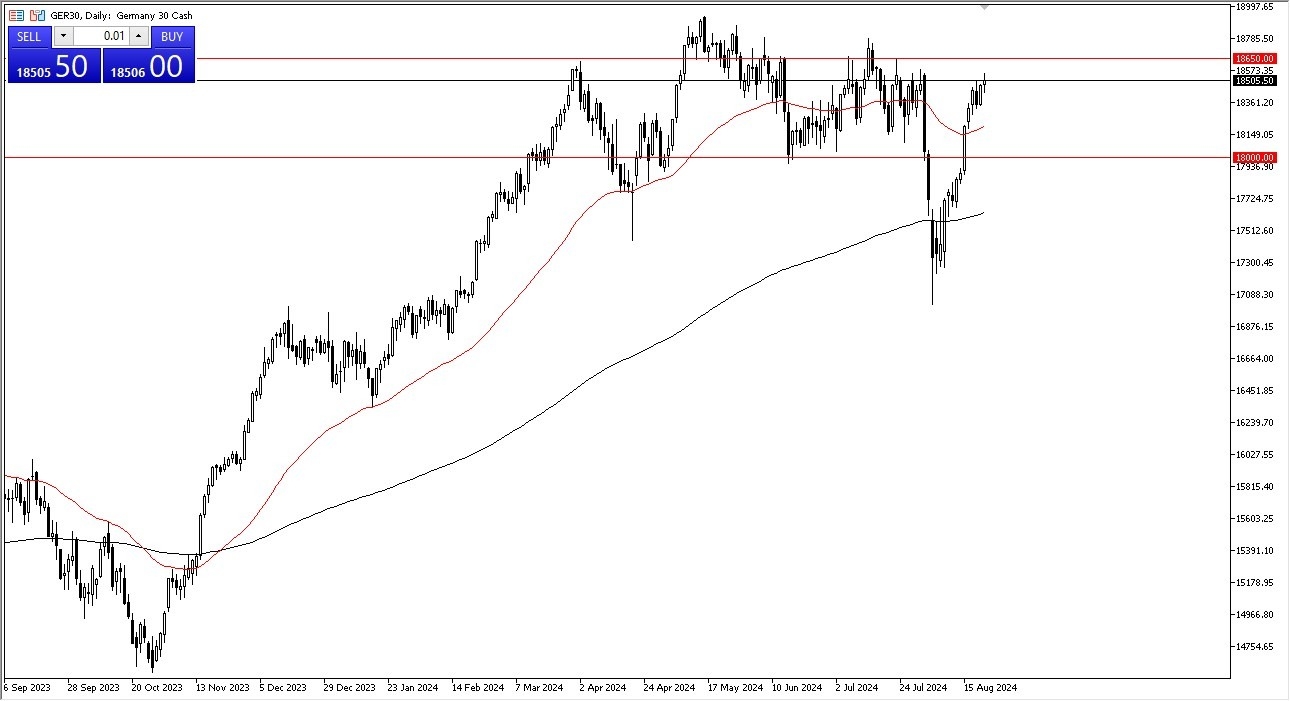

- In my daily analysis of the German index, I can see that the DAX is struggling a bit to continue going higher.

- Quite frankly, this does make a certain amount of sense considering that the market is a bit of a stretch, and we have essentially gone straight up in the air for 2 weeks.

- With that being the case, it’s worth noting that the €18,650 level above has been important multiple times, and I think a lot of traders will continue to look at it as a major ceiling.

The question of course is whether or not we can continue to go higher, and if we have any type of catalyst to make that happen. Speakers of the Jackson Hole symposium has suggested that the ECB might cut in September, but they have not put any preconceived notions or conditions on that potential cut, live in the market a little bit confused. Regardless, I do think that momentum is probably a little overdone at this point, so it does make a certain amount of sense that we take a bit of a breather.

A Potential Pullback

Top Forex Brokers

Potential pullback is presenting itself, and I think it would make a lot of sense for the text to drop toward the 50-Day EMA. The 50-Day EMA of course is a major indicator for momentum and trend followers, so I think that could cause a bit of noise just by its very presence. Even if we were to break down below there, then you have the psychologically important €18,000 level that people will be following as well, so I do think that there are buyers underneath. This of course assumes that there is not some type of shock that comes into the market, and these days it seems like the market has either the euphoria of “we are never dropping again”, or the absolute despair of “we are going into the Great Depression again.” This is just the world that we live in, and unfortunately, I don’t see that getting any better.

With the volatility being the way it is, I think you need to be very cautious with your position size, not only in the text, but just about anything else that you trade. Because of this, position sizing in my account at lease, has been about half of what it normally is.

Ready to trade our daily forex forecast? Here are the best CFD stocks brokers to choose from