Potential Signal:

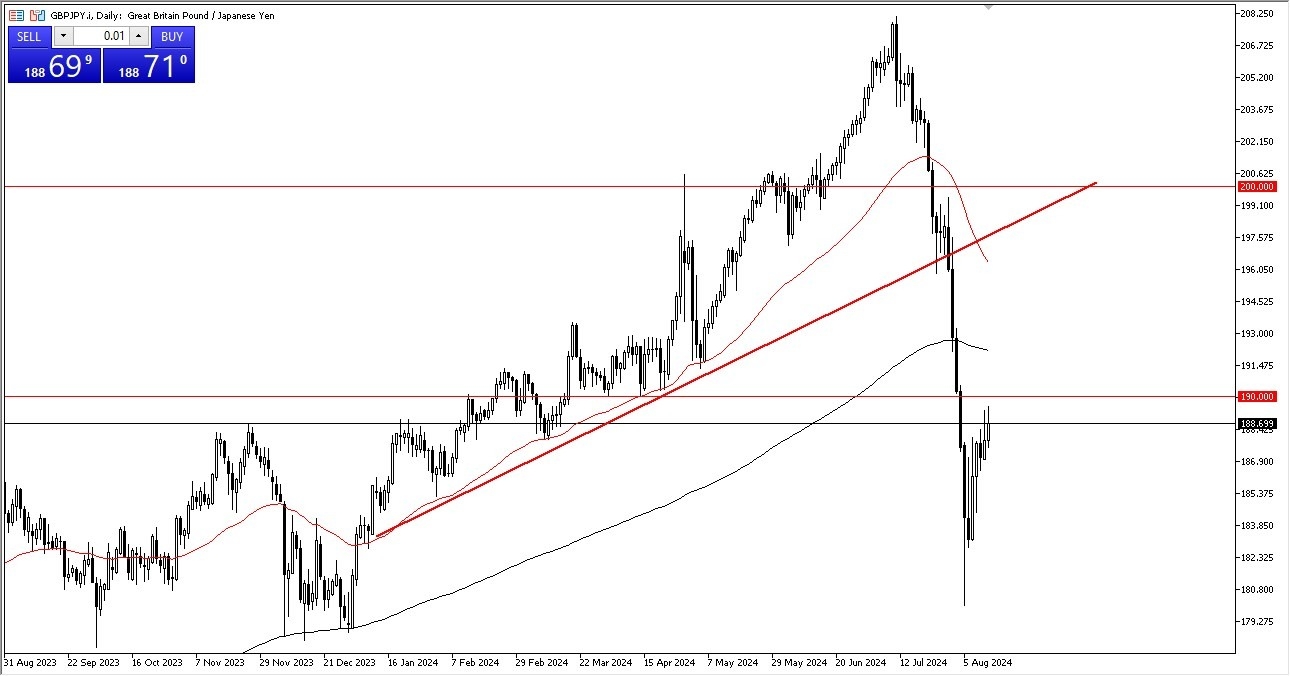

- At this point, if we can get a daily close above the ¥190 level, I will be willing to throw a little bit of money into this market.

- I would keep the position size small, and I would have my stop loss at the ¥188 level. The target would be ¥196 above.

- The first thing I notice is that the ¥190 level has offered a significant amount of resistance.

- This is crucial to pay attention to, because large, round, psychologically significant figures most certainly do seem to attract a lot of attention in these pairs, and therefore the fact that we could not break above it is something that sends off red flags immediately.

Top Forex Brokers

That being said, the market were to break above the ¥190 level on a daily close, I think that could send the British pound much higher. Furthermore, you need to keep an eye on the Japanese yen carry trade overall, because the JPY-related pairs tend all move in the same direction. If we continue to see the Japanese yen strengthen, we will not only see it here, but we will see it in multiple pairs around the world. Ultimately, this is all about going “risk off”, and at this point in time that would not be a huge surprise considering that the recent selloff had been so brutal, and of course a lot of people will be very cautious about trying to jump back into this market. However, if we can break above the crucial ¥190 level, that might build up enough confidence for people to do so.

Downtrend Still Strong

The downtrend is still strong from what I can see, and although we have bounced quite a bit, the reality is that he had fallen 28 handles, but then turned around to bounce just 6 after that. While it is an impressive rally in the short-term, when looked at through the prism of the last two months, it’s but a blip on the radar. It is because of this that I would be very cautious about jumping in right away, and I do think that it is probably going to be a scenario where traders are extraordinarily cautious about taking on risk. Don’t get me wrong, you do get paid at the end of every day and that of course is something worth paying attention to, so we will have seen whether or not the carry trade come back into vogue.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.