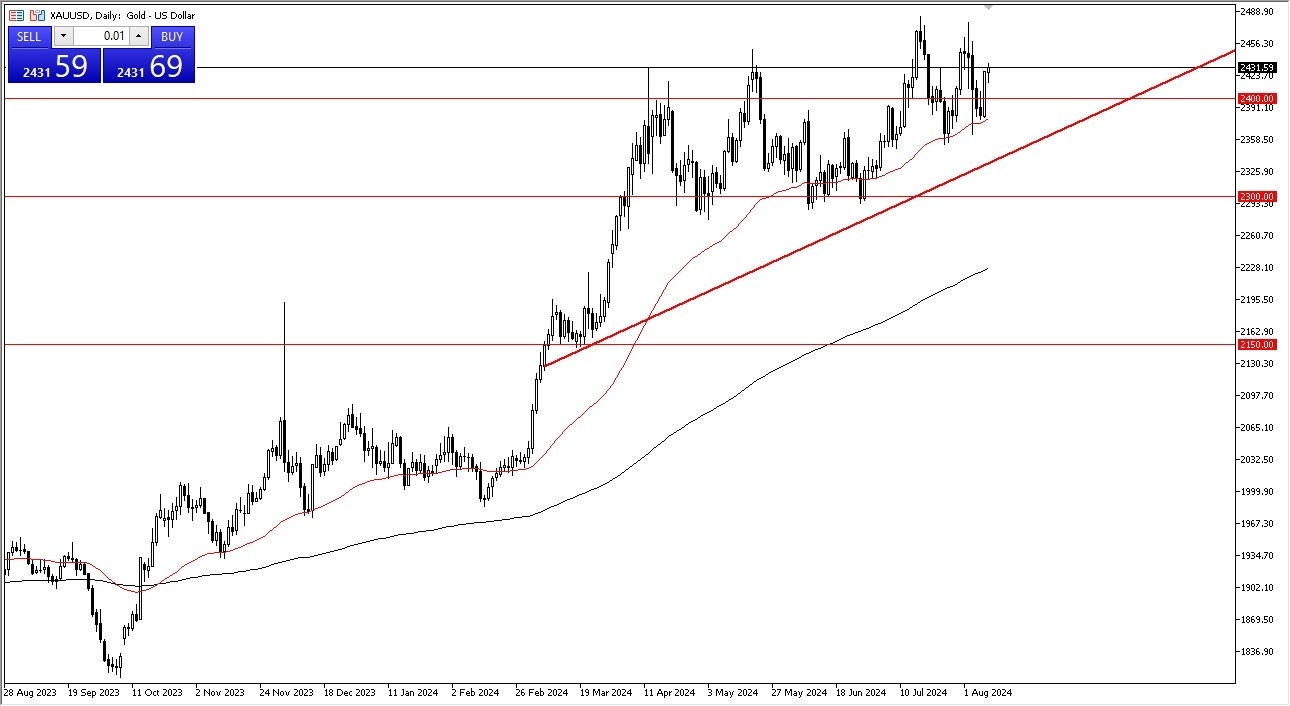

- The first thing I see is that gold initially sold off at the open, but then had people jumping back into the market looking for safety.

- As we head toward the weekend, it looks like traders are willing to step in and pick up gold, which is a bullish sign, and it does suggest that the overall uptrend will continue to be something that people are trying to hang onto.

Over the last couple of days, we have seen the gold market reach down to the 50-Day EMA before turning back around. Furthermore, the Thursday candlestick was impressive, and it looks like Friday has shown itself to be somewhat resilient. This tells me that there are plenty of people out there willing to get involved and pick up gold every time it drops. This also suggests to me that we are going to try to get to the upside again, perhaps reaching all the way to the $2480 level, an area where we had seen resistance a couple of times over the last month or so.

Top Forex Brokers

Global Macroeconomic Picture

The global macroeconomic picture is a bit murky to say the least, and in that environment it does make a certain amount of sense that people will be looking to take advantage of the safety trade. The safety trade of course includes a lot of different things, but the gold market is most certainly one of the major ways that traders get involved. With that being said, I do think that gold eventually reaches toward the $2480 level, and I also believe that eventually it goes above there and starts to look toward the $2500 level, which of course has a large, round, psychological significance to it, and is probably an area where there would be a lot of options barriers.

All things being equal, I think you will continue to see a lot of volatility, due to the fact that there has been a lot of geopolitical tensions, and of course there are a lot of concerns when it comes to interest rates and the global economy perhaps slowing down. As long as that’s the case, gold will have a certain amount of allure to it. I have no interest in trying to short this market anytime soon.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.