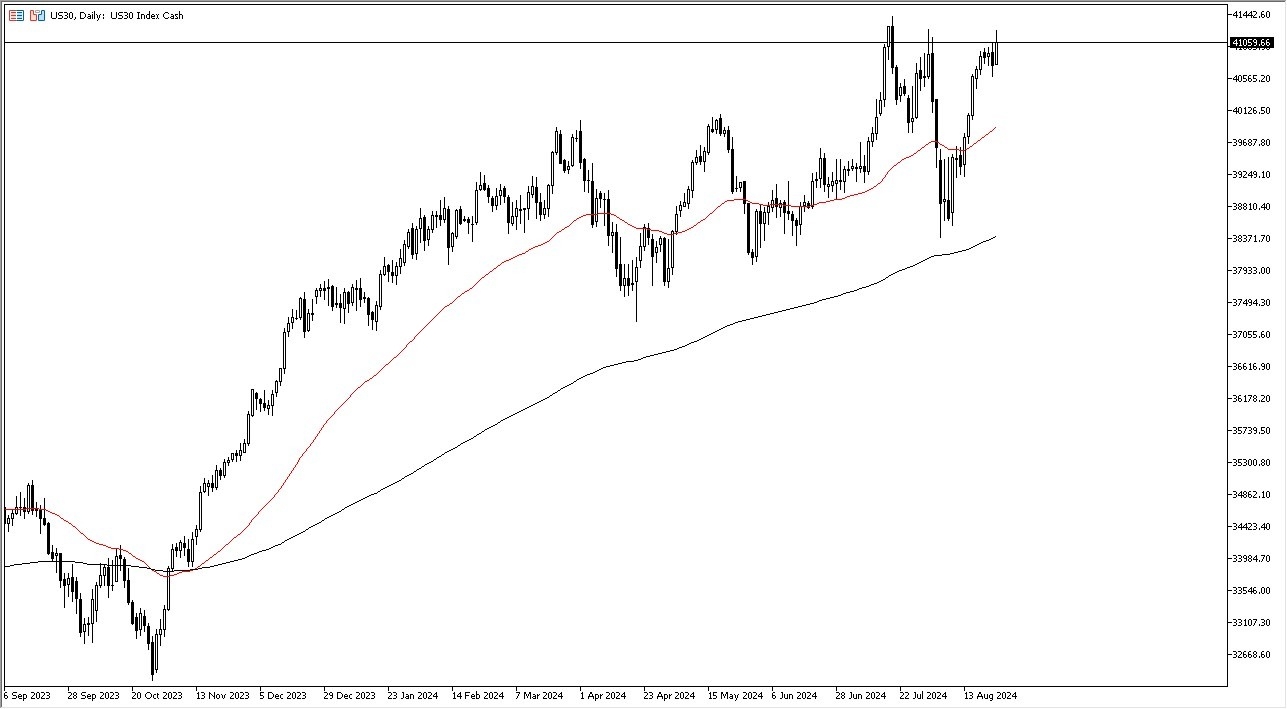

Potential Signal:

- If the Dow Jones 30 breaks above the 41,500 level, it’s a buying signal that a lot of people will be paying close attention to.

- The stop loss would be at the 40,500 level underneath, and it’s likely that the market will eventually make its way to the 42,500 level above.

- We are doing everything we can to reach all-time highs.

- This is a market that has been very noisy as of late, but with the Jackson Hole Symposium speech released on Friday, it has become an open fact that the Federal Reserve is going to start cutting rates.

- This should help the Dow Jones 30 as it is an industrial’s average, and a lot of these companies will benefit from any type of stimulative effect on the economy as they are considered to be the “blue-chip” stocks.

Top Forex Brokers

Short-term pullbacks will almost certainly attract a certain amount of attention, and I do think that the fact that we have cracked above the 41,000 level is an area of interest for traders, and I think at the end of the day we should see plenty of buyers willing to get involved. If we can break out above the 41,500 level, then it’s likely that we get more of a “buy-and-hold” type of market. Quite frankly, Wall Street has decided that it is going to continue to push higher, demanding that the Federal Reserve acquiesce to its needs.

Federal Reserve Serves Wall Street

It is not lost on me that the Bureau of Labor Statistics admitted that they had over counted 818,000 jobs over the previous year, the day before the Federal Reserve states that they are worried about the job market. In other words, Wall Street is getting what it wants, in the form of cheap and easy money. This will cause havoc in the US economy as it will only drive inflation up higher, but Wall Street doesn’t care as it’s about equity pricing.

That being said, this is a game we are playing as it has nothing to do with reality. It’s all about liquidity, and as long as that liquidity is coming, it’s very likely that the Dow Jones 30 will just simply go parabolic yet again. It’ll be interesting to see how we close out for the weekend, but there’s a good shot that we see plenty of institutional buying heading into the close.

Ready to trade our daily analysis & predictions? Here are the best CFD brokers to choose from.