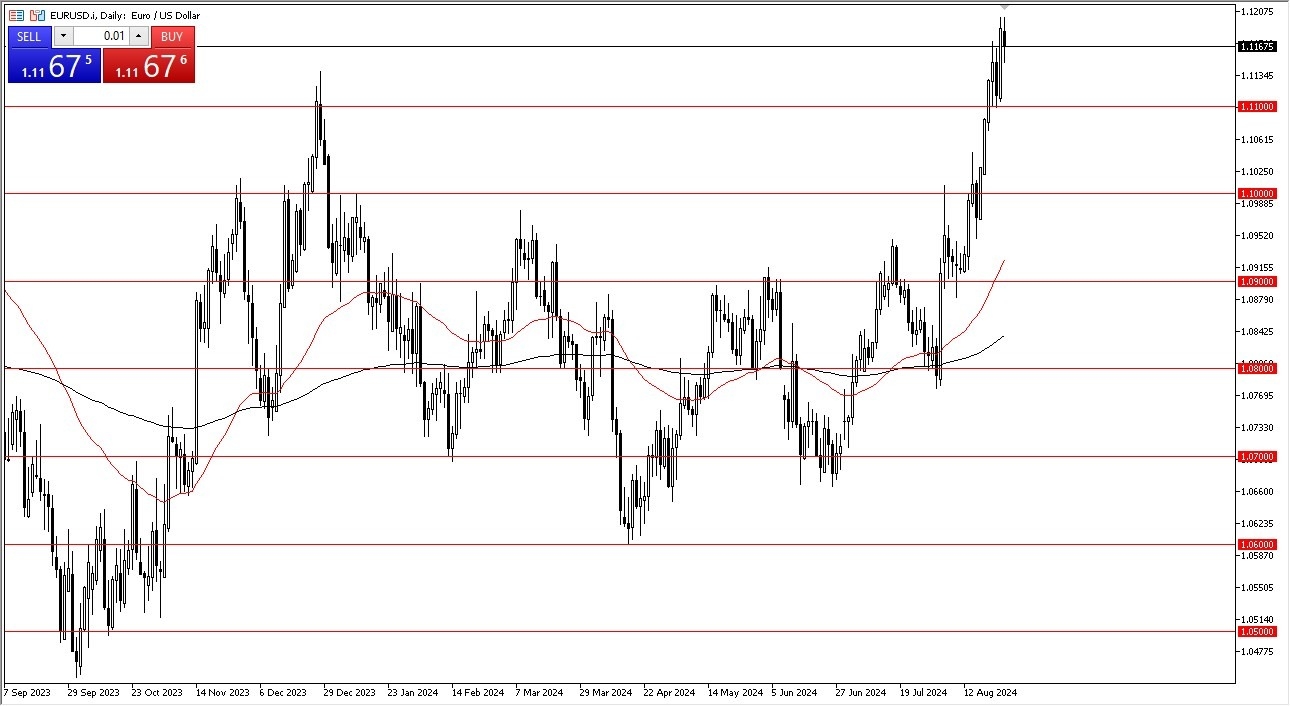

- The euro initially tried to rally during the trading session on Monday but gave back early gains to show signs of hesitation again.

- Quite frankly, the euro had gotten far too ahead of itself against the US dollar, and I think that’s something that we need to pay close attention to, as the markets don’t go in one direction forever.

- Because of this, I would not surprise me at all to see the euro drop a little bit further, and the 1.11 level underneath is an area that I would anticipate seeing a little bit of interest.

Breaking down below that level could really send the euro dropping, perhaps down to the 1.10 level, but at this juncture I think we’ve got a situation where everybody is focus on the Federal Reserve and the fact that they are going to be cutting interest rates. Because of this, people started to sell the US dollar, but I also recognize that this is a situation where the market had gotten far too ahead of itself, so it does make a certain amount of sense that we would see hesitation.

Top Forex Brokers

Buying the Dips?

I suspect that a lot of traders out there will be buyers of dips going forward, as this is such an obvious move to the upside. That being said, I don’t necessarily think that the euro can go astronomically high against the US dollar, mainly due to the fact that if we have a global economy that is starting to slow down, that will eventually favor the greenback. It’ll be interesting to see how Germany performs, because that’s probably your big tell in this environment. If Germany can strengthen drastically, then it’s possible that we could see this pair truly take off to the upside, but right now, I think we got a situation where it’s more about selling the greenback than anything else.

Do not get me wrong, I expect to see a lot of volatility, but it’s obvious that the market has gotten way ahead of itself, and it appears that traders are trying to price in up to 100 basis points of interest rate cuts between now and the end of the year. If the Federal Reserve does not do that, we could see a real mess in this pair.

Ready to trade our EUR/USD daily analysis and predictions? Here are the best trading platform for beginners to choose from