Potential Signal

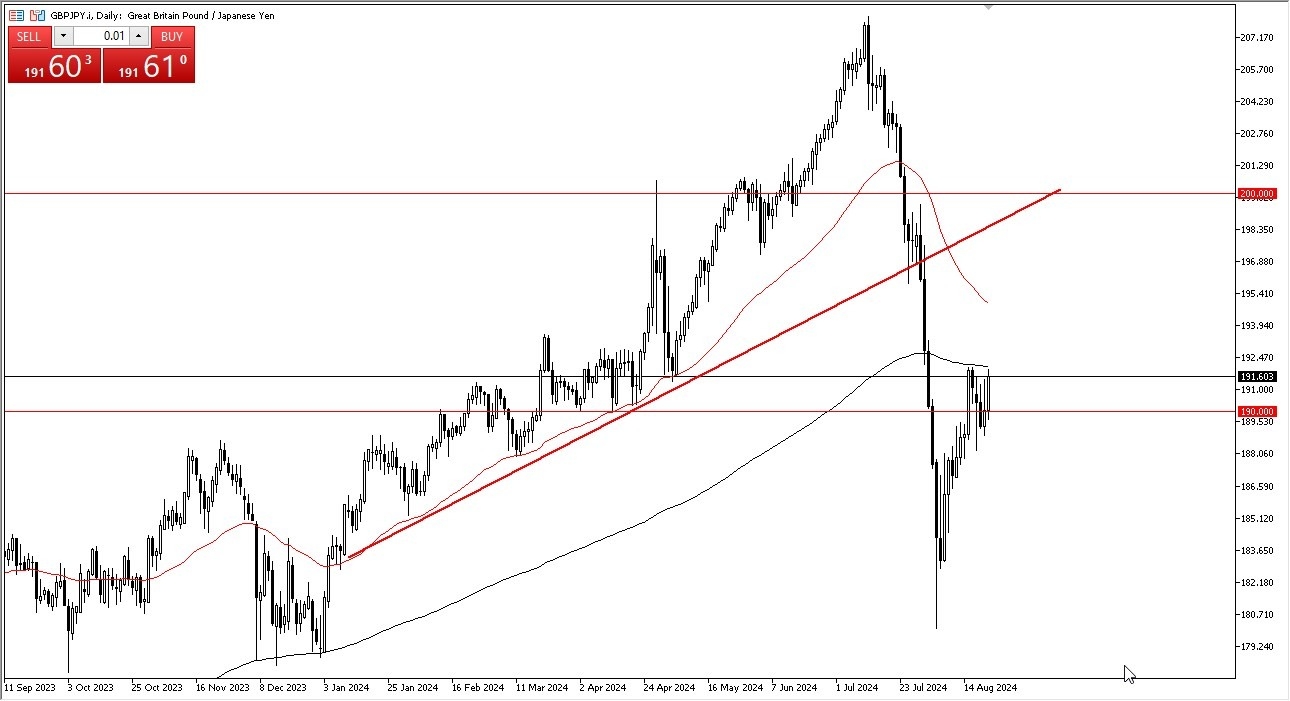

- I am a buyer of this pair on a daily close above the 200-Day EMA.

- I would put a stop loss at the 189.80 level and would use half the normal position.

- I would be aiming for the ¥196 level.

In my daily GBP/JPY analysis, the first thing I notice is that the British pound is testing the 200-Day EMA against the Japanese yen. It’s also worth noting that we are bouncing from basically the ¥190 level, which of course is a large, round, psychologically significant figure, and an area that you would have to believe that there are a lot of options barriers set up. The way we have bounce of course is bullish, but we need to get beyond the 200-Day EMA for technical traders to start to get involved in this market again.

After all, keep in mind that this is a market that was absolutely crushed at one point, mainly due to the carry trade being destroyed. At this point, we need to keep in mind that the market has suffered an extreme trauma as of late, so to be difficult to get overly aggressive to the upside. That being said, it’s also worth noting that the market has started to grind it’s way higher over the longer term, so if you are patient enough, you may find that this ended up being a decent position to hold onto.

Top Forex Brokers

Yen Carry Trade to Return?

A lot of this comes down to whether or not the yen carry trade will return. Keep in mind that the Bank of Japan has recently tightened monetary policy, which was a bit of a shock to the market. That being said, they can only do so much without wrecking the Japanese economy, so one would have to assume that we will see somewhat limited upward pressure on the Japanese yen over the longer term. Quite frankly, the Japanese are stuck, and I do think that sooner or later this is a market that goes much higher, or perhaps better put, the Japanese yen will be eviscerated.

That doesn’t do much in the short term, but it does give you an longer term outlook. I think at this point in time if we break above the 200-Day EMA, it might be worth getting involved in this market, but I would not do so with the massive position as the volatility will probably only get worse, not better. For example, a lot of the upward pressure that we have seen has been due to central banks at the Jackson Hole symposium suggesting that interest rate cuts may not be as aggressive as traders wished for. The amazing thing is that it wasn’t even a central bank that’s shown on this chart.

Start trading our free Forex signals. Get the most recommended Forex broker in the UK here.