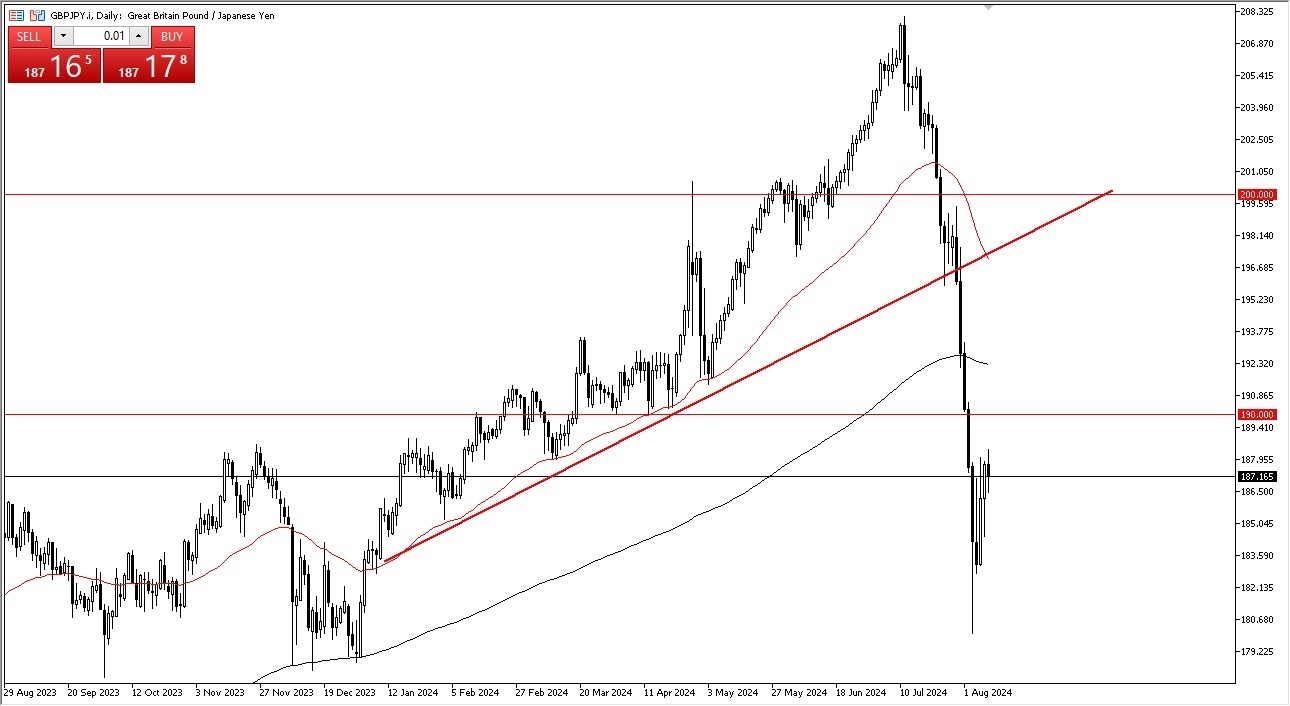

- The British pound has gone back and forth during the course of the trading session on Friday, showing a little bit of hesitation, which of course is not a huge surprise considering that the market has been so noisy.

- All things being equal, the market had recently sold off quite drastically as there was a major risk off type of scenario from the 180 yen level.

- For what it is worth, the weekly candlestick looks as if it is going to be a hammer. So that does suggest that we are ready to go higher.

That being said though, if we can break above the 190 yen level, that could be a very bullish sign. At that point, we could go look into the 200 day EMA, perhaps even towards the previous uptrend line.

Top Forex Brokers

The other scenario

On the other hand, if the market were to fall from here, I think we could go looking to the 182 yen level. This is all about risk appetite and that will continue to be the case going forward. Looking at the chart, it's obvious that volatility has been a major factor in this market, and I think we also have to keep an eye on whether or not the Bank of Japan has to give up its idea of doing everything it can to tighten monetary policy and save the end in the short term they've done a really good job but the question then becomes how long can they continue to tighten monetary policy without damaging their own economy which is essentially a bug looking for a windshield I do think eventually we get a bounce but in the meantime I expect to see a lot of noisy behavior

Ultimately, this is a market that is highly sensitive to risk parameters of the interest rate markets, and as a result, I think you will have to watch multiple markets at the same time, as the global markets continue to show a lot of concerns in general.

Want to begin trading our daily Forex forecasts? Get our most recommended Forex brokers to open a demo account with.