- The British pound has risen slightly against the US dollar during Friday trading as we continue to see a lot of noisy behavior.

- That being said, the market is likely to continue to see a lot of volatility.

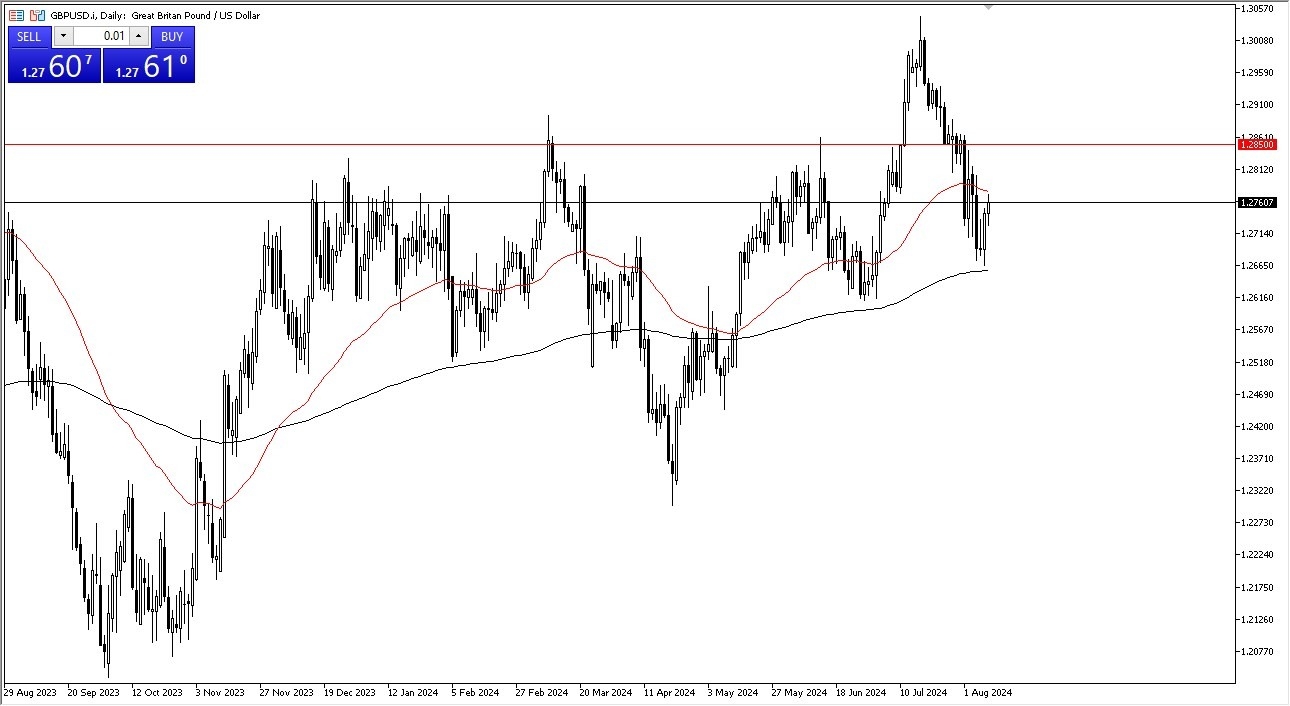

- It's probably worth noting that the market has been bouncing around between the 200 day EMA and the 50 day EMA indicators, which of course causes a lot of chaos for technical traders sometimes.

If we can break above the 50 day EMA, then it's likely that this market will continue to go much higher, perhaps reaching the 1.2850 level.

Anything above there then really gets things going. But what I would point out is that the 200 day EMA has held as support. And from a technical analysis standpoint, that's a very bullish and positive turn of events. The candlestick size itself during the trading session on Friday isn't necessarily anything special, but the candlestick on Thursday most certainly was. It looks as if we are ready to continue to grind higher and that might be the main feature here. The fact that we are grinding and not necessarily shooting straight up in the air. That does make a certain amount of sense.

Top Forex Brokers

Dips Could Bring in Buyers

So, I think ultimately, you've got a scenario where traders will continue to look at dips as potential buying opportunities, at least until we break down below the 200 day EMA, which ostensibly means the 1.2650 level below. I do expect a lot of choppy volatility, but that's not necessarily an indictment on this pair. It's just the way things have been in most financial markets. I don't know that much will change as far as the way we are seeing more caution in a lot of markets. GBP/USD is a pair that favors the US Dollar on safety concerns, but the British Pound certainly won’t be as susceptible to few selling as many of the other currencies that I cover.

Ready to trade our Forex daily analysis and predictions? Here’s the best forex trading company in UK to trade with.