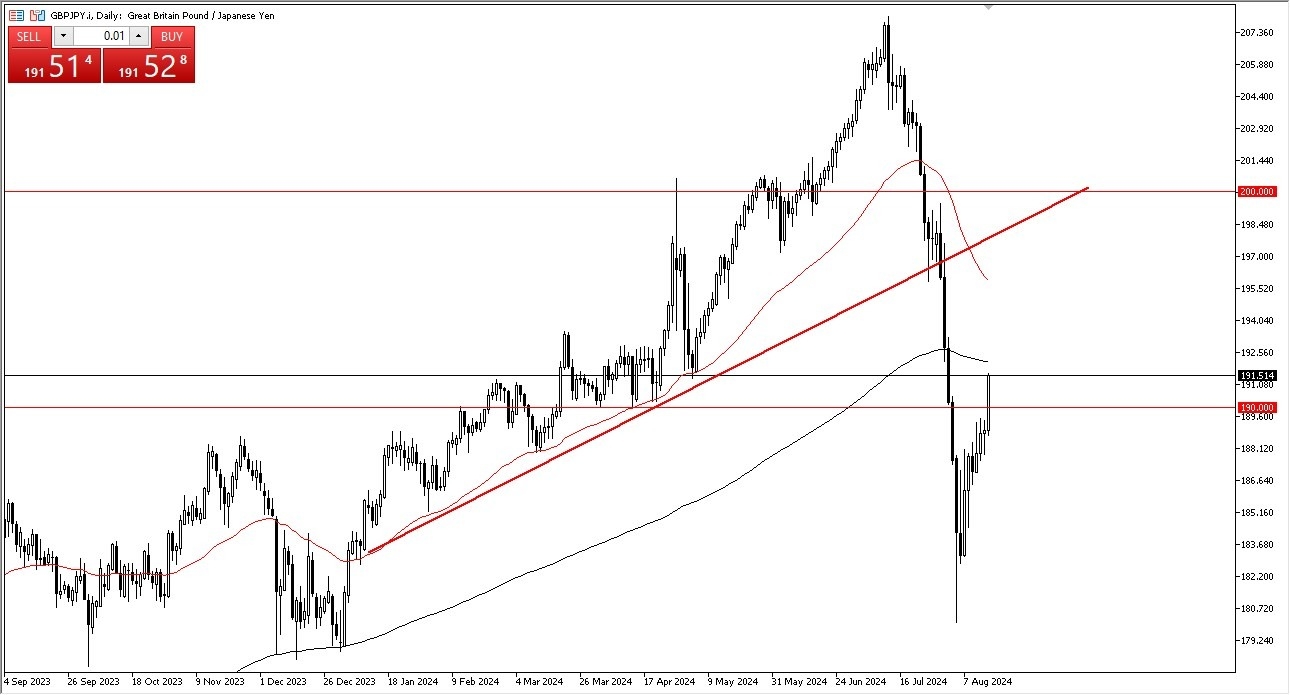

- The daily analysis of the GBP/JPY shows that we have had a major break out to the upside, as we have cleared the crucial ¥190 level.

- This is an area that I think continues to attract a lot of attention due to the fact that it is a large round psychologically significant figure, and it had previously offered resistance for several days in a row.

One of the things it seems to have kicked off the carry trade again as the idea that the US economy is not slowing down as drastically as people had hoped, and therefore the interest rate differential between the Japanese yen and almost everything else should continue to remain quite wide. After all, the Bank of Japan cannot necessarily tighten monetary policy for a significant amount of time, at least not without wrecking the Japanese economy itself.

Top Forex Brokers

Interest Rate Differential

The interest rate differential between the British pound and the Japanese yen is essentially a mile wide, and as long as that’s going to be the case, it makes a lot of sense that traders will be hanging onto this pair as you get paid to do so. With that being the case, I like the idea of buying short-term pullbacks, with perhaps the area right around the ¥190 level as a short-term support level. On the other hand, if we break above the 200-Day EMA, then the market could go looking to the ¥195 level next, which has seen a bit of action in the past.

The size of the candlestick is of course very bullish, and that does suggest that we have more momentum in this market to burn off, meaning that we could go much higher. However, if we were to turn around a breakdown below the ¥188 level, that could send this market crashing back toward the ¥183 level underneath which has been an area of significant noise in the recent past. Ultimately, that’s the least likely of scenarios but it is something that you need to keep in the back of your head just in case.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.