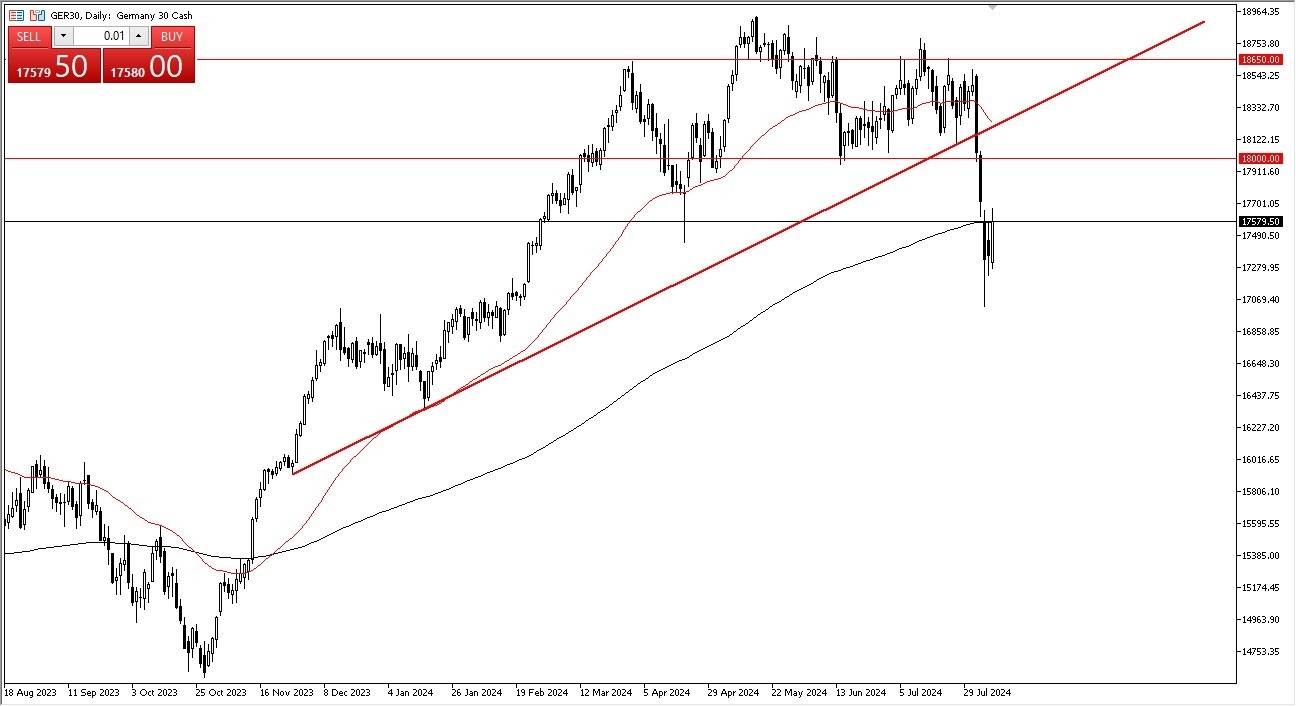

- The DAX in Germany has rallied pretty significantly during the trading session on Wednesday as we are now threatening the 200 day EMA again.

- At this point in time, I do think that we need to clear the 17,700 euro level for traders to jump in and have more confidence.

If traders do see this as a significant bounce, it's likely that the DAX could go looking to the 18,000 euro level. That being said, there's been a lot of technical damage done to not only the DAX, but general markets overall. And I think that's probably going to continue to be a bit of an issue going forward. If we were to turn around and drop down below the 17,000 euros level, then at that point I think we have real issues. Keep in mind that Germany is more likely than not going into some type of recession, but then again so is the rest of the world and that might be the problem. After all, it's worth noting that Germany is a major exporter to various countries, not only in the EU but North America as well.

Top Forex Brokers

DAX Susceptible to Foreign Economies

So, it's likely to be a scenario where the DAX is going to be held hostage by foreign economies at the same time. While the recent action has been rather substantial, the reality is we are still waiting to see if we get any follow-through on the upward momentum. So far, we're just stabilizing it and that's okay. That's something that you need to see before any sustainable turnaround. Because of this, I am watching this very closely, but I also recognize that we are in a situation where the market could throw this a few curveballs along the way.

Position sizing is crucial, due to the fact that there is so much uncertainty, but quite frankly that’s not a phenomenon that is solely in the domain of the DAX. I think that can be said for all markets at this moment, so therefore I urge caution.

Ready to trade our stock market analysis? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.