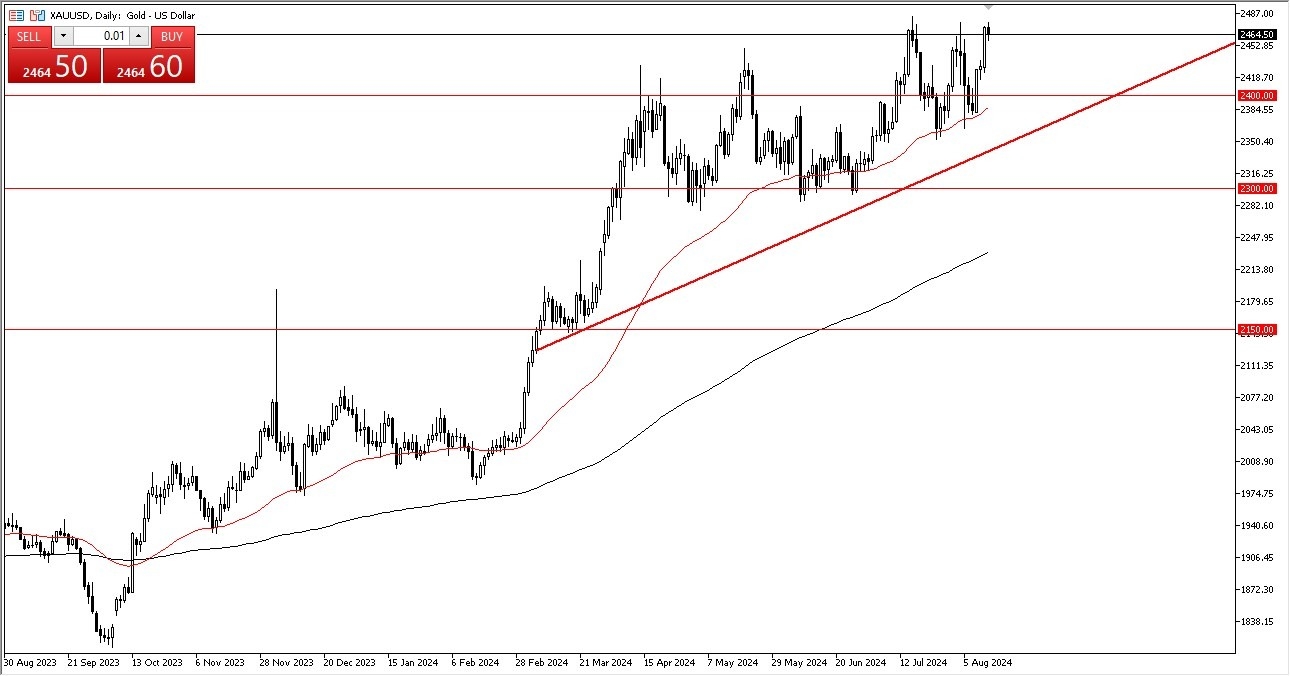

- I can see this asset is doing everything it can to break out to the upside.

- Gold continues to be a place where people run toward, and with the PPI numbers in the United States coming out lighter than anticipated early during the session, that gives the idea that perhaps the Federal Reserve might be compelled to loosen monetary policy.

All things being equal, gold has plenty of reasons to go higher, and it reaches far beyond the Federal Reserve. After all, the geopolitical issues around the world continue to be a major issue, and I think you’ve got to look at it through the prism of a safety asset at the moment. However, loose monetary policy of course does help gold do better, and therefore I think you have a bit of a “one-two punch” that is currently helping out the market. With that being said, it’s also worth noting that we have seen a lot of upward momentum over the last couple of days, so I do think that it is probably only a matter of time before we finally break out above the short-term resistance just above current levels.

Top Forex Brokers

Breaking Consolidation

The question now is whether or not we can break consolidation? I think we can, and I think we are likely to see that end up being the case given enough time. We have seen a lot of bullish pressure recently, and therefore I think you need to accept the fact that sooner or later this is a market that will finally break through the barriers. If it does, I think we could go looking to the $2500 level rather quickly, and then after that we could see the market really start to take off.

I recognize there is a certain amount of psychology near the $2500 level as it is a large, round, psychologically significant figure, and therefore if we can break above that level, then I think you will see a lot of people rushing into the market. This would possibly be due to some type of panic, but even that doesn’t necessarily have to be the case considering that we have seen so much demand as of late anyway.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.