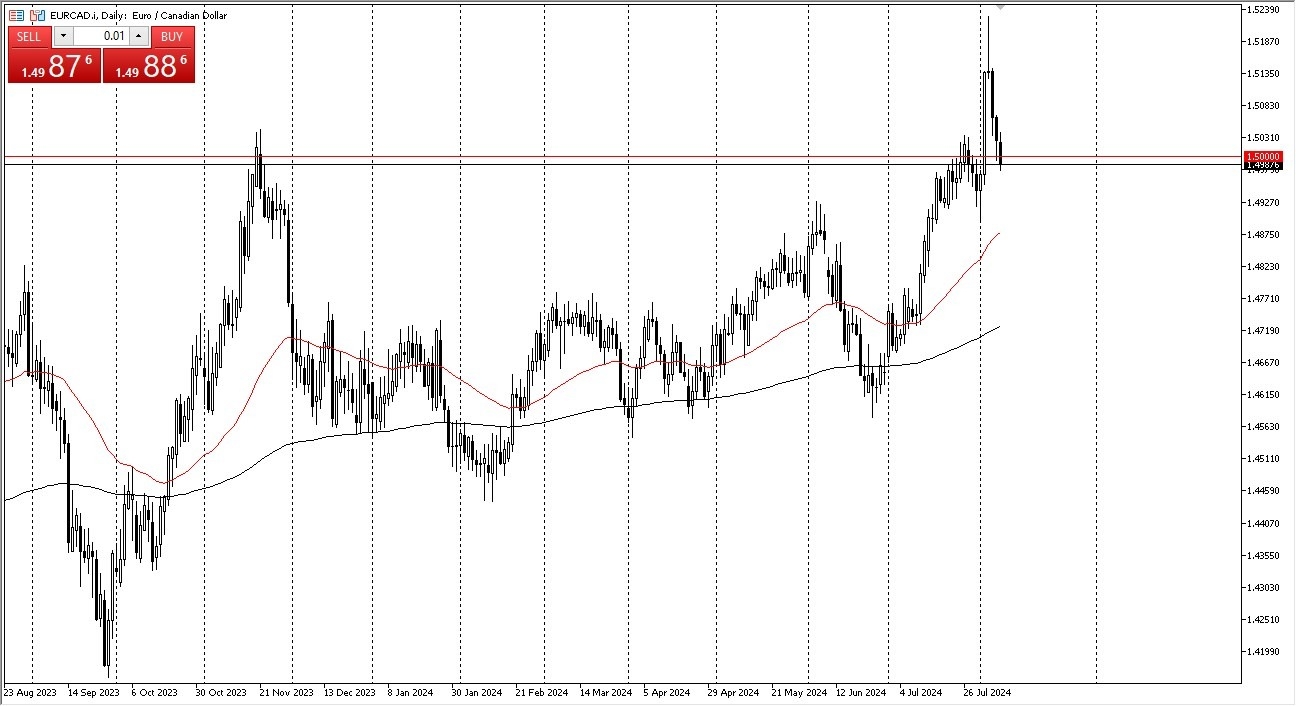

Potential Signal:

- I would be a buyer of this pair at the 1.5050 level, with a stop loss at the 1.4975 level.

- I would be aiming for the 1.52 level at the very least.

In my daily EUR/CAD analysis, this is an asset that has plunged below the crucial 1.50 level. This is an area that previously has shown itself to be significant resistance, so I do think there is a bit of market memory to be paid attention to here. This does make a certain amount of sense because quite frankly we get major news out of Canada on Friday, so I think people are bit cautious about getting aggressive to the upside. All things being equal, this is a market that is likely to see volatility on Friday due to the fact that we of course get Canadian employment figures.

Technical Analysis

The technical analysis for this pair is that it had recently broken out, only to pull back to the resistance barrier to test it. At this point in time, the market is more likely than not to see some buyers jump into the market in order to take advantage of the overall trend. Furthermore, if Canada has a poor jobs report come out on Friday, that will almost certainly add fuel to the fire here. Ultimately, if the market were to break above the 1.51 level, then the follow-through should be rather aggressive.

Top Forex Brokers

Ultimately, I’m not necessarily overly bullish of the European Union, I just recognize that the Canadian dollar itself is very soft. The Bank of Canada has cut rates a couple of times now, and the ECB of course is leaning more toward his dovish site as well. That being said, oil markets have been miserable, and that of course has its knock on effect on the Canadian dollar as well.

Underneath, we do have the 50-Day EMA near the 1.49 level, which of course is a level that people will be paying close attention to due to the fact that the market is likely to see that widely followed indicator make some traders stand up and pay attention. If we were to break down below there, then we could see a much deeper correction, but quite frankly I think we would need to see the Canadian economy, and in this case jobs, perform rather strong to make that happen.

Ready to start trading our Forex signals? Get the most recommended Forex brokers for beginners here.