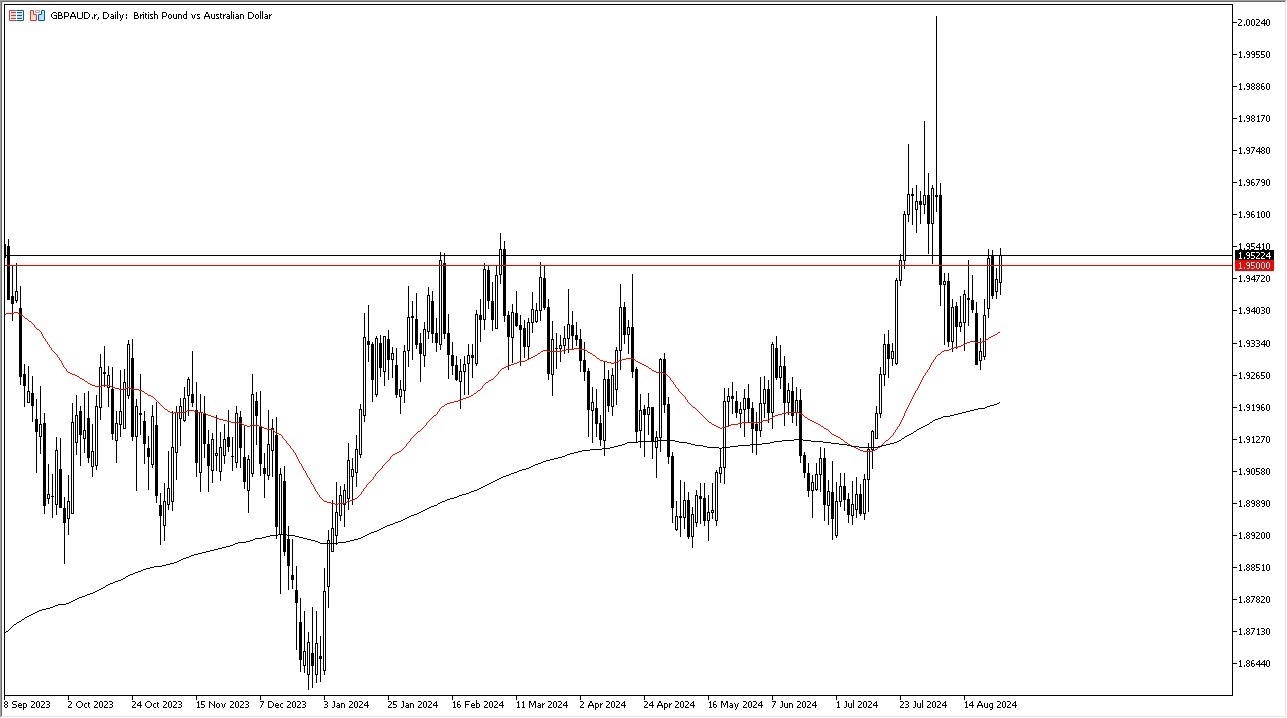

- The British pound has rallied pretty significantly during the trading session on Tuesday against the Aussie dollar as we are now above the 1.95 level.

- Yet again, if we can continue to go higher, then I think the 1.97 level is more likely than not going to be where we are aiming to get to on pullbacks.

- I do think that there is plenty of support underneath, especially as the 50 day EMA is currently right around the 1.935 zero level.

With that being the case, this is a market that is going to continue to be noisy, but I also recognize that it's been in an uptrend for a while. And I do believe at this point in time that the British pound continues to be one of the better performing major currencies.

Top Forex Brokers

Aussie has a lot of External Pressures

Keep in mind that the Australian dollar is highly sensitive to global growth and risk appetite. Of course, in and of itself could be a major problem. There are concerns about the United States slowing down and that will put even more pressure on the global economy and therefore commodities. A lot of forex traders use the Australian dollar as a bit of a proxy for the commodity markets so all of this ties together for a potential shot higher. This would be the more likely of the outcomes at this point in time.

If we can break above the 1.97 level, then it could open up a move towards where we had spiked, which was the 2.00 level, a level that obviously attracts a lot of headlines. On the other hand, if we were to turn around and break down below the 1.93 level, then it could open up the possibility of a breakdown to the 1.90 level underneath. This is a bullish looking market, but I do recognize that there is a lot of noise above that could get in the way.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.