Potential signal:

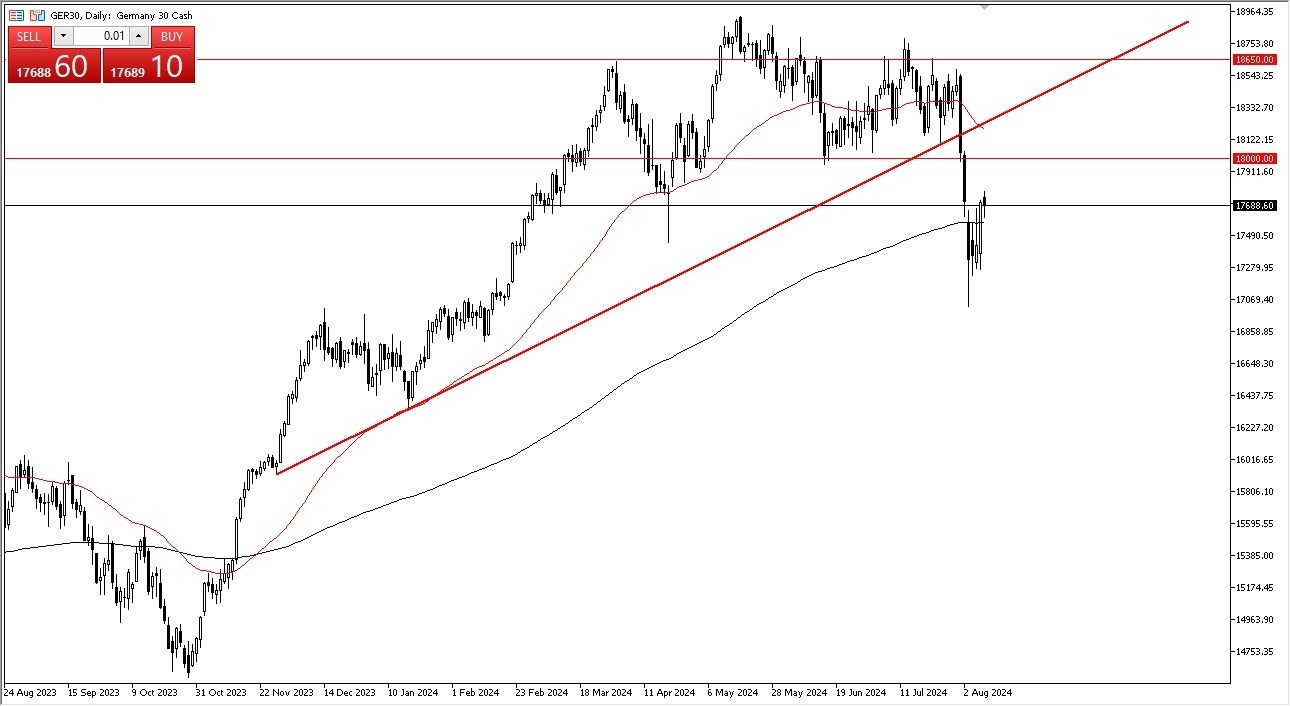

- If the DAX breaks above the €17,750 level on a daily close, I think a short-term buying opportunity presents itself.

- I would have a stop loss near the €17,490 level, with a potential target of €18,000 above.

- The German index has gone back and forth during the course of the trading session on Friday, as we continue to hang around the 200-Day EMA.

- This is a market that of course will be crucial due to the fact that it is a huge portion of the European Union and its GDP, but it is also one of the largest economies in the world.

- With this being the case, I think you have to pay close attention to this market and try to figure out whether or not it is going to rise from here.

Top Forex Brokers

The Thursday candlestick was extraordinarily bullish, breaking well above the 200-Day EMA for the first time in 3 sessions, and the fact that the Friday session is relatively quiet suggests that perhaps traders will more likely than not be a little bit more comfortable holding this index. That being said, I also recognize that the world is a very volatile place right now, it may take a while for this to play out.

As Goes Germany, So Goes Europe

Keep in mind that with Germany being so important, I can give you a bit of a “heads up” as to what happens in other parts of Europe, as it is considered to be the “blue-chip index.” For example, if the DAX is starting to fall again, it’s very likely that the smaller countries such as Holland, France, Austria, and so on are all falling as well. It doesn’t have to be that way, but as a general rule, if the DAX is selling off aggressively, other smaller European countries are being absolutely squashed.

On the other hand, if the DAX is rising then people feel little bit more comfortable stepping out into the risk spectrum and trying to pick up stocks in places like Greece. For example, one of my favorite trades is to wait for the text start rallying, and start buying stocks in the MIB, Italy’s major index. That being said, I also do the exact opposite, so while I don’t necessarily place a ton of trades in the text itself, I use it as a risk appetite measure of the European Union on the whole.

Ready to trade the daily analysis & predictions? We’ve made a list of the best online CFD trading brokers worth trading with.