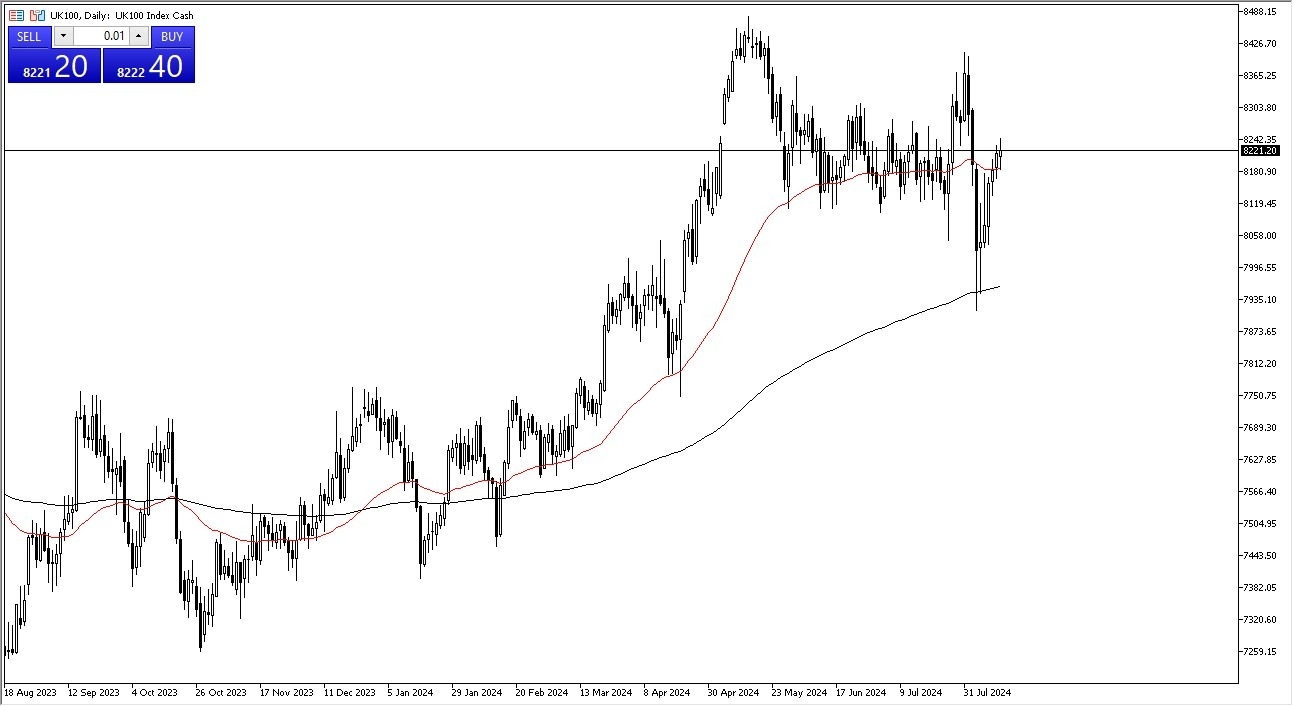

- The FTSE 100 was very noisy during trading on Tuesday as we continue to hang around the 50-day EMA.

- The 50-day EMA, of course, is an indicator that a lot of people pay attention to, and it is flat.

- So basically, we've seen a lot of noise over the last couple of weeks, only to end up where we've been.

I think we are heading into a very quiet summer period and therefore it would be a very neutral market. That being said, there are a couple of levels most certainly worth watching. The first one of course would be the 8300 level. If we break above there then it would be very bullish. Just as a breakdown below the 8100 level would be very negative. On a breakout to the upside, I do think that we revisit the recent highs near the 8500 level, and if we can break that, then we will just continue the overall uptrend.

Top Forex Brokers

Its Been Rough on Many

That being said, we've seen a brutal move to the downside, and I think that does take a certain amount of the risk appetite out of the market. I suspect this is a market that is still trying to sort out where it wants to go in the longer term. And it is probably worth noting that we bounce from the crucial 200 day EMA. If we were to turn around and fall below the 8100 level, we will almost certainly test the 200 day EMA again.

If we break through there, then it will cause a lot of technical damage to the trend and the market. We do get GDP numbers out of London on Thursday, and that of course will have its own importance as well. So, the next day or two might be fairly quiet. But once we get through the GDP figures, it's possible that we could get a little bit more of an idea as to what the Bank of England will have to deal with as far as inflation is concerned going forward.

Want to start trading the stock market forecasts? Get our most recommended CFD Forex brokers here.