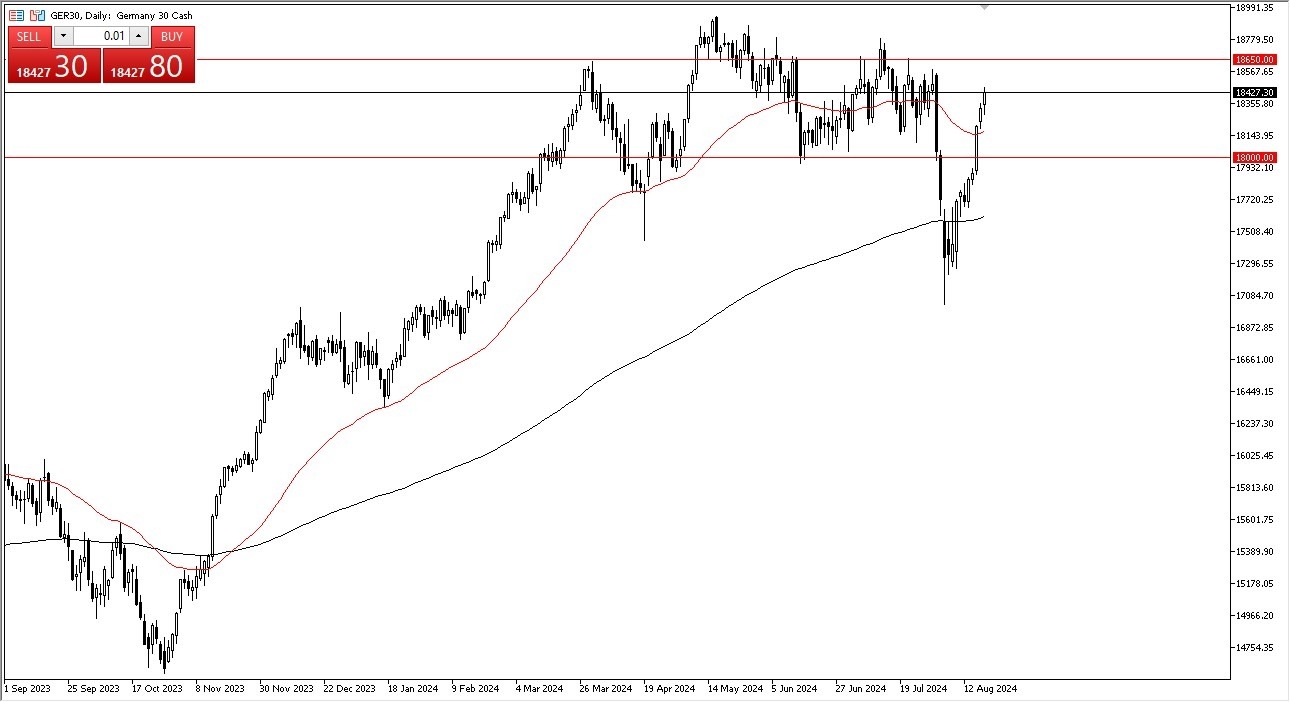

- The German index has rallied slightly during the trading session here on Monday, as it looks like we are trying to grind towards the 18,650 euro level.

- That's an area where we have seen a lot of resistance.

- This is an area that has been important more than once.

- I think if we can break above there, then it's likely that we could go looking to the 18,750 euro level.

Short-term pullbacks probably are going to be thought of as potential buying opportunities. I do think that the 18,000 level underneath is going to be a fairly important support level. In general, this is a market that I think you have to be very cautious with because it is stretched a bit to the upside in the short term.

Top Forex Brokers

The Market Remains Bullish Despite Noise

Nonetheless, this is a bullish market, and I do think that money will continue to flow into Germany before anywhere else at the European Union region. So, with this being the case, I think you've got a situation where we try to find value, but we also need the market to come back to us. The last thing you want to do is chase the stock market when everybody is schizophrenic. That certainly seems to be the case with most investors right now.

If we do break out above the 19,000 euro level above that opens up a move to the 20,000 euros level and I do think eventually that could happen. But with this being said, you also have to be cautious about looking for that. Like I said, I would prefer to find value on dips in order to get long. I have no interest in shorting the DAX anytime soon, due to the fact that this is one of the first places money flows into the European Union, and of course the German economy, although a bit soft at the moment, is going to be the first to recover. There are indices in the European Union I am much more interested in shorting.

Ready to trade our daily stock market analysis? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.