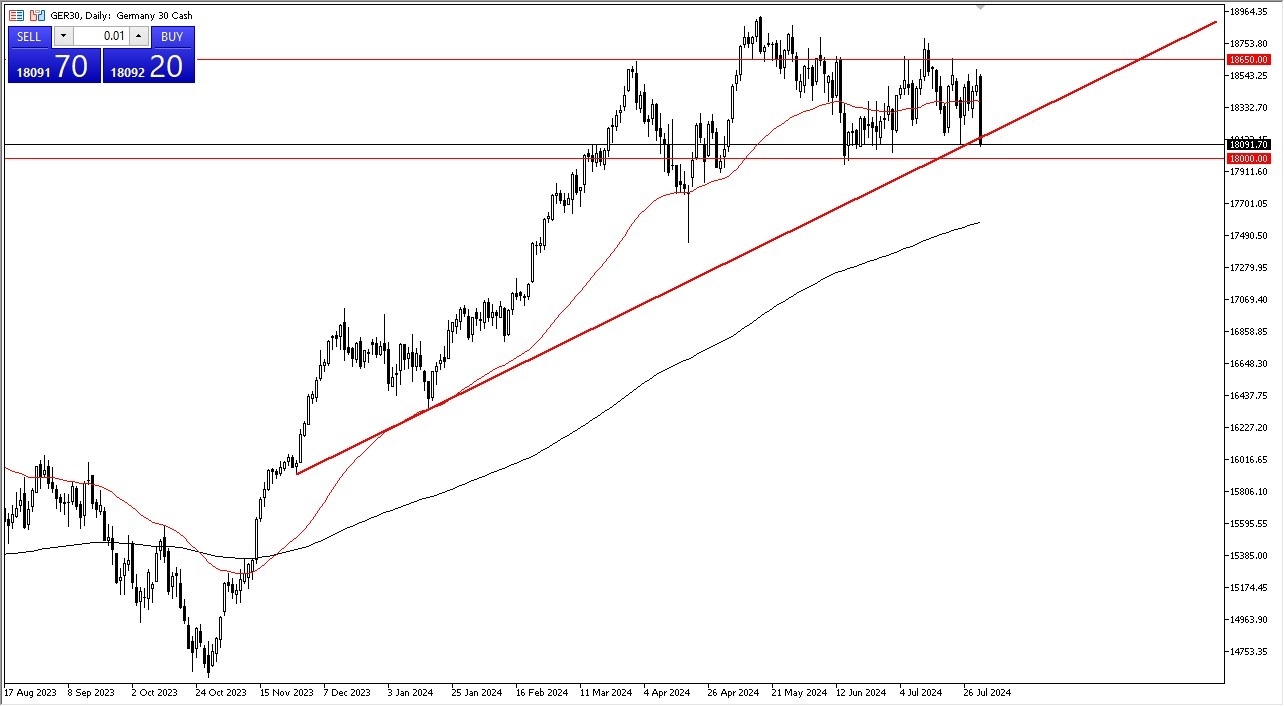

- In my daily analysis of the DAX, the first thing I notice is that we are threatening a major trend line, and therefore we need to pay close attention to what happens next.

- Beyond the trend line, we also have the €18,000 level sitting underneath offering a significant amount of support as well.

- Ultimately, it is worth noting that this is a very ugly candlestick, but at the end of the day, we are still very much in the same range that we have been in for several months.

The European Central Bank continues to look like it’s going to remain fairly loose with its monetary policy, so it’ll be interesting to see whether or not that list the DAX. There is a school of thought that says perhaps they are cutting rates due to the fact that they see something ugly coming down the road, and it’s probably worth that the first place that people put money to work in the European Union is in Germany, and therefore I think you get a situation where if money starts leaving the EU, we could see it appear in the form of the DAX getting blown up.

Top Forex Brokers

Volatility Should Continue

I think regardless of what happens next, we will continue to see a lot of volatile moves as the market is certainly a bit confused at this point and trying to sort out where we go next. You can say that about the DAX, and for that matter you can say that about most indices, and of course this one will be any different. With the Federal Reserve likely to cut rates in September, that does have a bit of a “knock on effect” in Europe as well as other places, so at this point in time it appears that money is flying around the world and trying to sort out where it’s going to go next.

In this environment, I do believe that there is a lot of support at the €18,000 level, but if we were to break down below that level, it would obviously be a major “shot across the bow” for the buyers. We will have to wait and see how this plays out over the next 24 hours or so.

Ready to trade our daily forex analysis? Here are the best CFD brokers to choose from.