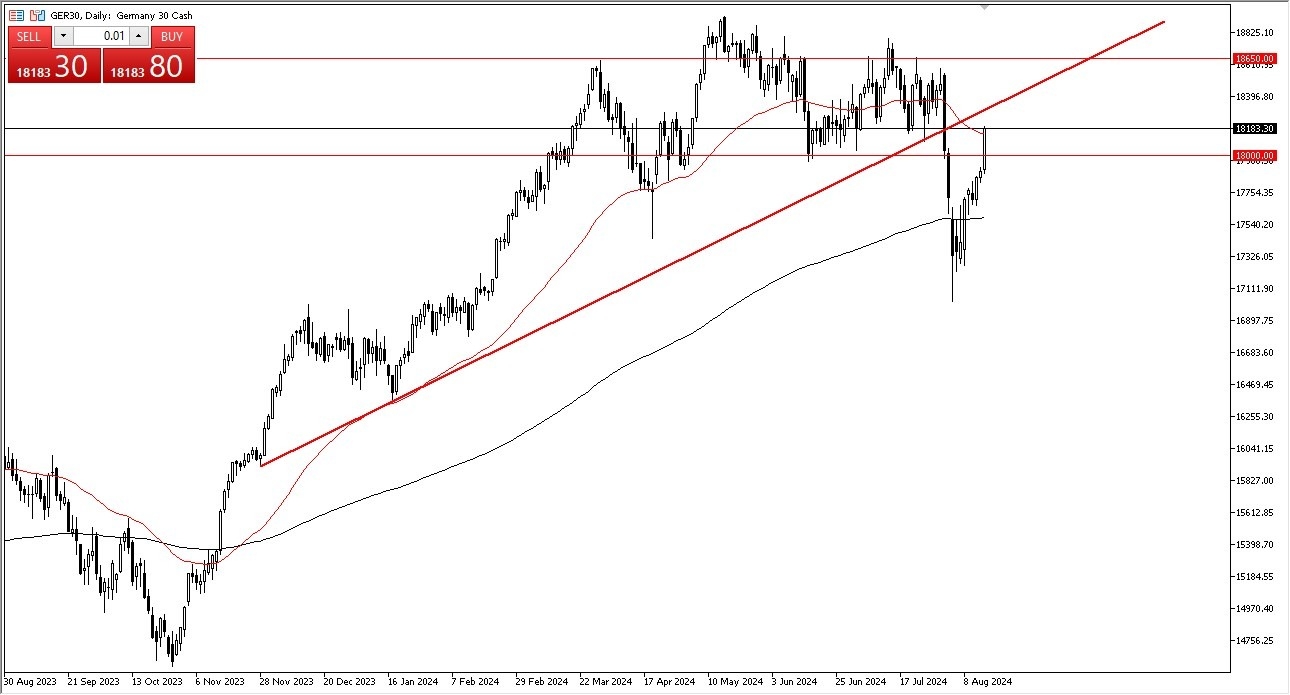

- The German index has shown quite a bit of upward momentum during the trading session on Thursday, as we have broken above the 50-Day EMA, and before that even broke above the €18,000 level.

- All things being equal, the market is likely to continue to see a lot of noisy behavior, and with that being the case, short-term pullbacks will more likely than not be a common phenomenon.

However, if the market were to pull back at this point in time, I think somewhere near the €18,000 level I would anticipate seeing quite a bit of support. After all, we had seen the €18,000 level offer support multiple times in the past as well as resistance, and therefore I think it makes a certain amount of sense that “market memory” has come into the picture.

Top Forex Brokers

The size of the candlestick for the Thursday session is of course impressive, as it is a very large range. This suggests that we are more likely than not to continue to see buyers jump into this market and try to push the DAX higher. Ultimately, this is a market that will continue to focus on the idea of whether or not monetary policy is going to loosen, and therefore it gives equities traders more money to gamble with.

European Union in the ECB

The European Union seems to be struggling a bit, so that does make the idea of buying stocks a bit counterintuitive to the average person. However, the market is likely to continue to see traders look forward to the idea that the European Central Bank might start cutting rates more aggressively, and therefore it gives funds the ability to gamble with cheap money. They typically will apply a lot of leverage, and therefore it starts a bit of a squeeze.

However, sooner or later people start to pay attention to the actual economy. We are not there yet, and since the Great Financial Crisis, we have seen the entire game be sorted out via liquidity and not much else. It looks like liquidity could come flooding back into the system.

Ready to trade our daily forex analysis? Here are the best CFD brokers to choose from.