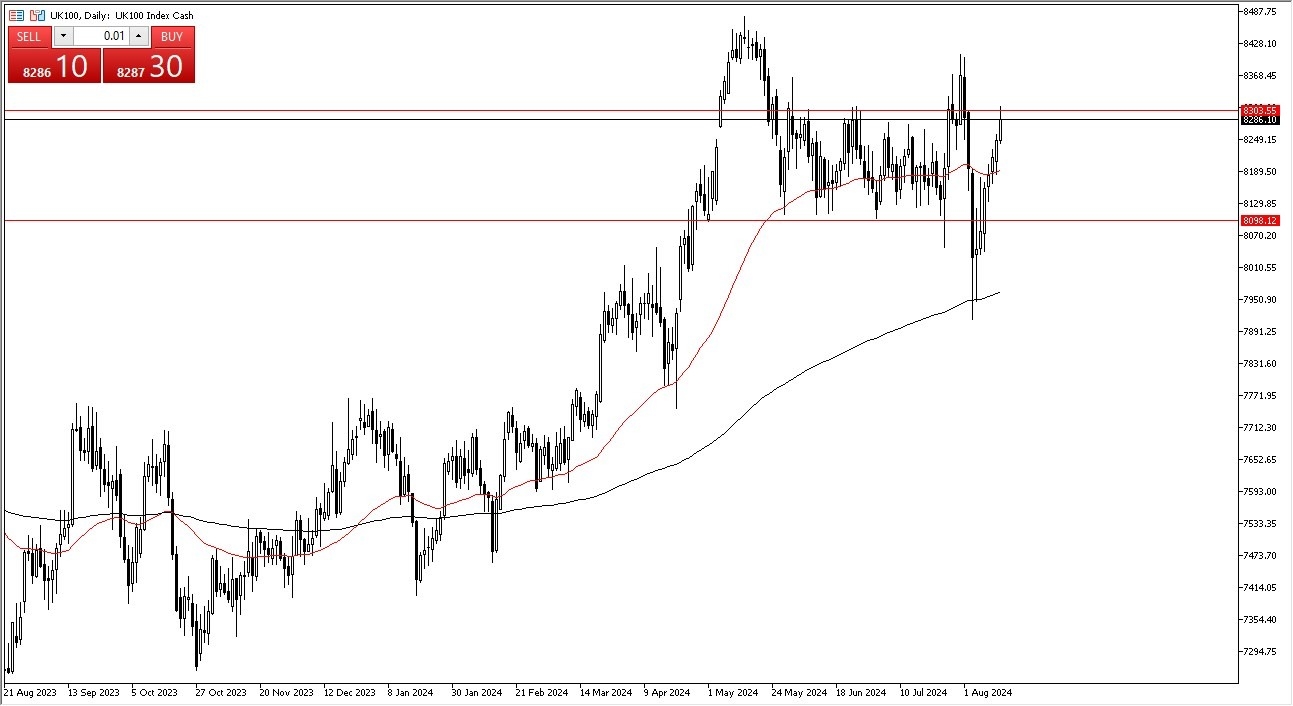

- I am paying close attention to the 8300 level, an area that has been important multiple times, and the area that we had pierced in the early hours on Wednesday, only to turn around and show a little bit of hesitation.

- Quite frankly, this is a market that has been a little overextended during the last several days, so I think short-term pullbacks makes a certain amount of sense.

Ultimately, this is a market that is probably going to see a pullback, but the pullback I think will end up being a potential buying opportunity. After all, we have the 50-Day EMA underneath the current trading and going flat, suggesting that we are more or less sideways in general. With that in mind, I think a short-term pullback offers enough value for traders to get involved in, and I certainly think that the 8100 level underneath will be massive support as well, as we have seen a lot of action there previously.

Top Forex Brokers

Equities Move Together

As a general rule, Google equities tend to move in the same direction, and I think this is a situation where the FTSE 100 may simply follow what other indices around the world are doing such as the DAX, and most certainly the ones in New York as they are the biggest ones. With that being the case, the market is likely to continue to see a lot of knock on effect when it comes to the idea of whether or not we are going to see people willing to step out and take a certain amount of risk. After all, the stock market has a lot of things to think about right now, and it’s not just a local issue, it’s a global one.

Not only do we have to worry about the global growth situation, but we also have to worry about whether or not there isn’t some kind of massive issue out there. After all, the markets have been running on liquidity more than anything else since the Great Financial Crisis, and therefore I think volatility is here to stay, at least for the time being. With that in mind, I fully anticipate that there is going to be a little bit of a pullback. Whether or not it’s anything important remains to an open question.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.