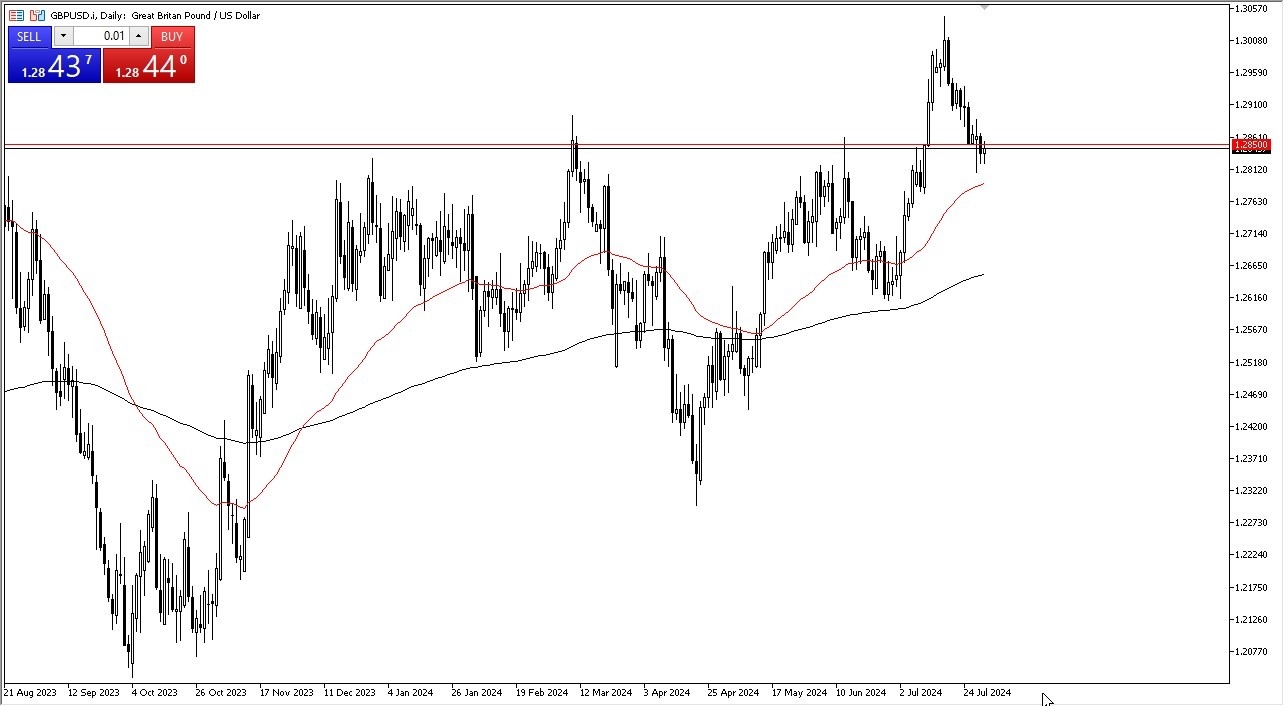

Potential signal:

- After the Bank of England announcement, I will be looking to trade this pair.

- If we are below 1.28 level, I am a seller, with a stop at the 1.2915 level.

- I will be aiming for roughly 1.26 below.

- On a move above the 1.29 level, I will put my stop loss at 1.2785, and aim for a move back to the 1.3050 region.

In my daily analysis of the pound, I recognize that we did see a little bit of selling pressure across the board, and part of that might be due to the fact that the Bank of England has an interest rate decision on Thursday. That being said, we are at a major crossroads against the US dollar, and later in the trading session on Wednesday, we will also have the Federal Reserve announcement. So, this essentially is going to be ground zero for markets and volatility. With that being said, I do think that we are more likely than not to see a bit of a bounce, but anything's possible. So, I have to look at this through the prism of various levels that I am going to be triggering trades at. If we can break above the 1.29 level on a daily close, then I would become very bullish of the British pound.

Top Forex Brokers

On the other hand, if we break down below the 1.28 level and close below there, then we may see a correction down to the 200-day EMA. That being said, you need to get the Bank of England announcement on Thursday out of the way to get any real confirmation. And between now and then, we probably have a lot of noise ahead of us. While I don't necessarily advocate putting money into this market right now, it is something worth watching.

This Could Be a Sign of USD Movement Overall

This could give us a bit of a heads up house to what the US dollar is going to do in general. And then of course, what the British pound could do against other currencies such as the Swiss franc, for example. Ultimately, I'm more inclined to the upside, but I recognize this as an area that the market will decide the next couple of handles over the next 24 hours, and I'll just simply follow it.

Want to begin trading our GBP/USD Forex signals? Get our most recommended Forex brokers in the UK here.