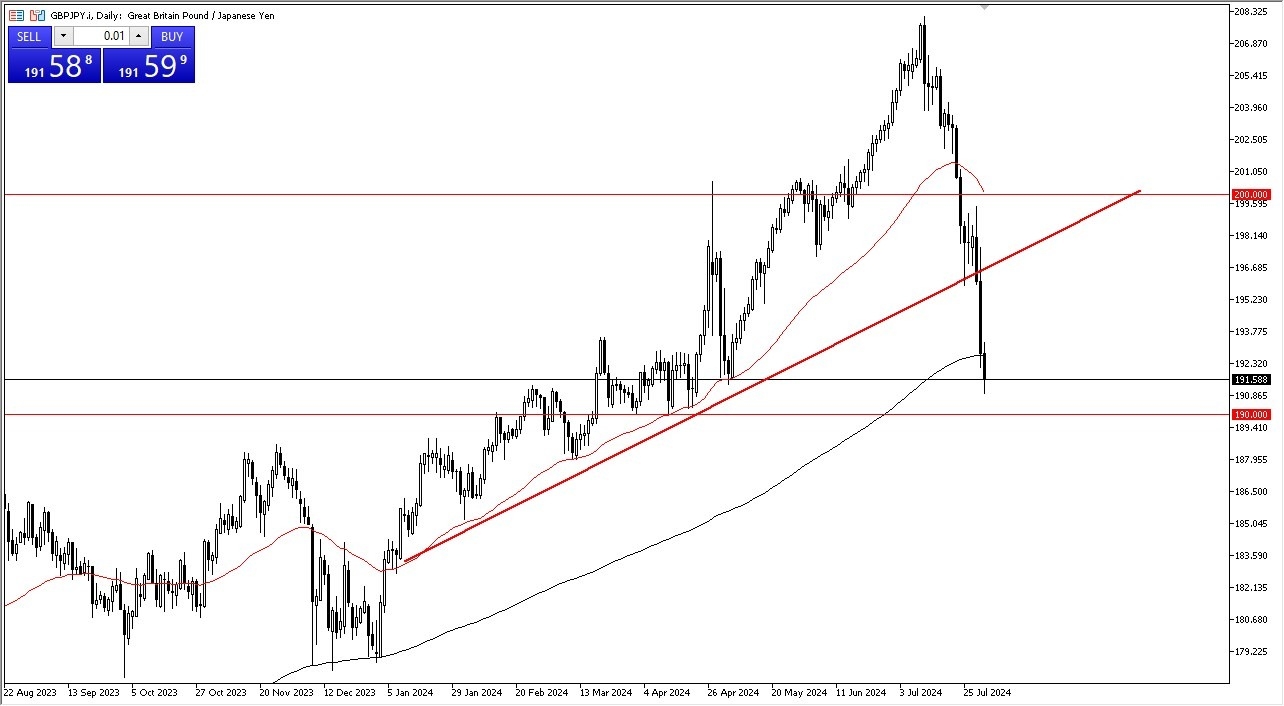

- In my daily analysis of the British pound against the Japanese yen, I find the price action somewhat interesting.

- The Bank of England cut rates during the session and while the British pound did fall, as you would expect, the reality is that perhaps we've seen the worst of it.

- We started to turn things around later in the day as the interest rate differential still heavily favors Great Britain.

After all, the Japanese barely offer any interest in, even with the interest rate cut coming out of the Bank of England, the market will still see the overnight rate at 5%. So, you're earning well over 4.5% to simply hang on to this pair, and traders will be paying close attention to that. And of course, the pair is oversold.

Top Forex Brokers

Its Been Due for a Few Days

So, I think it's probably due to bounce anyway. If we can recapture the 200 day EMA, I think a lot of traders will jump in based on FOMO and we'll have to see how things work out from there. The other side of the equation of course is that we break down below the crucial 190 yen level. And I think at that point in time, you probably have a scenario where you end up just completely retracing the entire move, basically from Christmas of last year. The 190 yen level is also the 61.8% Fibonacci retracement level, so that comes into play as well, as a lot of traders will look at that as some type of guidepost.

Another factor that you need to pay close attention to is risk appetite. After all, the interest rate differential does favor more of a “risk on move”, as traders try to look for stable currency markets to pay swap at the end of each day. After all, even if you do get a little bit of a swap and at the same time the currency moves 300 pips against you, that doesn’t do much good. Stabilization will begin more buying before it is all said and done.

Ready to trade our Forex daily analysis and predictions? Here are the top UK forex trading platforms to choose from.