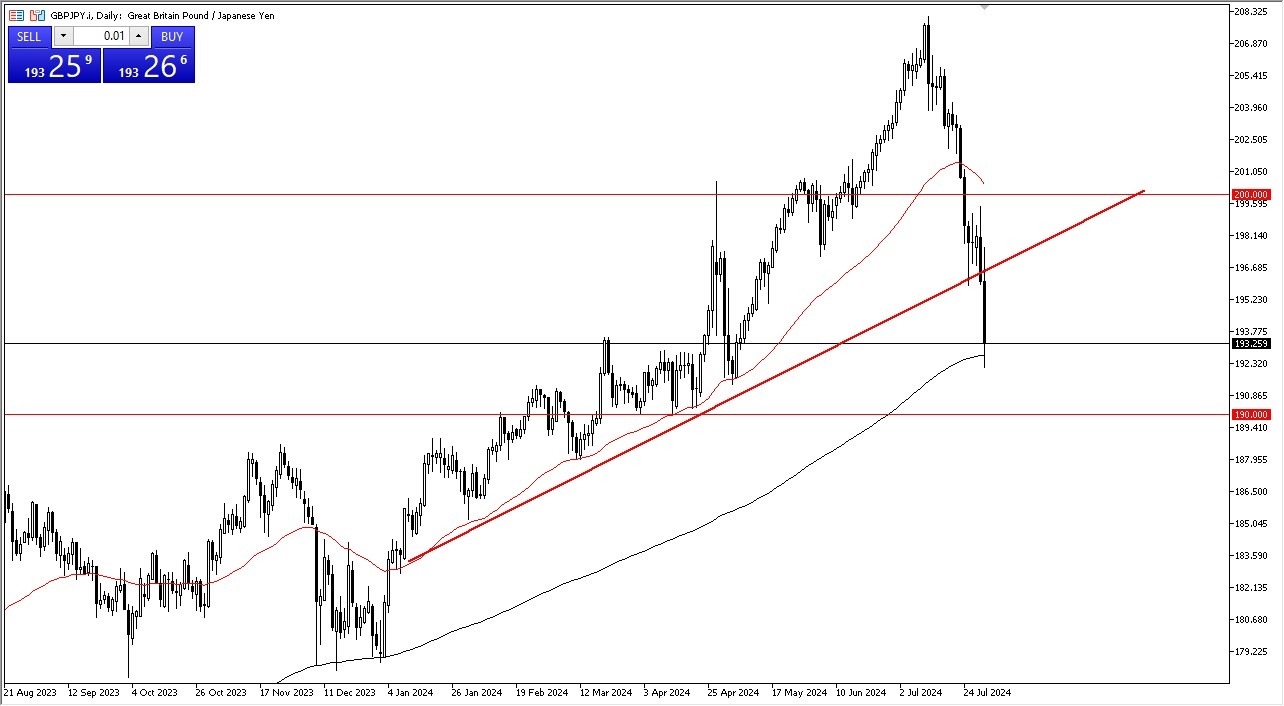

- The first thing that comes to mind in the British pound against the Japanese yen analysis is that the Bank of Japan did in fact raise interest rates.

- That being said, we have plunged quite significantly and now seem to be threatening the 200-day EMA.

- The 200-day EMA is sitting just below the 193 yen level and that, of course, will attract a lot of attention in and of itself.

That being said, we have been down about 7.5% since the highs and now we have to ask questions of this pair. This has been a brutal sell off, but we've seen this happen before and now we have to keep in mind that the Bank of England has an interest rate decision on Thursday which could have a major influence on what happens next, as the Bank of Japan has raised interest rates by 15 basis points. The interest rate differential between these two currencies is still wide enough to drive a truck through. And at this point in time, should continue to be something that attracts traders into this market as they get paid at the end of every day to hang on to it. Given enough time, I do think that we stabilize given that the market has been so rapidly oversold.

Top Forex Brokers

The 200-day EMA

But the question now for me is whether or not the 200 day EMA ends up being that barrier that buyers jump on or if it ends up being the 190 yen level. This has been a brutal sell off and I am the first person to admit that. However, it also looks a lot like a market that is due for some type of bounce. This bounce could end up being fueled even more by the Bank of England meeting on Thursday, especially if they sound more hawkish that anything else. At this point the markets are essentially looking at the potential action as a coin flip, pricing in about a 50% possibility of a rate cut.

Ready to trade our daily Forex forecast? Here’s a list of some of the best forex brokers for beginners to check out.