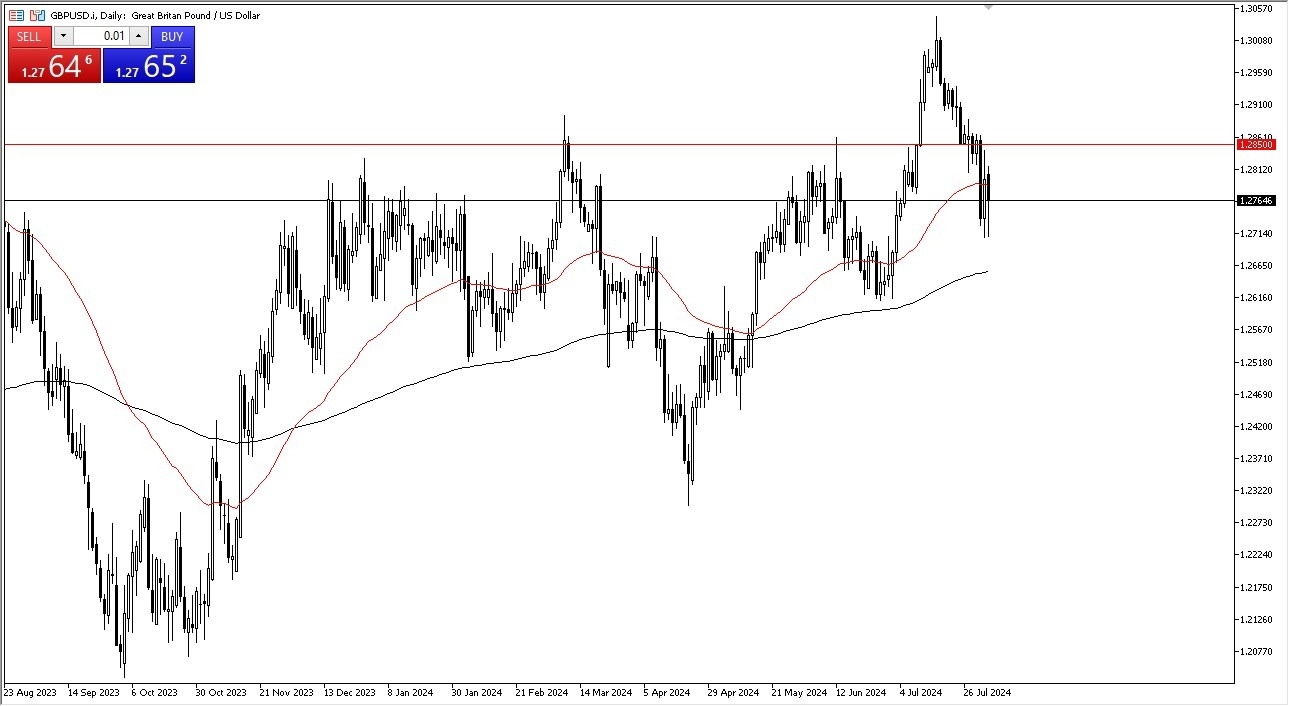

- The GBP/USD pair has seen the British pound plunged toward the 1.27 level, only to turn around and show signs of life again.

Ultimately, this is a pair that is very noisy at the moment, but I do think there is a certain amount of support due to the fact that people believe that the Federal Reserve is likely to get aggressively dovish, and people are already starting suspect that there could be 50 basis points at the next meeting in the offering. If that’s the case, it’s how the Federal Reserve has behaved in the last couple of crises, which of course could cause a bit of fear.

Top Forex Brokers

Technical Analysis

The technical analysis for the GBP/USD currency pair is extraordinarily interesting, as we have fallen just below the 50-Day EMA, and then above the 200-Day EMA near the 1.2650 level. As long as we stay in this area, technical traders will be interested in buying this pair. However, if we get a massive selloff when it comes to risk appetite, then we could see a situation where the US dollar suddenly strengthens. Quite frankly, I think we are going to continue to see a lot of volatility, and at this point in time the 1.2850 level above is a major barrier.

If we can get a daily close above the 1.2850 level, the market could very well find itself going to the 1.30 level above. That of course is a large, round, psychologically significant figure, and an area where a lot of people would be interested in getting involved again. If we break above that level, then it could be a major break out in favor the British pound over the US dollar.

On the other hand, if the market were to break down below the 1.26 level, then we could see the British pound really start to selloff. I suspect that and, in that environment, we would probably see massive risk aversion out there, and it will make quite a bit of sense that everybody runs into the US Treasury Department for safety.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers UK to check out.