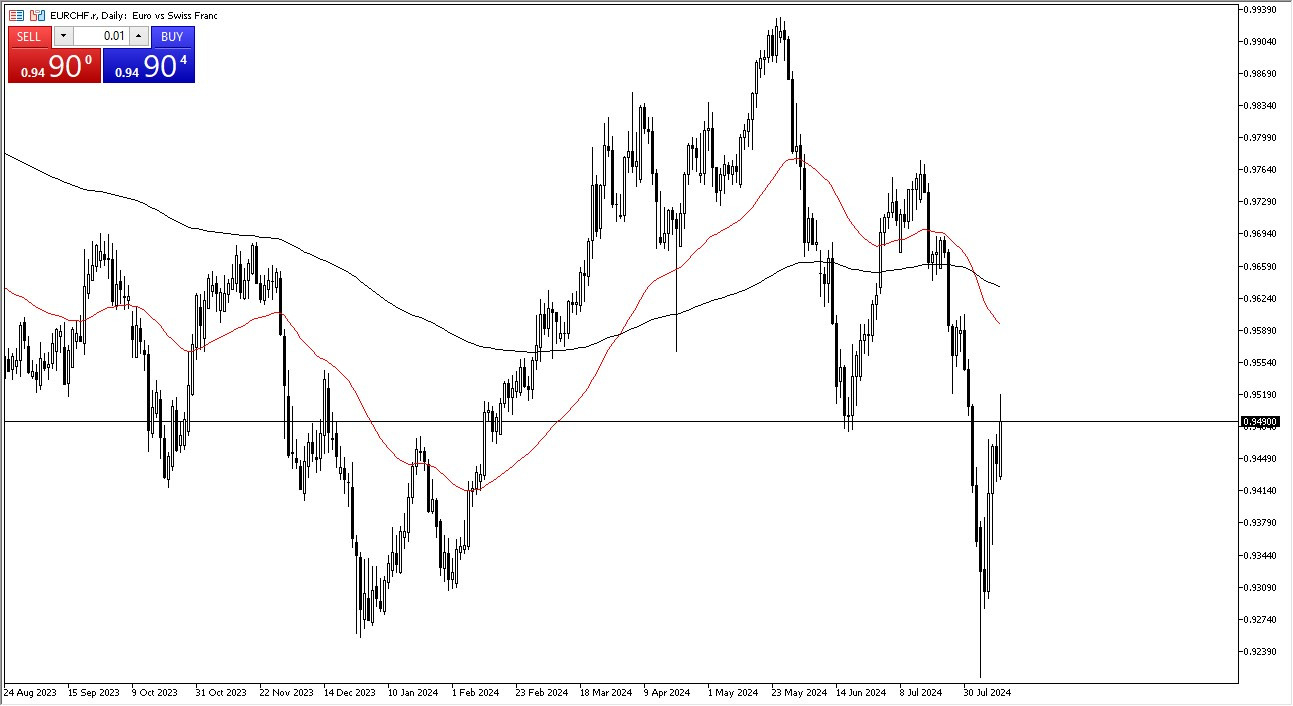

- In my daily analysis of the Euro against the Swiss Franc, it's obvious that we have seen a lot of noisy behavior and upward pressure as we are trying to break above the 0.95 level.

- The 0.95 level is an area where we have seen a lot of noise in the past, and of course it is a large round psychologically significant figure.

- If we can break above the top of the candlestick for the trading session, then it's possible that we could go looking at the 50 day EMA.

Potential Short-Term Target

Top Forex Brokers

The 50 day EMA is near the 0.96 level and therefore that could be your short-term target. Keep in mind that this is a risk appetite sensitive pair because quite frankly, Europeans run towards Switzerland when they are concerned. That being said, at this point in time, I think we've got a situation where we are trying to recover, but I also think it's going to be a lot of noise between now and then. Short-term pullbacks should end up being buying opportunities as the market is going to continue to see the 0.94 level offer support.

If we break down below that level, then we could go down to the 0.93 level which is even more supportive. While things being equal, I expect a lot of noise, but I still think we are in the midst of trying to recover. If we get a sudden risk off type of world that obviously helps the Swiss Franc, and this will be a pair that falls apart. We are at a major crossroads right now as we have balanced from a massive support level going back multiple years. So, it'll be interesting to see if we can keep this momentum up.

Keep in mind that this is a market that will continue to see a lot of back and forth, as the pair is choppy under most circumstances, and I don’t think this move will be any different. A lot of patience will be needed at this point in time.

For additional & up-to-date info on brokers please see our Forex brokers list.