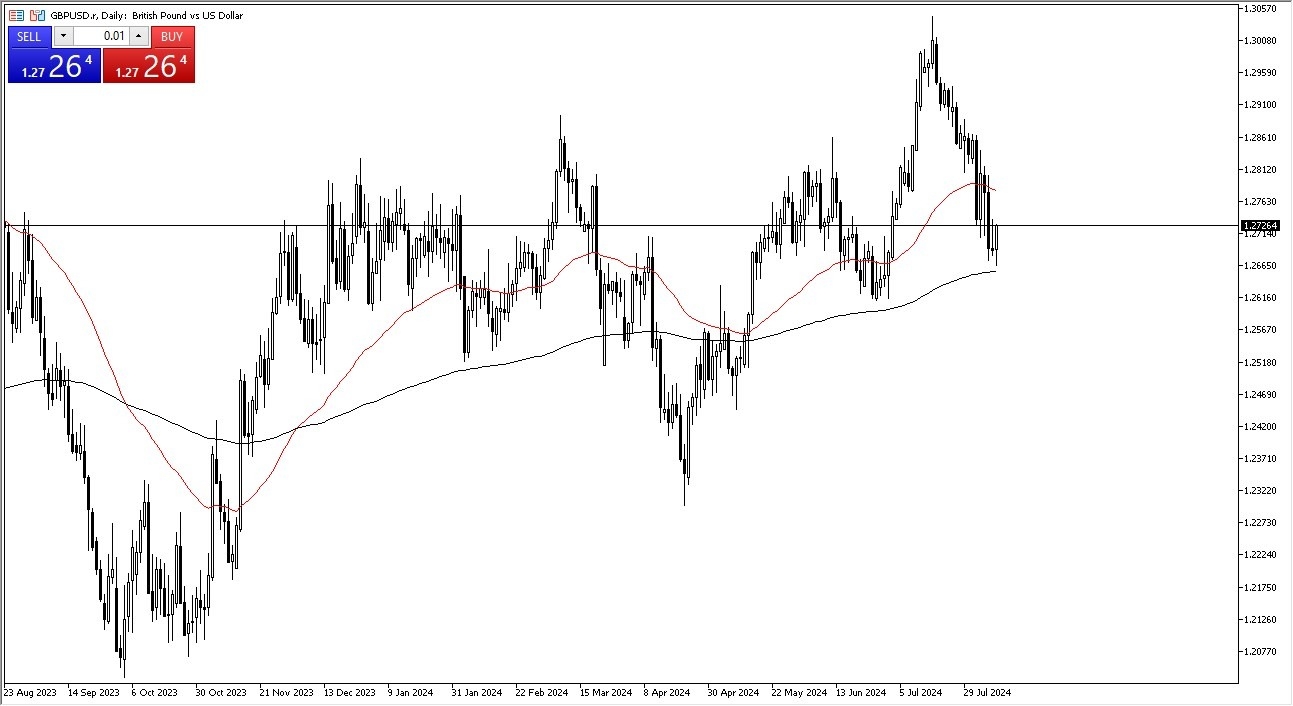

- The British Pound initially fell against the US Dollar during early trading on Thursday but then found itself bouncing as the 200-day EMA caused people to look at this through the prism of perhaps trying to buy the dip.

- The 200 day EMA of course is a major inflection point for technical traders and it's not a huge surprise that it did end up causing a bit of a reaction.

- With that being said, I am cognizant of the fact that traders look at this as a risk on or risk off type of situation as the U S dollar itself continues to be the ultimate safety currency.

- It's not so much that the British pound is considered to be risky. It's just that it's further out on the risk spectrum.

Patience Will Be Necessary

So, with this, I think you have to be a little bit patient, but if you are bullish of the pound or perhaps even bearish of the US dollar based on the idea that the Federal Reserve may cut in September, you probably have to wait to see if we can break above the top of the inverted hammer from the previous session, and perhaps even more importantly, break above the 50-day EMA.

Top Forex Brokers

This is a market that is typically choppy, as you can see on longer-term charts, but it seems as if the trajectory continues to look like it's trying to find its footing. A breakdown below the 200 day EMA could blow the narrative right out of the water, so we'll have to wait and see how that plays out. But I think given enough time, we should get a little bit of clarity.

One of the most important things you can watch over the next day or two is how we close out the week. After all, traders will tell you what they really think when they close their positions out or choose not to close their positions out heading into the weekend when they could be facing a massive gap on Monday morning. Because of this, if we see a move to the upside and it's sustained into the close on Friday, I'd say that's a really bullish sign. Obviously, the exact opposite could be true as well.

Ready to trade our daily GBP/USD Forex forecast? Here’s a list of some of the top forex brokers UK to check out.