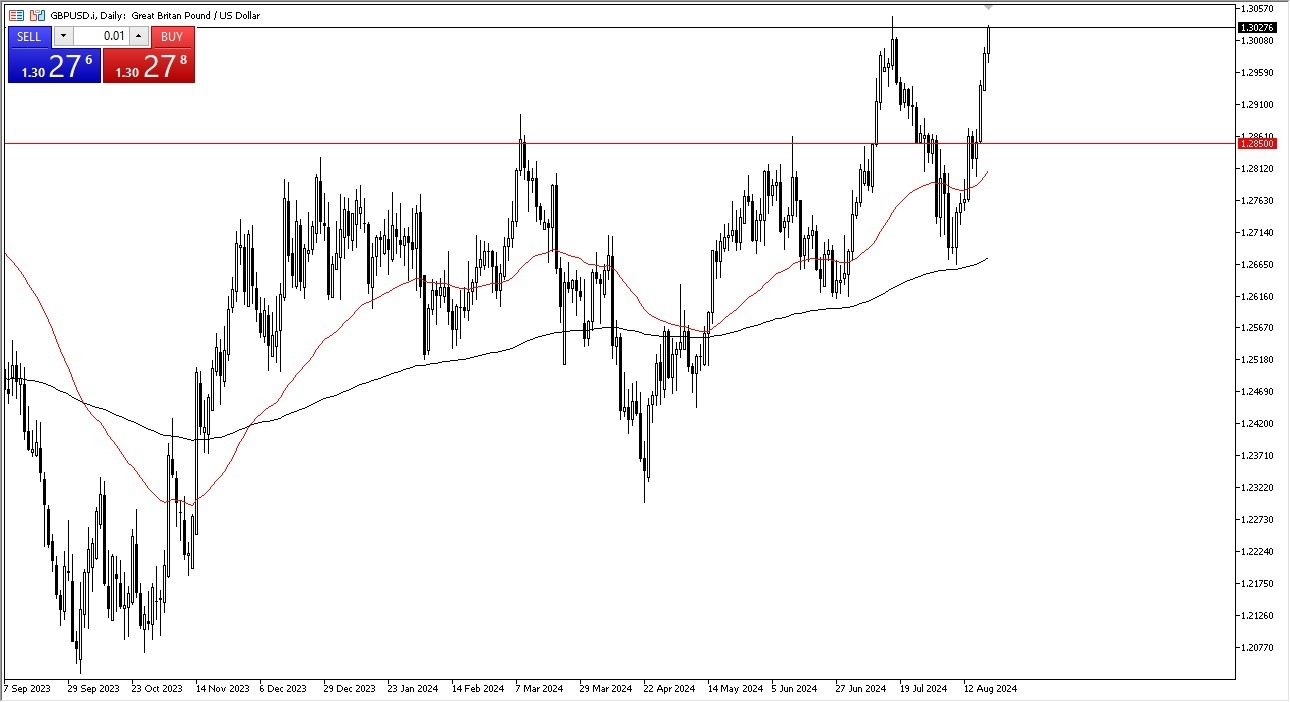

- The British pound has rallied again during the trading session on Tuesdays.

- It looks like we are trying to continue to see the market rise above and make a fresh new high.

- That being said, we do have a historical precedence of where we go next. And that would be the 1.31 level.

That's an area that's massive resistance. And I think there, are a few things to pay attention to later this week that could have a major influence on this pair. After all, both central bank governors are giving speeches on Friday at the Jackson Hole Symposium. So, I would anticipate GBP/USD is a pair that probably has to deal with that.

The Market Remains Stretched

All things being equal, this is a market that is a little stretched, so I'm looking for signs of exhaustion because I do think a pullback is coming. Whether or not it would turn things around for a bigger move remains to be seen, but I think you would be very reckless to jump into this pair and start buying all the way up at this level. This isn't to say that the market can't go higher. Of course it can, but really at this point, you will have wanted to be in this trade somewhere lower, perhaps closer to the 1.2850 level. Speaking of the 1.2850 level, I do think that a pullback would probably see a lot of support in that area, especially with the 50-day EMA racing toward it.

That being said, we could just take off to the 1.31 level, and a break above that would obviously be very bullish. I think this is all about the US dollar, probably having very little to do with the British pound, as we are seeing the US dollar struggle against most things at the moment. The market is set up to see a lot of raid cuts coming out of the Fed. So, if September disappoints, that could rock the markets. And because of that alone, I think we more likely than not are going to in fact see that.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers UK to check out.