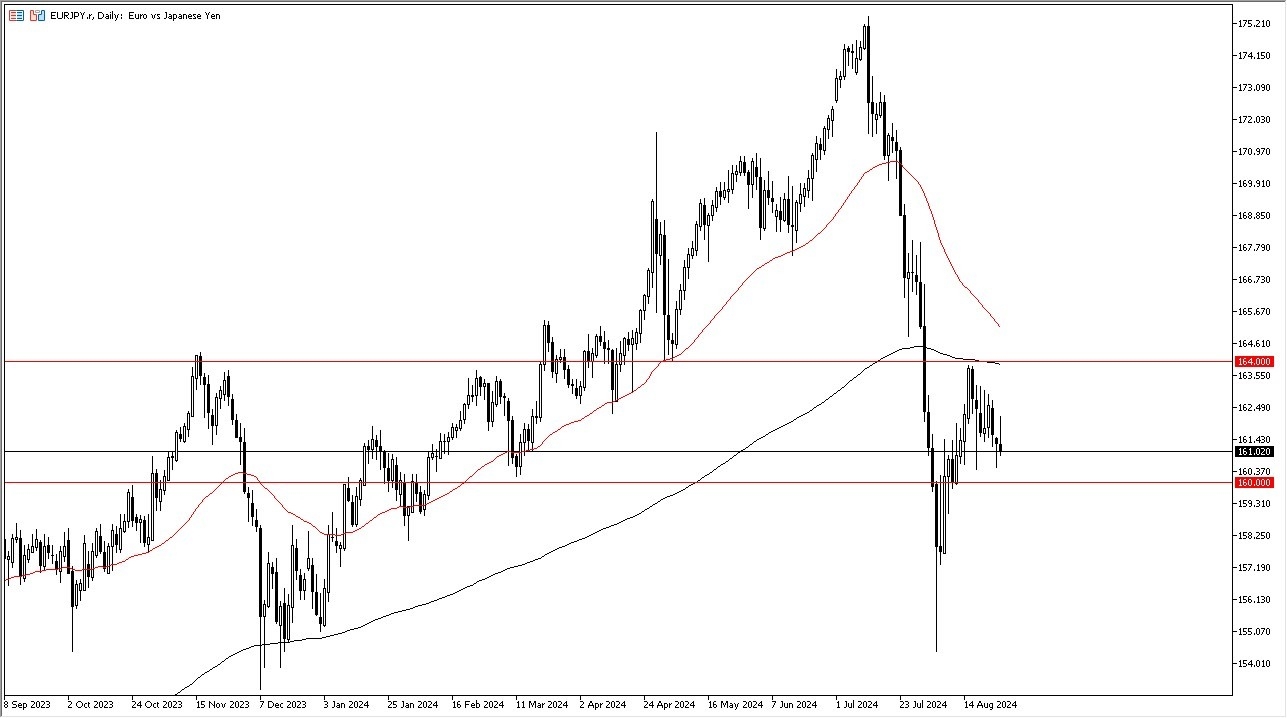

- The euro initially did rally against the yen during the trading session on Tuesday but has been completely wiped out at this point.

- Late in the day in New York, we are trading near the 161 yen level, and I am watching the 160 yen level because a breach of that to the downside could end up being a very negative turn of events.

- In that environment, I imagine the Japanese Yen is probably picking up strength against most things.

On the other hand, if we turn around and break above the 164 Yen level then we would not only clear the most recent consolidation, but we would also clear the 200 day EMA both of which would capture a lot of attention. Keep in mind that this is more or less about the Japanese Yen.

Top Forex Brokers

With that being the case, I think you've got a situation where you need to watch other pairs such as the US dollar against the Japanese yen or the New Zealand dollar against the Japanese yen. Granted, I think the euro's overbought against several currencies right now. So, it may not be the big mover when it comes to a reverse the Japanese yen's fortunes. But really, at this point, it should move in the same direction.

Back and Forth is the Norm?

All things being equal, this is a market that I think continues to see a lot of back and forth and choppiness and this 400 point range. Keep in mind we recently sold a massive number of positions in the market. So, I think it makes a lot of sense that we have to stabilize and probably see a lot of trouble between now and any type of recovery as far as hanging on to a position. This is a very noisy thing to go through. That being said, if we break down below the 160 yen level, then it's likely that we go to the 155 yen level underneath.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.