Potential Signal:

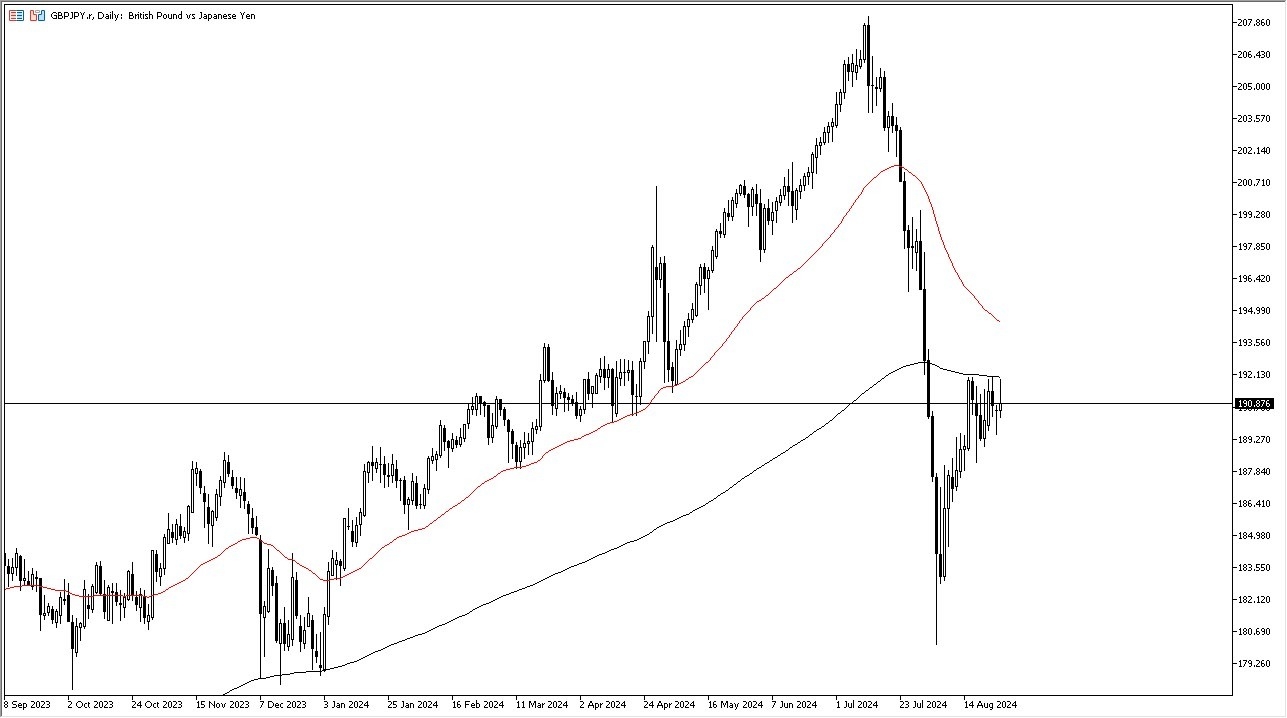

- I would buy the GBP/JPY pair at the ¥192.20 level, with a stop loss at the ¥189.90 level.

- I would be aiming for the ¥196 level.

- This asset has pulled back from a significant technical indicator in the form of the 200-Day EMA, and I think at this point in time it does make a certain amount of sense that we continue to watch as indicator as it has been a bit like a brick wall over the last 2 weeks or so.

- Ultimately, this is a market that I think will eventually find buyers and we could break above there, but right now it looks like we just don’t have the momentum to make that happen.

Top Forex Brokers

Keep in mind that the technical traders out there will continue to pay close attention to the 200-Day EMA, but if we were to break above it, that could actually work for the British pound to continue going higher as you might have a bit of short covering. Quite frankly, the fundamental situation is a bit murkier, as the Bank of Japan is pretending like it’s going to enter a major tightening cycle, but it can only go so far. At the same time, the Bank of England is more likely than not offer more interest than Japan going forward of the next several years, so I think it’s only a matter of time before we take off.

Carry Trade

Keep in mind that the carry trade is still the major factor here, and if we can get that going on, then you could see the market going much higher, especially if we get some type of “FOMO trading” after a break above the previously mentioned 200-Day EMA. All things being equal, that happens then I think the British pound goes looking to the ¥200 level.

On the other hand, if we pull back from here, then the ¥189 level should offer a certain amount of support, followed by the ¥187 level, which is an area that previously had been short term resistance. This could be one of my favorite trades, but we will have to see whether or not the Japanese yen starts to take again, because this will be one of the bigger movers.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.