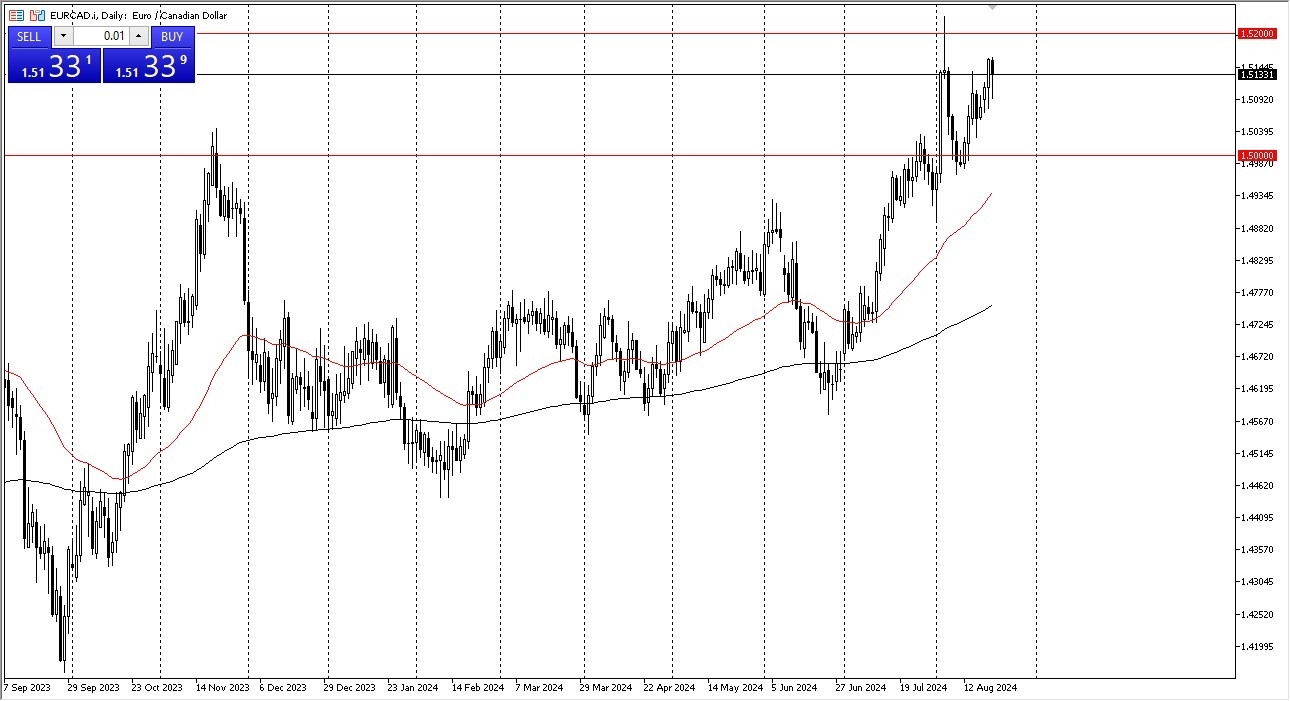

Potential signal:

- I am a buyer of this pair at this point in time.

- I would add a position on a daily close above the 1.52 level.

- I’d place a stop-loss at 1.4980 below.

The euro has pulled back just a bit during the early hours on Wednesday against the Canadian dollar to test the 1.51 level. That being said, we have turned around to show signs of life, and it does look like the overall uptrend should continue. There is a significant amount of resistance above near the 1.52 level, which is where we pulled back from just about two weeks ago. The 1.52 level being broken to the upside on a daily close would be a very bullish sign. I think most certainly that there would be plenty of buyers willing to get involved. Underneath, we have the 1.50 level offering significant support. And now we have the 50 day EMA racing towards that area to offer a little bit of a floor.

Noise Ahead? Probably.

Top Forex Brokers

In general, this is a market that I think continues to see a lot of back and forth as we consolidate after the shot higher that we had seen during the previous month. I do think ultimately the Canadian dollar is probably going to remain somewhat soft because there are a lot of concerns about the Canadian economy. But furthermore, we also have to worry about oil. Oil does have a major influence on the Canadian dollar. And although the Canadian dollar has strengthened against the US dollar, the reality is that the Euro has outperformed both. So, it triangulates quite well for a move to the upside. Do I think now that it's going to be an explosive move to the upside? Probably not. But I do think that the buyers will continue to be attracted to this pair. And that is probably only a matter of time before we continue much higher.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.