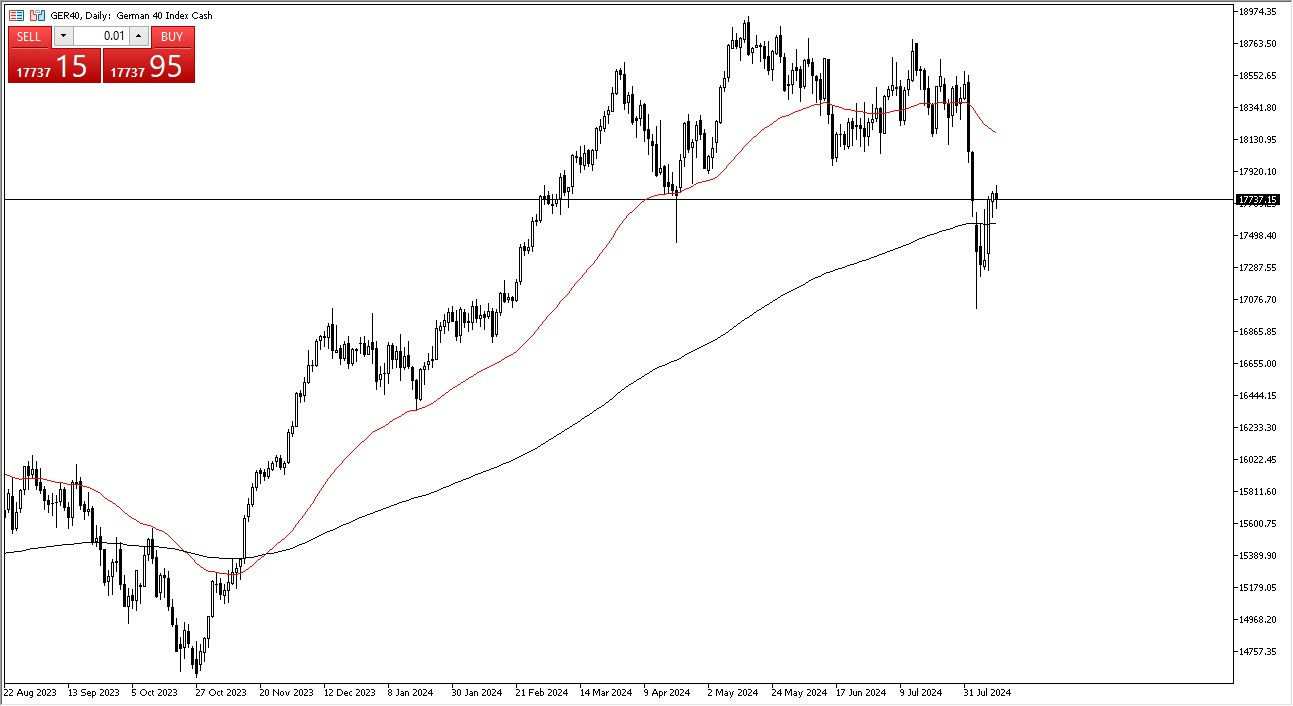

- In my daily analysis of the DAX, the first thing I bring to the forefront and your attention will be the fact that we are remaining somewhat sideways after an initial bump to break above the 200 day EMA.

- This of course is a bullish sign in general, but what I would point out furthermore is that this is a market that will be very heavily volatile right along with the other indices around the world.

- Because of this, I don't really like the idea of getting overly aggressive here as the geopolitical risks and, of course, economic macroeconomic, that is, concerns, continue to take front and center stage.

The 17,750 euros level seems to be a little bit of a magnet for price, but if we can break higher, then you have to pay close attention to the 18,200 euros level, as it has been important in the past, and of course we have the 50-day EMA sitting there. If we turn around and break down below the 200-day EMA, I would look for support at the 17,250 euros level where we had bounced from previously.

Top Forex Brokers

The Support Below

After that, the next support level could be the 17,000 euros level and anything below there would be extraordinarily negative. Because of this, I think you do have to be somewhat cautious. And I do think that if you decide to dip your toe in the water, you need to do so with a small position because right now the markets are still very much on edge. And I think that might continue to be the case for a while.

The DAX of course is the major index that everybody pays attention to in the European union. So ultimately, I think you've got to understand that this is a market that I think you could start to get bullish on, but you can't do so with a lot of money. The most important thing that you need to keep in mind is that the market is still very skittish.

Ready to trade our daily forex forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.